What is a Universal Money Address?

A Universal Money Address Standard leverages the Lightning Network to enable payment handles that are easy to read, share, and remember.

If you think about it, human civilization first started because of the emergence of a few foundational technologies. Money — early tablets tracking credits and debits against harvests — was among them.

Nevertheless, for all of the advances of civilizations and iterations of money since, we still lack a universal, planetary-scale way to quickly and efficiently exchange value.

Maybe there’s good reason: until recently, the tech stack needed to overcome jurisdictional control of money, or a way to keep the books in a way that works for everyone, just didn’t exist.

This is one of the major value propositions of Bitcoin and other major cryptocurrencies. On the backend they enable the creation of digital ledgers that don’t need the control or authority of a corporation or government to work at global scale. On the frontend they enable the creation of new kinds of currencies suitable for efficient exchange.

But, Bitcoin and other cryptos, by themselves, aren’t necessarily up to the task of making a seamless, fast, cost-effective, and super easy to use money system. While Bitcoin’s base layer, it’s layer one, is great for absolute security and storing assets in a non-custodial way, it’s still a little cumbersome to use universally.

Bitcoin does, however, create a great infrastructure layer to build a more universal money system. In fact, a new project aptly called the Universal Money Address Standard is doing just that. Universal Money Addresses (UMAs) leverage the Lightning Network, a layer two Bitcoin scaling technology, that makes it possible to send inexpensive micro payments through a simple wallet address (opposed to long string of numbers and letters, which is what a typical bitcoin address looks like).

Enter the universal money address

As I re-read this post before publishing, it almost read like I’m shilling UMA. I’m not. In fact, I’m not totally convinced that it will work (more on this at the very bottom of the post). But what caught my eye about UMA is that it’s a very human-centered design approach to the potential of open, permissionless money.

When you think about it, the best crypto options are ones where people don’t even realize they are actually using crypto as the financial rails for their transaction. All of the wiring should be hidden from view and the entire experience and the product or service just works better than its legacy counterpart. Even better when it’s an app or service that couldn’t possibly even exist in the traditional system because of limitations of geography or interoperability.

There are flickers of this happening around the crypto ecosystem — but it’s not yet happening at a massive scale.

That’s what’s so exciting about something like a Universal Money Address Standard.

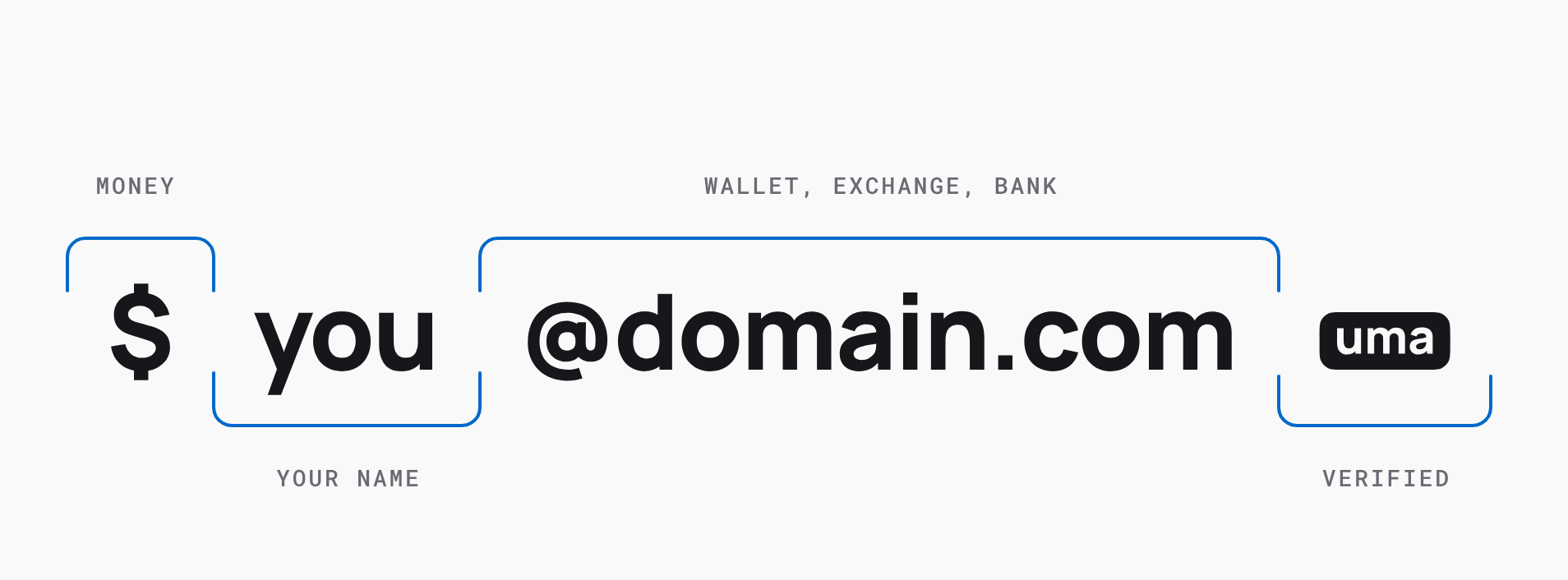

At the most basic level, the UMA is like an email address that you can use to send and receive money. In order to work, the address needs to be supported by a bank, exchange, or digital money wallet that can convert the address to actual currency.

One of the advantages of a universal money address is that I could send dollars to an address and the recipient could receive it in pesos or a currency of their choice, or more accurately in a currency supported by the local exchange or banking partner.

This is all made possible because the universal money address uses Bitcoin as its rails and settlement layer.

How does a universal money address work with the Lightning Network?

The Lightning Network is a layer two Bitcoin scaling solution which makes it easier to use bitcoin for small or frequent payments. Typically, if I send bitcoin over the layer one Bitcoin network then I have to wait for miners to confirm the transaction (this takes up to ten minutes, or longer if I want additional confirmations), I also have to pay network fees.

The confirmation times and the fees are the tradeoffs for a super secure and globally accessible asset network. But, these attributes don’t necessarily make bitcoin a great option for everyday payments or to use if I want to buy a cup of coffee.

The innovation behind Lightning makes it possible to leverage the security and network effects of Bitcoin, but at the same time, open up payment channels that act like mini ledgers that track credits and debits. The channels themselves sync with the Bitcoin blockchain. This cuts down on the number of transactions in each block, alleviating both scaling issues for the network and costs for individual transactions.

Open sourcing the Universal Money Address (UMA) standard. Money needs to move like email, so we’ve extended Lightning and LNURL to support compliance and FX. Users will be able to send/receive fiat & crypto via their UMA-enabled exchange, wallet, or bank. https://t.co/zKuydqRH7g pic.twitter.com/ye7PWsGMRI

— David Marcus (@davidmarcus) October 23, 2023

Lightning also enables the creation of Bitcoin addresses that are more human readable.

These two factors: that Lightning is better suited for faster, more cost-effective payments and that the addressing system allows for configuring in a way that’s easier for humans to interact with (like sharing a payment address in the form of an email or a social handle instead of a long alpha numeric chain) makes it a good building block for a Universal Money Address.

How universal is a universal money address?

Tech-wise, a universal money address built atop the Lightning Network is a feasible innovation that doesn’t require multiple new leaps to work. It works right now.

But with a big idea like a universal money address, success really depends on scale. And in this case, scale depends on partnerships and adoption by wallets, banks, exchanges, etc.

So, while there might be demand by consumers for an easy to use universal money system — and one that claims to do good job of abstracting the tech and focusing on the human-centered design elements, there’s still a sense that universal money will ultimately rely on the pace and ease at which it can be integrated into more traditional or at least more established more financial networks.

There are a lot of reasons why something like the Universal Money Address Standard could fail. It could be viewed as too competitive to traditional payment and money transfer systems (and then not adopted by partners), or there might be some kind of tech hiccup, which might make consumers not trust it or want to use it, or it might suffer from the longstanding on-ramp, off-ramp issue that other similar or adjacent ideas face.

Interested in the role of open money in a post-globalized world? ⬇️

But despite all of the issues or potential hurdles on the way to obtaining a critical mass that makes UMAs achieve escape velocity, there’s an appeal in the concept that universal money as something that everyone on the planet could have in common.