What is a Bitcoin Strategic Reserve?

Bitcoin, not bombs. What is a Bitcoin Strategic Reserve? And maybe more importantly, why is everyone suddenly talking about it?

It’s hard to keep up with the political headlines these days. Take a day off, and it feels like the whole world shifts.

So it’s understandable if you missed the new conversation about a Strategic Bitcoin Reserve.

We’ll dive into the specifics in a minute, but the basic idea is that Bitcoin’s unique capabilities (both as a financial technology and an encrypted information network) make it a viable system of defense in a time of increasing uncertainty in regard to cybersecurity, artificial intelligence, and the emergence of new kinds of warfare.

If you’ve been following crypto for any length of time, you will understand that this idea is fascinating on so many levels.

-

First, it’s an acknowledgment that Bitcoin is a different animal and that the network has tremendous value outside of what’s reflected in its ever-fluctuating market cap.

-

Second, not that long ago Bitcoin was considered fringe and soley in the domain of the far-flung corners of the internet. In the early days, many Bitcoiners just wanted to get the currency into the hands of more people because it benefited the network overall. The idea that Bitcoin would become a technology to shore up national security was, well, far-fetched.

-

Third, Bitcoin has no CEO, no marketing budget, no headquarters, no shareholder meetings, no quarterly statements, etc. Instead, Bitcoin is a self-sustaining network that gets stronger and more secure as more time passes. Compare that to the traditional mechanisms of the military-industrial complex and you start to get glimpses of why a Bitcoin Strategic Reserve is so intriguing and could potentially put things like policy, diplomacy, etc., on a completely different footing.

In other words. Bitcoin, not bombs.

Bitcoin as an electro-cybersecurity technology

It’s hard to separate Bitcoin the network from bitcoin the currency. It’s hard mainly because Bitcoin the network exists to secure bitcoin the currency.

And bitcoin the currency exists to help grow and maintain the network.

But let’s pretend for a second that we can forget about the financial implications of bitcoin the currency and only think about the Bitcoin network.

As the network continues to scale and become more powerful and more decentralized (in terms of overall number of active nodes, addressees, and miners), then Bitcoin becomes more attractive or more formidable as a defensive technology.

OK, how?

Well, it’s pretty clear at this point that cybersecurity attacks will become a key component of large-scale warfare in the future. Even if somehow digital warfare and cyber-attacks are not weaponized at the level of nation-states or by organized rogue actors trying to attack or disrupt governments, normal people are already under attack.

In the last few weeks, I got emails from a credit union, a large crypto company, my phone company, and I can’t remember who else explaining that some of my personal information may or may not have been compromised during recent hacks.

I’m sure you’ve experienced something similar.

This is why we need physically defensible information networks. Most information networks are defended programmatically or with code-based logic.

Hackers and cyber attackers can exploit the code via brute force or other kinds of attacks. I’m simplifying this here, but the biggest attack deterrents are time and skill.

In the case of Bitcoin, the physical component is the amount of energy required to perform the complex computation required to maintain the decentralized network.

This makes Bitcoin different.

In order to change Bitcoin’s ledger or the record of the data stored, an attacker would have to gain control of more than half the network. Given the energy components and how physically decentralized the network’s operations are, this is a massive challenge that becomes more complex the older the network gets.

The idea of Bitcoin as a strategic tool predates the current news cycle. The academic underpinnings can be found in a paper written by Jason Lowery, an officer in the US Space Force and US National Defense Fellow at MIT.

From here out, I’m going to quote the paper heavily and a lot of the ideas in this post are derived from this source material. Also notable is that I only cover a small fraction of this paper, so if any of this is of interest you should check it out.

One way that Lowery frames the need for strategic Bitcoin is through what he calls the Power Projection Theory.

“Utilizing a grounded theory methodology, the author combines different concepts from diverse fields of knowledge (e.g. biology, psychology, anthropology, political science, computer science, systems security, and modern military strategic theory) to formulate a novel framework called ‘Power Projection Theory.’ Based on the core concepts of Power Projection Theory, the author inductively reasons that proof-of-work technologies like Bitcoin could not only function as monetary technology, but could also (and perhaps more importantly) function as a new form of electro-cyber power projection technology which could empower nations to secure their most precious bits of information (including but not limited to financial bits of information) against belligerent actors by giving them the ability to impose severe physical costs on other nations in, from, and through cyberspace.” SOURCE

A simplified version of the Power Projection Theory is that Bitcoin is emerging as the best-in-class security system for digital information, largely because of the way it was designed and how it operates.

Bitcoin, not bombs, a computer network as a strategic technology

So politicians are starting to talk about a Bitcoin Strategic Reserve.

A version of this concept, mostly focused on the financial strategy of holding bitcoin in a reserve, was introduced as a bill to the Senate on July 31 (more on this in the next section).

Regardless of how the bill fares during the legislative process, it will help create a fuller context for Bitcoin as an important innovation for the way we live now.

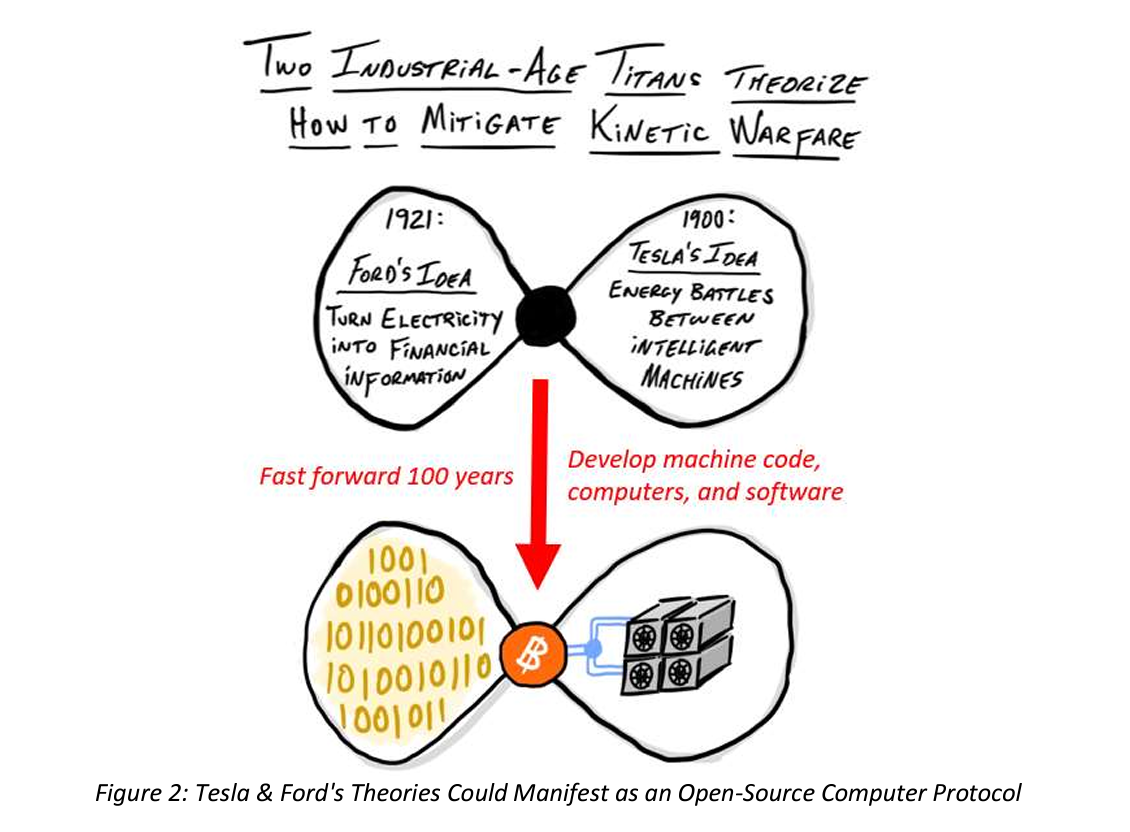

What’s crazy (and again referencing Lowry’s work here) is that heavy-hitting innovators and technologists like Nikola Tesla and Henry Ford all spent time thinking through how the power of electricity could become a tool of peace by creating a less lethal means of settling conflict.

Tesla envisioned a world where machines and technology would become so complex that humans would be forced to use wired systems to fight their wars. Of course, this was long before computers, AI, or robotics were even a thing.

For his part, Henry Ford thought that “society could eliminate one of the root causes of warfighting by learning how to create an electric form of currency that bankers couldn’t control.”

It’s wild that these ideas are from 100 years ago but they only start to make sense or become more concrete if we think about how Bitcoin comes into play.

According to Lowry, “What if Ford’s theory is valid, and it is indeed feasible to mitigate a root cause of warfare by converting electricity into monetary and financial information? What if Tesla’s theory is valid, and the future of warfare does indeed involve intelligent machines competing against each other in human-out-of-the-loop energy competitions? Would this technology not reduce casualties associated with traditional kinetic warfighting? If it did, would this technology not be worth every watt?” SOURCE

Things get heavy, quickly.

This is especially true for people who only view bitcoin as funny internet money or some speculative meme asset.

But, it kind of makes sense that the full utility of Bitcoin will only really emerge as the network matures and strengthens.

And then, what if Lowery’s thesis is only partially right? What if the Bitcoin network doesn’t achieve strategic significance? It would still be massively valuable to secure information at a global scale — something that is already well underway.

“It makes perfect sense that a proof-of-work computer network’s first use case would be to physically secure the exchange of vital financial bits of information, but that is clearly not the only use case. This technology could have far wider-reaching applications, as there are many other types of precious information that society would want to physically secure in the information age. To that end, Bitcoin could represent the dawn of an entirely new form of military-grade, electro-cyber information security capability – a protocol that people and nations could utilize to raise cyber forces and defend their freedom of action in, from, and through cyberspace. The bottom line is that Bitcoin could represent a ‘softwar’ or electro-cyber defense protocol, not merely a peer-to-peer electronic cash system.” SOURCE

Bitcoin as a financial reserve asset

Ok, so far we’ve danced around the idea that Bitcoin’s proof-of-work could provide a safe haven for critical information by making it so expensive to attack or compromise the data that it becomes infeasible.

Another related idea or component of the Bitcoin Strategic Reserve is that stockpiling bitcoin the currency makes sense for financial reasons.

Outlining the Bitcoin Reserve Bill in a press release, which was introduced to the Senate on July 31, by Senator Cynthia Lummis (R-WY), the goals are:

- Create bitcoin vaults within the Department of the Treasury “ensuring the highest level of physical and cybersecurity for the nation’s bitcoin holdings.”

- Authorize the government to acquire 1 million bitcoin or roughly 5% of all available bitcoin, which is similar to the level of the government’s gold reserve.

- Pay for the acquisition of new bitcoin via money already held by the Federal Reserve and the Treasury Department.

- Continue to work on self-custody rights for bitcoin holders. Notably, “the strategic bitcoin reserve shall not infringe upon individual financial freedoms.”

The only time the government would be authorized to sell bitcoin is to pay down the national debt. Or, as Lummis was quoted in the media as saying, “We will be debt-free because of bitcoin.”

One first step could be as simple as the government holding the bitcoin it has already seized or acquired, mostly via law enforcement activities.

The takeaway

All of this is to say that Bitcoin is at an inflection point.

In the early days, Bitcoin was mainly the domain of cypherpunks and others who believed that a peer-to-peer digital cash-like system was a way to resist some of the monopolistic and predatory forces of the corporate internet.

But now, jeez. Bitcoin is getting love from places not traditionally aligned with the cyberpunk ethos. At the same time, Bitcoin is moving from a far fringe to a technology with national defense implications.

We’ll end this one here, with one final quote from Lowery’s paper:

“The author asserts it would be beneficial for researchers to explore alternative functionality of proof-of-work technologies to eliminate potential blind spots, provide a more well-rounded understanding of the risks and rewards of proof-of-work protocols like Bitcoin, and positively contribute to the development of more informed public policy in support of the March 2022 US Presidential Executive Order on Ensuring the Responsible Development of Digital Assets and the May 2022 US Presidential Executive Order on Improving the Nation’s Cybersecurity.” SOURCE

If you get any value from my work, please consider sharing this. Thank you.