Unichain and the expansion of the layer 2 universe

Does the expansion of platform-specific L2s create more efficiency, more complexity, or both?

The week

In this issue

- Dispatches: World Network, big growth in prediction markets, Tesla's bitcoin moves, crypto PACs spending on the election like its a bull market

- Framework: The Unichain launch and the continuation of the Skinny Fat Protocol Thesis

Dispatches

News from the frontier

- Time for a rebrand? Worldcoin is rebranding itself World Network, but continues its mission to scan eyeballs.

- Q3 reporting in. CoinGecko released its Q324 report. Growth in prediction markets is up over 500% for the quarter.

- Tesla moves its bitcoin. The company holds $765 million in BTC, which it recently moved to new wallets for unknown reasons.

- The price of democracy. Crypto PACs are spending big — so far about $130 million in congressional races this election cycle.

Open Money

The coming layer wars

Sometimes in crypto, things move so fast it’s hard to keep up. Other times, it feels like you can see ahead and around corners and see the next big trends developing before they become a big deal — like watching an ocean swell become a wave.

Last week, Uniswap Labs (the main builder of the popular Ethereum-based decentralized exchange Uniswap) announced that it was launching its own layer 2 (L2) chain, Unichain.

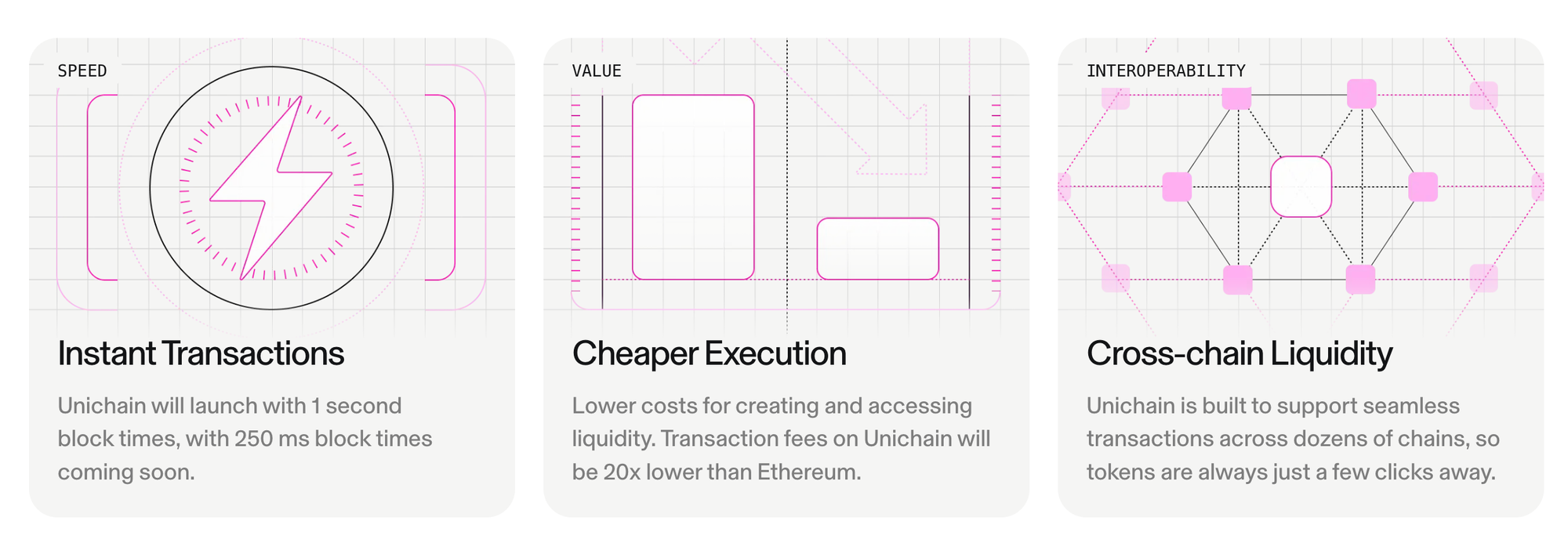

The main reasons cited for creating yet another L2 network is that the purpose-built network will enable faster and cheaper transactions and more liquidity to Uniswap’s ecosystem.

Before we dive into why this feels like a significant development, let’s connect a few dots to other trends that we’ve covered in the recent past.

What is Unichain and why does it matter?

Uniswap launched in 2018 as a decentralized exchange and automated market maker that allowed users to easily trade Ethereum-based tokens and assets.

It wasn’t until 2020, or DeFi summer, that Uniswap took off. Since then, the platform has gained a steady and loyal user base, which is part of the reason why something like its own L2 could work.

This chart shows the explosive growth and then cooling of UNI, Uniswap’s native token.

This is where things get a little bit confusing. Why build a chain when you already have a token?

One way to think about the difference between UNI the protocol token and Unichain the L2 network is that Unichain will be like the frontend and UNI will be like the backend.

Unichain’s functionality promises faster and cheaper transactions, allowing for a better user experience. Meanwhile, UNI still allows interested parties to participate in the overall governance and functioning of a decentralized exchange.

In theory, UNI token holders who participate in governance decisions could vote on outcomes that would affect Unichain.

How the dynamics play out between the two will be interesting. While it’s easy to compare Unichain to what Coinbase is doing with Base, it’s also important to remember that Uniswap operates as a decentralized entity while Base is controlled by a centralized company.

Also noteworthy, in terms of how Unichain will work from an engineering perspective, is that it launched on the OP stack.

You might remember a few months ago we talked about the concept of a superchain infrastructure enabled by a federation of companies and projects all building better tooling for layer 2s to achieve blockchain scale through lower costs and faster transactions.

Base, (again used as a reference point), is also built using OP Superchain infrastructure.

Seeing one example of something feels like a proof-of-concept. Seeing two examples feels more like a pattern. But seeing three of something enables triangulation and the ability to spot a trend.

With Base building on the Superchain and now Unichain, it feels like only a matter of time before we see a third high-profile example, proving the trend and potentially signaling a new direction for blockchain building.

Potential outcomes for Unichain and the rest of the layer 2 universe

The launch of Unichain fits into the growing body of evidence that the Skinny Fat Protocol Thesis is a real thing.

We are also reaching into the back catalog to talk about the Skinny Fat Protocol Thesis. For a long time (relatively speaking), the Fat Protocol Thesis dominated the discussion about how the economic interplay would work between infrastructure layers, like Ethereum’s layer one, and decentralized applications.

The idea, to simplify, was that value from the app layer would accrue back to the underlying layer one, making continued investment make sense.

This is where the fat part of the Fat Protocol Thesis comes in.

But things are changing as L2s become more advanced and more comprehensive, which is what we are seeing with the whole superchain concept.

The Skinny Fat Protocol Thesis addresses the idea that as L2s get good enough, the economics of how value accrues back to the underlying chain will likely start to change.

The rise of new L2 app chains built specifically to perform infrastructure tasks — and eventually compete with layer 1s is certain to have downstream consequences.

The thing is, nobody knows what those consequences will be yet.

Maybe the Fat Protocol Thesis holds up and value accrual still flows in a meaningful way to the L1.

Or maybe, the Skinny Fat Protocol Thesis gets to the point where a network like Base or Unichain starts to become more purpose-driven and more important to more people.

Either way, the trend of launching L2s is happening.