What is the Ethereum ETF? And why does it matter?

Ethereum ETF trading went live this week. That matters for reasons of access.

Ethereum ETFs, or exchange-traded funds, opened on Wall Street this week. The ability to buy Ethereum from a traditional brokerage, institutional, or brokerage account is a massive milestone for a lot of reasons.

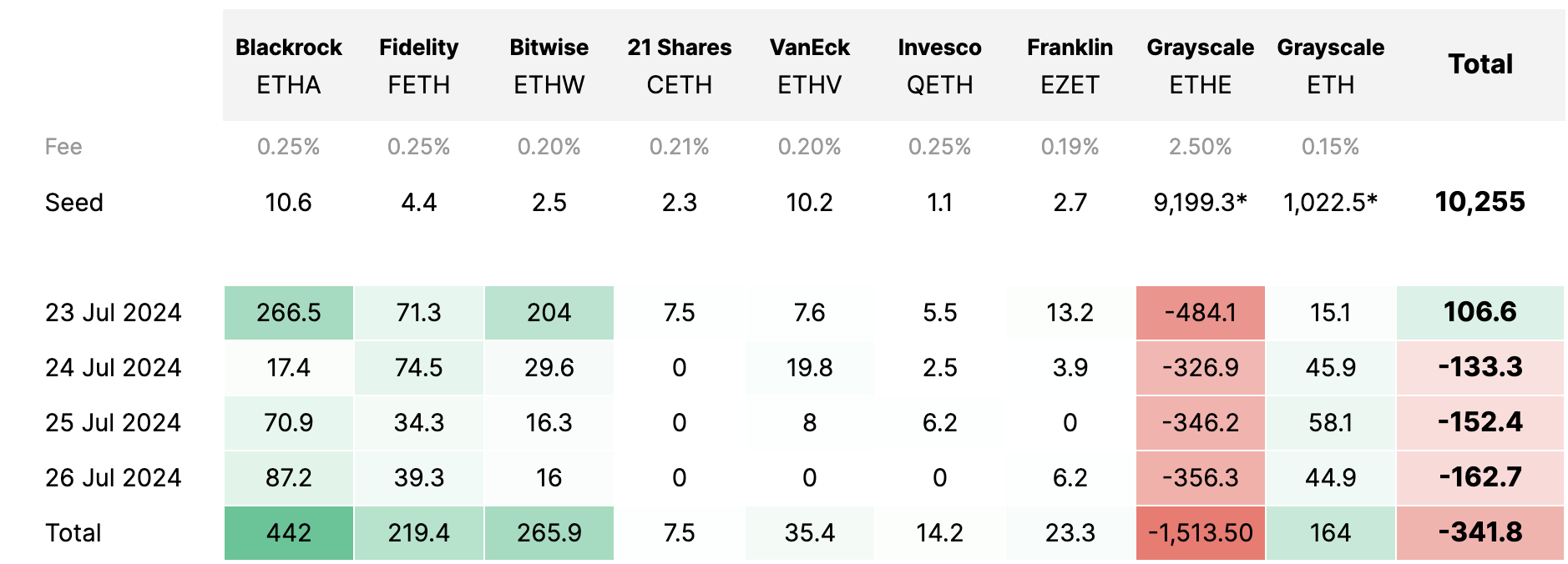

And while the news might have felt a bit muted compared to when the Bitcoin ETFs launched, the inflows over the first few days show a trend of demand.

Meanwhile the price of Ethereum is basically in the doldrums — and definitely not reflecting the broader market’s enthusiasm about the ETF opening news.

Why is that?

Well, one big reason is that the approval of the ETFs also triggered a massive outflow from Grayscale’s Ethereum Trust, which until the ETFs was really one of the few ways to gain access to Ethereum’s price action via a traditional brokerage account.

The approval of the ETFs meant that Ethereum held in the Trust were converted to ETHE, which can be traded more easily than previous shares of Ethereum that were subject to stricter rules.

According to the data from the last few days, it looks like people who had their Trust shares converted to ETHE are deciding to sell, which could be because they are just taking advantage of the easier liquidity, or because they are moving their Ethereum holdings to one of the newer and cheaper ETFs.

We saw a similar thing happen in the first few weeks following the Bitcoin ETF launch. If what happened during that reshuffle is any indication, then the selling pressure from the Grayscale Trust outflows will eventually slow, and the net inflows (buying pressure) will start to push Ethereum’s price.

The craziest part of all of this is that it was only back in late May that we talked about the quick about-face regarding the SEC’s authorization of the Ethereum ETF products. The announcement that the applications for the ETFs were approved in May was widely viewed as a signal that all of the ambiguity about how to classify Ethereum was resolved.

Like all of the noise that followed the Bitcoin ETF, the Ethereum ETF is a major turning point in terms of overall legitimacy. It is for sure a major bridge along the road to crypto mass adoption.

Why do Ethereum ETFs matter?

Ethereum ETFs make it possible for more people to access the economic potential inherent in Ethereum.

Ok, but what’s that?

We don’t know for sure yet. But we do know that the Ethereum ecosystem continues to grow year-over-year. One way I like to think about it is that buying Ethereum is like buying part of the network.

Conceptually, we’ve covered this in recent posts and talked about why buying part of the network is both a new opportunity and could have lots of upside (at least that’s what people are betting on when they buy and hold Ethereum).

Ethereum has been called a lot of things, like the world’s computer or digital oil (this plays off the idea that Bitcoin is digital gold).

So the big deal driving the excitement behind Ethereum ETFs is that all of this potential is now accessible via a traditional brokerage account.

That means that people who save money through investments like a retirement account or institutional investors professionally managing money now have access to Ethereum.

If you believe that one of crypto’s main value propositions is that it makes money and finance more accessible to more people via products like smart wallets or services like basic credit and lending via DeFi, then it feels like ETFs help round out crypto’s accessibility.

Accessibility is a major tenant of Open Money.

After all, if Ethereum really is something like the world’s computer then it will work the best if more people own it.

Downsides or known issues with Ethereum ETFs

But, and this is a big but, one of the biggest downsides to Ethereum ETFs is that holders don’t actually control the asset. The only own exposure to the asset.

For many people, or more specifically, for people only interested in owning something that has a good shot of becoming more valuable over time, the little wrinkle of what they actually own doesn’t seem to matter that much.

But in terms of things like self-custody, or having the ability to freely move naked Ethereum places, or the leverage that value in other apps or services, then an ETF doesn’t do a whole lot.

I covered some of this when we talked about the launch of the Bitcoin ETF a few months back, which, to be honest, feels like a lifetime ago.

To recap, access to Ethereum’s potential via an ETF is good because it means that more people will benefit from the market’s upside.

But, owning shares of an Ethereum ETF is kind of like having a ride-sharing app instead of owning a car. That works for some people, and it’s great for some needs, but it’s not quite the same thing as complete ownership.

Longterm, it will be interesting to see how much this distinction matters and whether owning naked Ethereum (or Bitcoin for that matter) becomes a thing reserved only for techno-purists.

What about staking Ethereum ETFs and what comes next?

One of the biggest differences between Ethereum and Bitcoin is that Ethereum generates dividends or yield through its consensus mechanism, which is known as proof-of-stake.

Currently, people who own Ethereum can participate in staking either by becoming a staking node or through a staking pool. To become a node, you need a minimum of 32 ETH. But you can also earn yield by staking a smaller sum through a pool, usually accessed via a consumer wallet or exchange.

Bitcoin, on the other hand, operates via proof-of-work, which means miners or people who dedicate intensive computation to the network earn rewards. In other words, it’s a different mechanism that couldn’t really fit inside an ETF wrapper.

But what if you owned a bunch of ETH in an ETF and wanted to stake that to the network in order to make additional yield? Hypothetically, this could be similar to owning a dividend-producing blue chip stock on the traditional stock market.

Unfortunately, staking within an Ethereum ETF isn’t a thing yet. But, laying aside the technical and regulatory details for a second, it does seem like a logical thing to bring to market.

It turns out that crypto ETFs might become its own niche. Already, even with the Ethereum ETFs only a few days old, market watchers are already moving on to trying to predict when the next digital asset ETF will hit the market.

And already people are floating the idea that mega memecoin launching network Solana could be next…