Why the Bitcoin ETF approval matters, sliced three ways

Here's a quick look at the good, the bad, and the ugly in regards to the Bitcoin ETF news.

Here are three ways to understand what the approval of a Bitcoin ETF means:

On one hand, an ETF approval longterm probably means more liquidity, or at least access to more liquidity, which over time could attract more participants to Bitcoin. More liquidity at scale = less price volatility.

On the other hand, a Bitcoin ETF, which is for the most part a product of traditional Wall Street outfits, is not open, permissionless money. Instead, it’s a very controlled means of mapping Bitcoin to the traditional financial system.

The reason it took years and years to get a Bitcoin ETF approved is because it took time to figure out how to make BTC controllable from a centralized entity (OK, that’s an oversimplification, but conceptually it tracks). Buying BTC through a broker doesn’t allow you to self-custody a digital asset and re-introduces all of the clutter that Bitcoin was designed to strip out.

So the alternative finance aspects of Bitcoin are lost if people only buy Bitcoin for price exposure via an ETF.

The third leg of this stool is the middle way. This is the way of the optimist.

In this view, the institutional flood of money into BTC helps add a level of maturity and sophistication to the space and there are multiple winners: Bitcoin goes legit, the ETF opens up new levels of access and interest from entire sectors of the finance world, everyday people get to benefit from Bitcoin’s profound network and economic effects, and the Bitcoin network flourishes allowing new levels of innovation and openness.

What follows below is more of a breakdown for each potential outcome.

Way one: Bitcoin ETF = Bitcoin as a legit financial asset in the eyes of Wall Street, traditional financialization ensues

There are many ways to understand Bitcoin. One way is as a financial network.

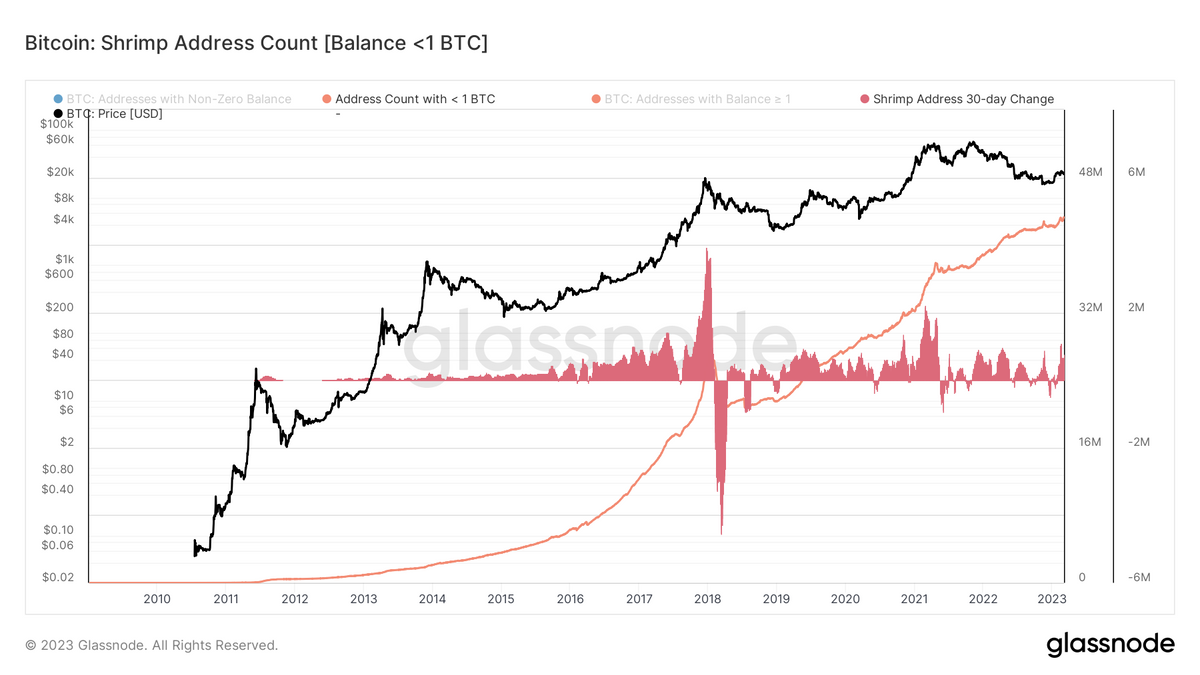

And while Bitcoin has gotten more robust, more global, and definitely more valuable as a financial network, it is still only functioning at a fraction of its potential when compared against the world’s other major financial networks, such as equities markets ($~100 trillion), real estate markets ($ ~400 trillion), or fiat currency markets ($ ~ 37 trillion).

One way to grow Bitcoin as a financial network is to increase its available liquidity. And one simple way to increase Bitcoin’s liquidity is to connect it to existing financial markets, such as the equities market via an exchange traded fund.

Over time, as more value is held on the Bitcoin network via mechanisms like ETFs, then bitcoin the currency should experience greater price stability and be less susceptible to overall market manipulation.

One utility of Bitcoin as a financial network that is often touted by its proponents is its digital gold like capabilities — its ability to store value. How you feel about this use case probably most closely correlates to the price at which you first bought into the network.

It also really depends on what kind of scale we are talking about. Daily, weekly, monthly, quarterly, etc., the price of bitcoin is all over the place. But zoom out to year-over-year scale and sure the network has done pretty well as a store of value — especially when compared to other financial instruments such as fiat currencies.

So the influx of new investment from institutions interested in bitcoin as a new asset class will likely add some ballast to the price volatility. This is a useful thing for bitcoin’s overall store of value properties.

On the flip-side, it probably also means that the days of massive year-over-year growth will likely fade over time.

Way two: Bitcoin ETF = The beginning of the end of decentralized finance and the vision of a true open, permissionless system is never realized.

In this vision, self-custody becomes something of a novelty — a thing done by only hardcore uses so they can flex from time-to-time.

If you remember, Bitcoin launched primarily as an alternative to the financial system. It was envisioned and designed as a form of digital cash, native to the internet, that could be stored securely (aka non-custodial wallet) by an end user.

The beauty of bitcoin is that it’s supposed to be a way to send money back and forth without the need for any kind of intermediary or middleman. In a lot of ways, bitcoin helps close some major gaps on the internet.

So if most people start to have exposure to bitcoin via an ETF, which is an intermediary, they won’t be holding the asset themselves. This opens up a lot of issues related to network security and utility.

Depending on how the Bitcoin ETF plays out — and the level of overall investment of people holding bitcoin exposure versus people holding actual bitcoin — it undermines Bitcoin as an alternative to the traditional financial system.

And in a lot of ways, we move back to square one in terms of developing any kind of meaningful system of storing and exchanging value that is outside of the main power structures.

So if there is a massive influx of institutional capital into Bitcoin, does it mean that the network’s 15-year experiment is over?

In other words, are we losing sight of the importance of a future built on self-custody? Holding exposure to bitcoin via some kind of professionally managed financial instrument might be the easiest work around some of the issues related to holding and securing private keys.

Way three: Bitcoin ETF = The middle way — BTC goes legit, but the follow-on helps to build accessible and open financial alternatives

Maybe it’s a little too simple to think of the Bitcoin ETF as an all or nothing kind of proposition.

On one hand, over time, there will likely be an influx of capital into the network. This will have interesting impacts to overall volatility, value, price, etc.

After all, Bitcoin’s overall scarcity and economics, which are both baked into the network, won’t change just because an ETF is approved. The network doesn’t care how its assets are controlled and distributed — the network will just keep doing what it has been programmed to do.

Overtime, maybe institutional capital drives more interest in understanding bitcoin as a one-of-a-kind financial asset.

It’s possible that the approval of a Bitcoin ETF (or likely a raft of ETFs offered by a bunch of different financial firms), brings another level of maturity and sophistication to the network that helps push the sector past its tribal roots and casino culture.

Maybe a little suit and tie vibe will be good for the network overall, which means that more people will be able to access and build on Bitcoin.

Here’s an example from VanEck, one of the firms trying to win approval for a Bitcoin ETF.

Only time will tell how this all plays out and how compatible the cypherpunk vision of the future is with the vision of the future enabled by the traditional finance system.