What is open money? An introduction

Open money describes digitally-native asset systems that are built on accessible, programmable, and user-controlled architectures. These attributes allow them to leverage network effects to become useful and valuable.

I use the term open money a lot. I use it in probably every other post. I even named my newsletter Open Money.

When I write it out, I usually pair open money with permissionless. Oftentimes, I say open, permissionless money.

But I realized that I don’t define open money. So, here it goes.

Open, permissionless money has three main attributes:

- Accessibility

- User control

- Programmable (modular and composable)

These three attributes create a simple framework to understand when a new system is based on open money principles, or whether it’s just the latest version of the status quo (more on this in this future of digital money post).

The features of open money provide leverage at both the individual user level and the protocol level.

Access: Open money is accessible

As the name implies, open money is open. Open as in accessible.

Accessible from the level of the code that open money is written with, all the way to the point of a person having access to a wallet, apps, and services that use the money.

Another way to say this is that open money is accessible from end to end. The openness is a feature, not a bug — it allows for follow-ons like accountability, transparency, and composability, all without the need for an intermediary or middleman.

The openness has its tradeoffs. Sometimes contentious forks happen — or a splitting of the codebase over differences of opinions. Other times, the openness gets exploited by fraudsters or hackers.

But it’s impossible to create anything new without tradeoffs, and likely as open money networks become more mature and established some of the tradeoffs get mitigated by the powerful network effects.

Access and permissionless go hand-in-hand. A very basic definition of permissionless means that a person doesn’t need any kind of approval or special credentials to join or use a system.

Bitcoin, for example, is permissionless because anyone can access Bitcoin’s code, recommend changes or updates, or take the entire codebase and build something new with it.

At the same time, the consumer side of Bitcoin is also open. Anyone can send and receive bitcoin from a supported wallet without the need for any kind of connected bank account or credit card.

Quick caveat or clarification: If a bitcoin user wants to exchange bitcoin for fiat currency or fiat for bitcoin then they will need to find an exchange. For regulatory and compliance reasons, exchanges have their requirements and guidelines about who can and can’t create an account.

But the larger point here is that open, permissionless money systems change the paradigm of how the modern money system works. The results open up new opportunities for money-based apps and services.

User control

Public key cryptography is a powerful technology. Open, permissionless money allows everyday people to harness and leverage public key cryptography in a way that gives them more control over the internet.

One way to think about open money is that it challenges the traditional way of setting up “accounts” or credentialing. The current user account credential database system leaves users’ identifying details vulnerable.

The current setup also means that platforms, everything from banks to social media, are in control of user access and own the underlying data.

Often this data is monetized via advertising, or our contact info is sold to other companies or platforms.

Public key cryptography flips this system through an architecture of wallets and keys giving end users ultimate control and the ability to self-custody assets.

What this means is if crypto users store assets in their wallet where they control the private keys, then they can restore their wallet on a different platform if there are any issues, or if they just want to move platforms.

The downside to this model, so far, is that non-custodial crypto wallets and the need to manage private keys have created a challenging user experience. These challenges have likely held back mass adoption, and at the very least have led to people losing money and other frustrating outcomes.

Major crypto product breakthroughs in the future will likely be made at the overall user experience level. Wallets and other services that make it easy for users to self-custody, but do it in a more intuitive way, would likely get enormous traction.

Programable and composable

Another of open money’s powerful features is that it is programable and therefore malleable or customizable to the exact needs of end users.

Programmability also makes it possible to continually upgrade, scale, or innovate on top of open money systems. Looking back at the recent history of the top two public blockchains provides great examples.

The Lightning Network, which is built on top of Bitcoin and creates payment channels that are faster and cheaper than moving assets on-chain, but still uses the Bitcoin blockchain for final settlement is one example.

Bitcoin ordinals, which just launched in 2023 and created smart contract-like functionality for the Bitcoin blockchain is another example.

Ethereum, the second largest blockchain by market cap, was able to change its entire consensus mechanism in 2022 from proof-of-work to proof-of-stake, which was a massive engineering feat.

The benefits of programmability and composability, or the ability to have various parts of a blockchain app work or communicate with other parts, have multiple benefits.

On one side, blockchain developers can create better functionality faster and make solutions that are targeted to small user populations. On the consumer side, the programmability and composability features of open money drive down costs by leveraging network effects and things like token standards.

Open source development also fosters a sense of competition and collaboration that ultimately drives innovation faster.

The future of open money

An aspect of open money is that it can get complicated quickly. One of the reasons is that conceptually it challenges the way we traditionally do things.

Another reason it’s complex is because open money operates on multiple levels, from the end user to the level of global-scale internet protocols. So when talking about open money, or the benefits of permissionless systems, it can sometimes get confusing about which level we are talking about.

I’m interested in open money because I think having a viable financial system that competes with the traditional financial system will ultimately be better for everyone.

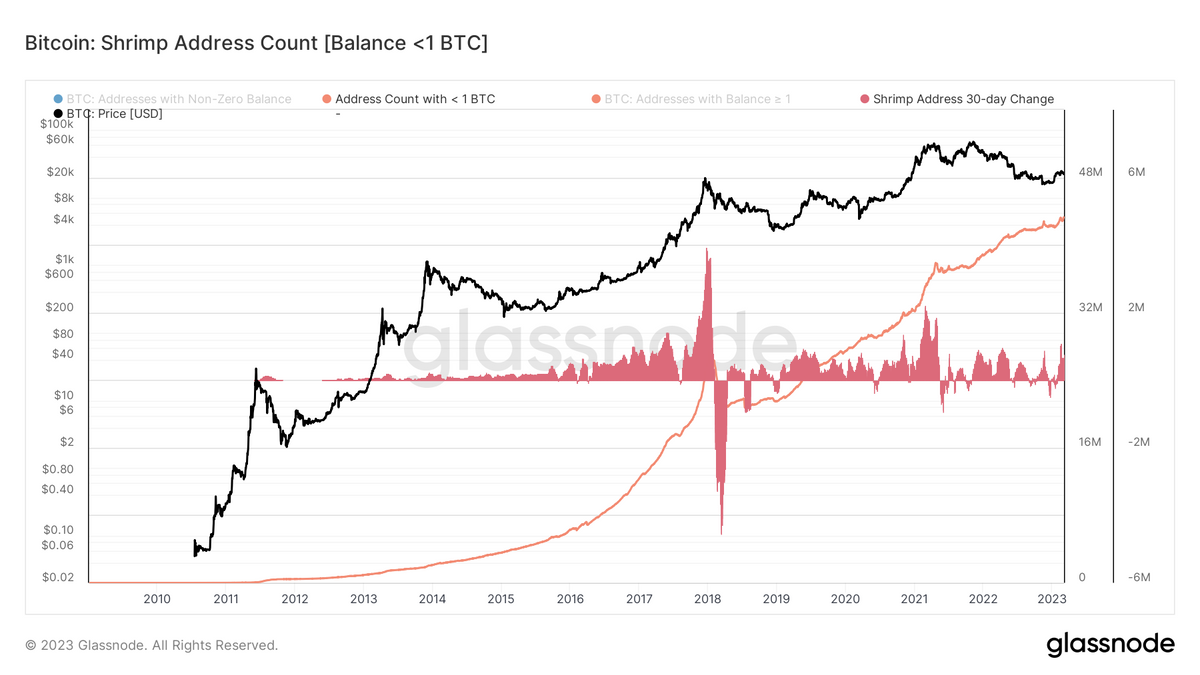

I’ve said it all along: I’m here for the shrimp, or the small-time investors, or people trying to save and make decisions for themselves or their families. To that end, I think people who fall into the shrimp category who will benefit most from open systems — because most often these are the people excluded from other forms of financial products and services.