Blockchain evolution: How changes in Ethereum transaction type demonstrate network utility | DYOR

To dismiss massively valuable permissionless networks, like Ethereum, as trash because they are not backed by anything, is, well, a mistake.

One of the most scathing and also bothersome/painfully ignorant critiques of digital assets goes something like this, “Crypto is a scam because it is not backed by anything.”

For sure there is unwarranted hype and straight up pump-and-dump schemes in crypto.

But there is also a tremendous amount of new value being created in the form of global crypto networks. The top two crypto assets by market cap, Bitcoin and Ethereum, account for a little bit less than 75 percent of the overall $1.1 trillion crypto market cap (current at the time of this writing, but both numbers are dynamic).

To dismiss these massively valuable networks as trash because they are not backed by anything, is, well, a mistake. Here’s why:

The power of network effects as economic value

Critics arrive at their conclusion probably because they don’t understand the power of a network, or that a network (especially one that isn’t owned or controlled by anyone or any corporation) has intrinsic value.

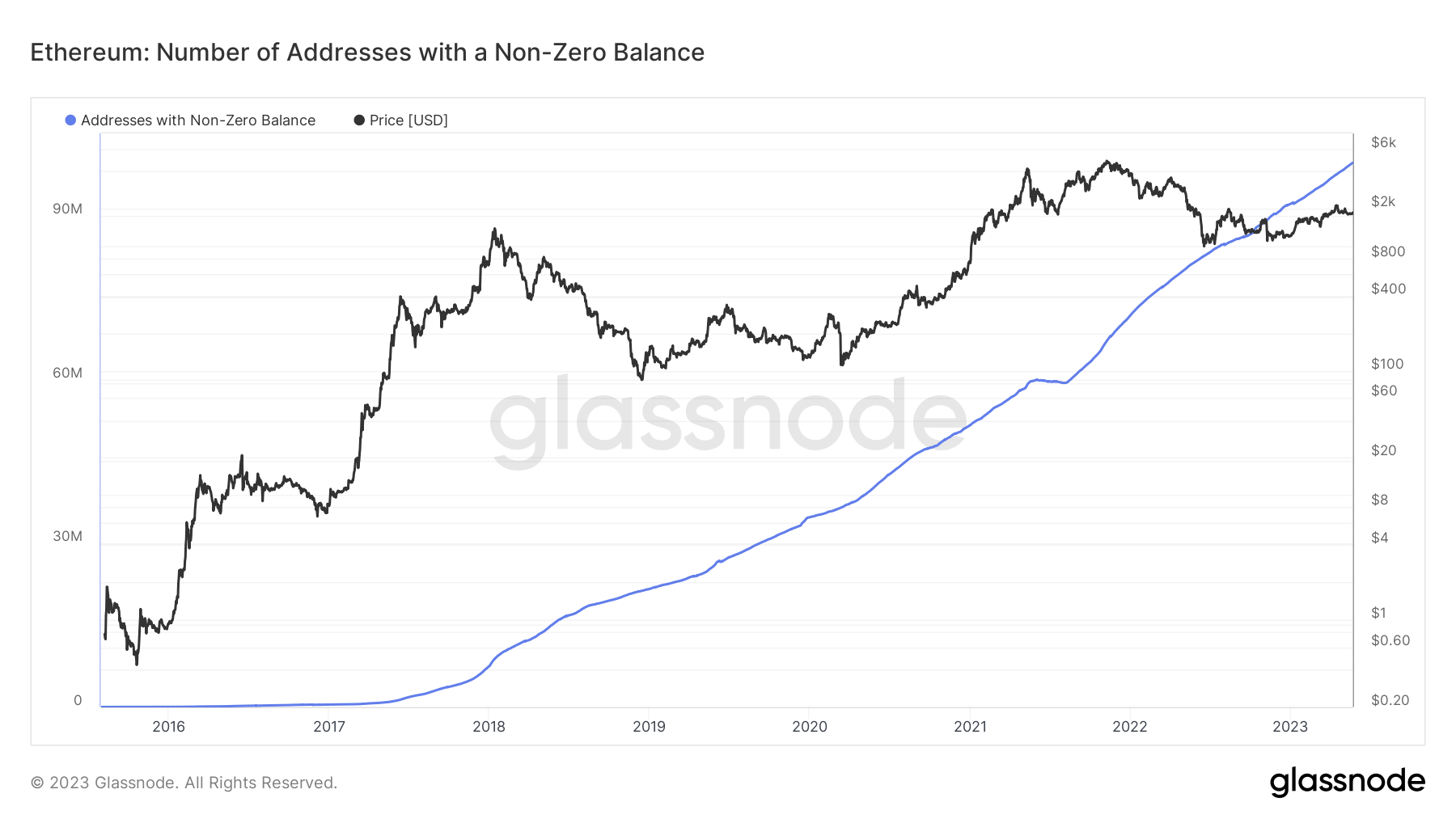

The utility of a network can be expressed in a number of metrics such as overall number of participants (the number of unique address, for example), or transaction volume, or kinds of transactions happening on the platform (especially if these kinds of transactions can’t be replicated elsewhere because the underlying tech stack is unique or novel).

In other words, thinking of the value of decentralized financial resources like you would think of the economics of gold, or why fiat currency backed by a standing army, is a dead end when trying to evaluate emerging blockchain-based assets.

Instead, we need new ways of looking at frontier forms of finance and new ways of trying to decide their value.

One simple way to evaluate utility is to look at the overall utility of a digital asset is to look at how people are using the underlying network.

Use case: Ethereum’s changing transaction dynamics point to overall network utility

Another to understand overall crypto utility is to look at how the Ethereum network has unfolded or grown so far.

Looking at the chart at the top of this post is kind of like looking at tree rings of a cut stump. You can see distinctive patterns that when taken together add up to a pattern of growth and change over time.

By just looking at transaction dynamics on the Ethereum network since it launched in 2015 we can see major phases:

-

Network launch, buyers speculate: The initial phase of a network launch is characterized by early adopters speculating on future use and utility. Speculative buying in the early days helps fuel network growth and attracts developers and community members to start building out the network and experimenting with use cases. It’s during this phase that the highest risk/reward ratio exist. If a network takes off, like Ethereum did, then early adopters who still hold the network’s assets will be rewarded. But this is also the phase of network growth that is susceptible to the most hype, inflated valuations, and overall shitcoin-like tactics. Ethereum launched in mid-2015 and it took more than two years of speculative growth before on-chain transaction types started changing from pure speculation to actual utility. And even then, and for a few more years, the utility use cases were more widespread and commonplace.

-

Smart contracts launch, ERC-20 token standards: In the case of Ethereum, this is where things got interesting, and where the first flickers of network utility started to emerge. About a year after the launch of the network, the ERC-20 token standard was created. For developers on Ethereum, this mean that it was easier to create new apps, services, and tokens that were supported by smart contracts. Having a smart contract standard also drastically reduced development overhead as utilities became interoperable and smaller token economies could leverage the larger Ethereum network effects. In a way, the ERC-20 smart contract growth began a flywheel effect that started to attract more developers and more network members to the overall Ethereum-based ecosystem.

-

DeFi, smart contract-based financial products: In 2017 more and more DeFi activity starts building on Ethereum first with straightforward borrowing and lending apps and services and then eventually maturing into decentralized exchanges and automated market makers. Between the launch of DeFi and now, the majority of DeFi protocols are build in Ethereum, adding to the utility of the network in terms of total value locked (TVL) and the number of new addresses and wallets.

-

Stablecoins, Ethereum-based assets with a price peg: Ethereum-based stablecoins first started appearing in late 2017 and then in another way in late 2018. But the market volatility and trading between then and late 2020, saw a steady increase of ETH-backed stablecoins. Stablecoins have proven to have a number of uses, but mainly they act like a calm harbor in a time of volatility, or an easy way for crypto users and traders to move assets between apps, wallets, and service — and/or to hold digital assets over time without having exposure to market volatility. Again, the increase in the stablecoin use case utlitimately adds to the underlying network value.

-

NFT, non-fungible tokens add a new kind of scarcity to a world of digital abundance. In mid-2021, the interest in Ethereum-based NFTs exploded. In fact, the arrival of NFTs on the crypto scene was so dramatic that the interest and intrigue in digital collectibles and art issued as one-of-a-kind digital tokens even broke into the mainstream. By the end of 2021, Collins Dictionary said that NFT was the world of the year. Again, while Ethereum is not the only blockchain where NFTs are minted, it does account for the majority of NFT-related transactions, which also adds more value to the network in the form of unique smart contracts and the amount of value transacted.

-

Emerging use cases : MEV bots, AI on chain: By now, a trend is developing. What the future holds for Ethereum and the utility of the underlying blockchain is wide open. What’s clear is that as each new network use case comes online, the network effects become additive, which is reflected in the overall growth in global users and in the increase price in Ethereum itself.

The key takeaway of looking at Ethereum as a use case is that the underlying network is dynamic and changes over time. Far from a bug, or the composability of an open and accessible blockchain means that its overall utility can continue to grow as developers and community members think of new use cases.

We actually see this playing out on the Bitcoin network right now too. Even though Bitcoin’s evolution and utility is different than Ethereum — Bitcoin has been more stable in terms of products and services being built on top of it — use cases can change over time. The recent launch of Bitcoin Ordinals, and how the new tech has impacted Bitcoin’s transaction dynamics is is one great example.

Over time, what will give a crypto network value is that it continues to attract users, settle transactions, and offer utility.

What’s also interesting, by looking at Ethereum’s historic transaction data, we see that while some users are just buying Ethereum to speculate on cost, increasingly the utility of the network — and the number of transactions happening on the network is diversifying and become more specialized. This is all happening while the network is growing and while the price of the underlying asset continues to climb.

Far from being “backed by nothing” crypto networks that get traction are supported by the growth and utility of network effects that can grow to internet scale.