Why self-custody matters for Open Money

Is the ability to self-custody digital assets slipping away?

THE WEEK

In this issue

- Dispatches: Tether under investigation, Kraken launches an L2, Bitcoin legal rights, Microsoft board voting on buying bitcoin, a hacker with cold feet

- Resource: Braintrust, a decentralized career networking platform

- Framework: Why self-custody matters

DISPATCHES

News from the frontier

- On a short Tether: The recent crypto rally was hampered by news that Tether, the largest issuer of stablecoins by market cap, is under investigation by the DOJ for issues related to anti-money laundering and sanctions busting.

- A followup to last week: Kraken, a popular centralized crypto exchange is launching a layer2 on Optimism’s Superchain. The main goal, based on the company’s announcement, is to enable faster and more secure decentralized finance operations. That should sound familiar.

- Bitcoin rights: Pennsylvania is in the headlines recently as a battleground state in the upcoming election. But the state’s legislature passed a new law this week protecting people’s right to self-custody (see below for more on this) and run a bitcoin node.

- Macrosoft: One interesting item on Microsoft’s most recent SEC filings is a line item asking for a vote about investing in bitcoin.

- Just kidding: This week a hacker drained a wallet controlled by the US government of $20 million. The hacker returned $19.3 million to the same address the next day.

RESOURCE

Braintrust: A new marketplace for job hunters

Braintrust is a new platform designed to better connect job seekers with opportunities. There’s also a token-based marketplace of sorts where people looking for mentors, guidance, and other career-related input can find expertise.

If you are looking for work or trying to figure out how to navigate the wacky times of today’s job market dynamics, you might want to check it out.

OPEN MONEY

Notes on self-custody

The ability to self-custody financial assets is an important feature of Open Money.

It’s also what makes crypto as a financial technology so interesting.

Self-custody is like a cornerstone of a new kind of financial system built on access, equality, security, and minimal user cost.

Other key variables that makes Open Money an important alternative — things like its permissionless nature, or it programmability or composability — all rely on the ability for individuals to control their own assets.

Anything other than self-custody requires the use of trusted third parties or middleman.

Since the beginning of formalized economies, the use of financial intermediaries, and the costs associated with go-betweens — was generally accepted as standard practice.

It was something that was tolerated because a better system wasn’t available.

But the internet and crypto are changing the status quo of what’s possible. The two technologies are like a one-two punch that enable global network effects and individual independence at the same time.

A disagreement about the idea of self-custody

This week Bitcoin mega bull Michael Saylor made headlines for suggesting that the best way to custody bitcoin in the future for most people will be through formal financial institutions.

These institutions, the line of thinking goes, will be designed to custody bitcoin on behalf of their account holders. Essentially, they’ll be like bitcoin banks.

While this addresses some issues associated with self-custody — mainly it alleviates the burden or responsibility of having to manage private keys and deal with things like hardware wallets or other specialized security setups.

But, it’s worth noting, that the tradeoff for all of the convenience is that it also takes away one of the key features of bitcoin — the ability for individual people to control their underlying financial assets.

One of the reasons why Saylor’s comment drew so much attention is that he is an outspoken proponent of bitcoin and its attributes as a unique financial asset.

He’s the architect and champion behind MicroStrategy’s (the company he founded and ran as CEO for years) acquisition of billions of dollars in bitcoin.

MicroStrategy is a publicly traded company. Until the recent launch of the bitcoin ETFs, buying MicroStrategy stock was viewed as one way to gain access to bitcoin’s price movement via the public markets.

While the setup is unconventional, from a valuation perspective, the company’s investments in bitcoin seem to be paying off.

A recent article pointed out that over the last 25 years, MicroStrategy’s has grown 1,500%, which beats Microsoft’s growth rate over the same timeframe 1,460%.

Needless to say, Saylor’s comment’s about how bitcoin banks are the future caught some people by surprise. After all, the ability to self-custody is one of the main features that makes bitcoin such a different animal in the first place.

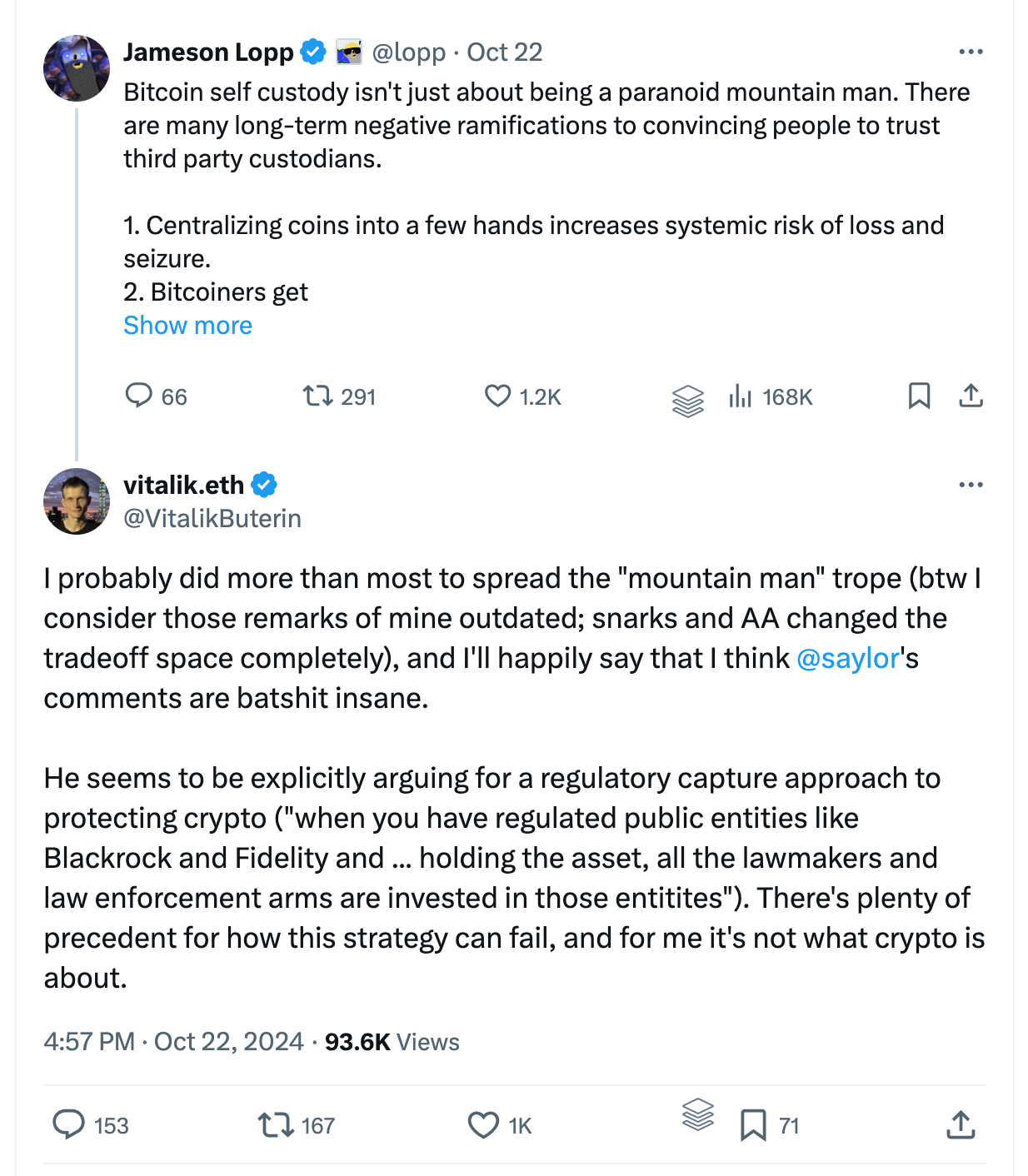

Here’s one indicative tweet response, for example:

Saylor has since walked back the comments or at least tried to give more context to the point he was trying to make.

Mainly, he was suggesting that most people don’t really care about the ability to self-custody digital assets.

And I think that’s largely true. Most people don’t really want to figure out how to securely hold bitcoin.

Nevertheless, I think it’s important to continue to make self-custody easier and more intuitive and not just accept that the old way of handling financial assets is necessarily the best way.

This is especially relevant as the financialization of everything is getting underway.

The push toward bitcoin mass adoption brings new ways to interact with the asset, like bitcoin ETFs for example, then it becomes increasingly important to understand what self-custody is all about.

And maybe it's becoming increasingly important for people to understand that holding bitcoin in a non-custodial wallet is a way different than holding some kind of financial product that merely offers access to bitcoin’s price action.

What is self-custody in crypto and why does it matter?

Self-custody in crypto is possible because of non-custodial wallets.

Non-custodial wallets or the ability to hold a naked asset are a feature of crypto’s public key cryptography system.

In other worlds, crypto is crypto because of the underlying system of wallets and public and private keys.

Or, put another way, crypto without the cryptography part is just a more complicated version of money controlled by governments, banks, and corporations.

There are a lot of reasons to support ideas like bitcoin ETFs or even bitcoin banks.

Opening access and opening the bitcoin market will help the asset mature and eventually the added liquidity will be like a ballast to the historically turbulent markets.

At the same time, it’s also important that people continue to learn about and understand self-custody and why it’s so important.

Holding bitcoin in non-custodial wallets helps move the world closer to toward the vision of more peer-to-peer interactions on the internet.

Without those aspects, we run the risk of just creating new technologies that benefit the companies and organizations who are able to build the strongest and most valuable intermediaries.