Stablecoins as shelter

By design, stablecoins are boring. They are designed to hold their value even as other digital assets fluctuate wildly. The mechanics of stablecoins are now attracting attention outside of the crypto space. They just might become an important tool for managing the United State's growing debt.

If you know anything about crypto, it’s probably that it is an extremely volatile asset class.

One minute headlines are screaming about how people are losing their houses, marriages, and life savings because they put all of their money into a dog coin that tanked.

Or the reverse, we’ve read stories about people who loaded up early and now they drive a Lambo, own a yacht, or have happily disappeared altogether (or maybe all three).

Yes, crypto is volatile. The underlying nature of constant price discovery mode is one of the things that make crypto so interesting as a financial asset.

Or, put another way, the wide and wild swings of the crypto market are one of the things that generate a lot of media coverage. It’s kind of like a “famous for being famous” situation.

Because of its reputation for volatility, stablecoins kind of stick out.

While the rest of the crypto sector is flashy from a price perspective, stablecoins are pegged to a fixed price (or price stable). That means, by comparison, they are extremely boring.

As it happens, the price stability of stablecoins might just be one of crypto’s greatest use cases.

Counterintuitive? Maybe.

Rapidly gaining traction as a useful financial tool in a rapidly changing world? Definitely.

Let’s dig in.

A quick intro to stablecoins + the role they play

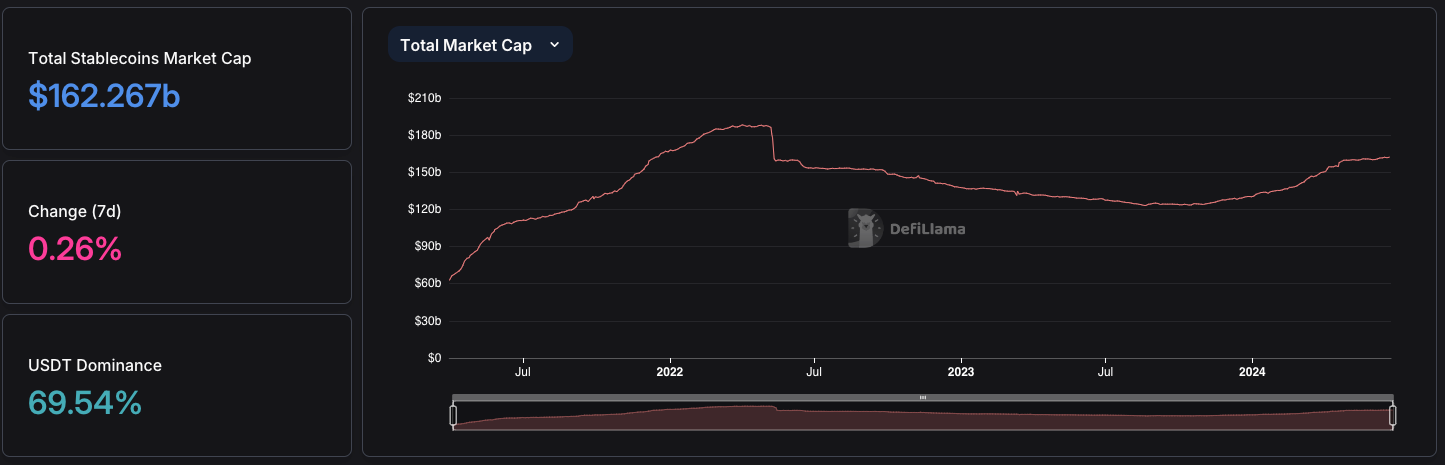

Stablecoins have been around for a while. Tether, or USDT, is the largest stablecoin by market cap, and the third largest crypto asset by market cap after Bitcoin and Ethereum.

Today, Tether plays a big role in the crypto markets. But when it was first created in 2014, its role and utility was not as clear. That, and there were some issues with creating a decentralized but fully verifiable treasury that is crucial for locking in a price peg, which is what makes a stablecoin stable.

The first use for Tether — and eventually the other stablecoins that would follow was to create a safe harbor of sorts for the otherwise choppy seas of the crypto market.

Traders and crypto investors saw a utility in keeping money in the markets, but they also needed a place to park assets in digital assets. There are a lot of practical reasons to do this, but basically, they all boil down to the idea that sometimes you don’t want exposure to volatile assets, but you also don’t want to have to move crypto to cash (and then back again) to take a breather.

Another common kind of stablecoin is known as an algorithmically-backed stablecoin. This means an algorithm replaces the human-managed auditing and accounting that happens with the stablecoin reserve system. The algo automatically buys and sells assets to maintain the peg.

The issue with the manual audit method is that it creates centralization or the need for trust in a third party to keep the books. Comparatively, an algorithmically-controlled system operates in a more decentralized manner.

But, if you remember the TerraLuna meltdown in May 2022 and all of the cascading effects that blew up the crypto sector, then you will remember that algo stablecoins can experience catastrophic failures.

By 2018 a partnership between Coinbase and Circle resulted in the creation of the other now-dominant USDC stablecoin. The second stablecoin by market cap and sixth asset overall, USDC was created, in part, to compete on the best way to manage a treasury or the backend of a stablecoin.

To maintain price stability or a constant price peg, especially in dynamic markets like crypto, requires some financial engineering. In the case of both Tether and USDC, that peg holds because their treasuries are constantly buying and selling assets like US dollars and short-term T-bills.

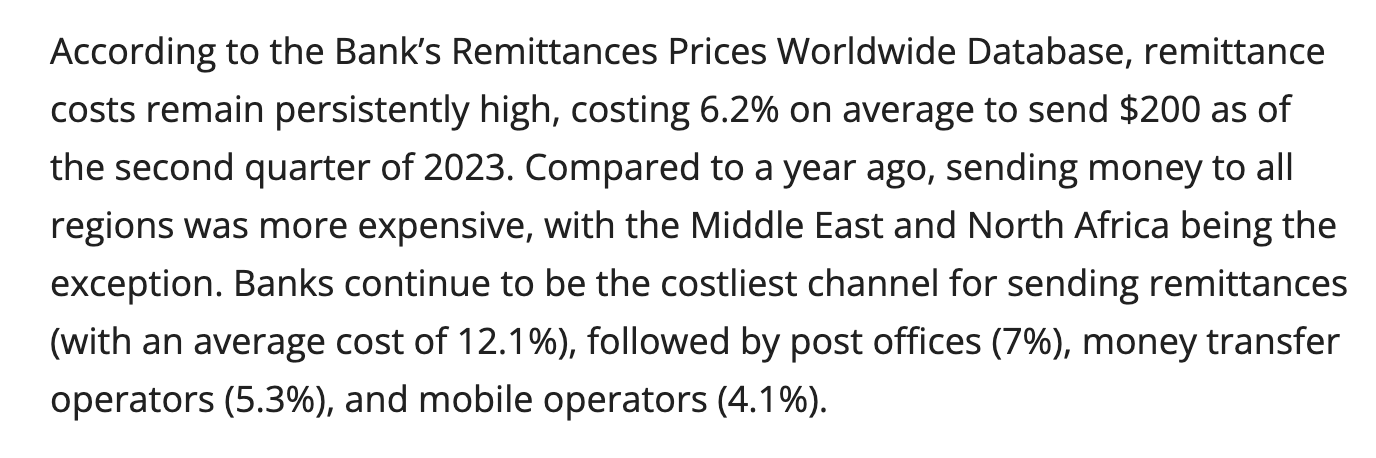

Another significant and early use case was the ability to use crypto to easily send money across borders (remittances) quickly and for a fraction of the cost of using traditional systems — and without risking exposure to crypto’s volatility.

Even if stablecoins were able to capture small percentages of the active trader market or the remittance market, the total addressable market could still be billions.

It’s hard to come across precise numbers for people using stablecoins as a place to park capital. But we do know that in 2023, people sent $669 billion in remittances to low-income and middle-income countries. That number is 3.8% higher than the amount sent in 2022.

But, given recent trends, stablecoins as tame digital assets might not be their only value proposition.

Stablecoins as a coping mechanism

Against the backdrop of current global dynamics, there is a new interest in stablecoins from people and places not typically crypto-friendly.

“We might start by taking stablecoins seriously,” wrote former Speaker of the House Paul Ryan in a recent Wall Street Journal opinion piece. “According to the Treasury Department and DeFi Llama, a cryptocurrency analytics site, dollar-backed stablecoins are becoming an important net purchaser of US government debt.”

“If fiat-backed dollar stablecoin issuers were a country, it would sit just outside the top 10 in countries holding Treasurys — smaller than Hong Kong but larger than Saudi Arabia,” Ryan wrote. “If the sector continues to grow, stablecoins could become one of the largest purchasers of US government debt and a reliable source of new demand.”

The big takeaway is that stablecoins — the most boring form of crypto imaginable — just got interesting. For all of the far-fetch techno-optimist-fueled futuristic ideas embodied by crypto, it would be ironic if a dominant use case becomes a sink for government debt. It would indeed bring things full circle.

Or, as Ryan put it, ”The framework for understanding how the dollar gets its power needs to be updated for a changing world.”

As the view on the utility and connectedness of crypto is changing, so too is the way that these assets are talked about. By way of illustration, I’ll sign off with this banger from Ryan’s piece, “Unlike China’s digital financial infrastructure, dollar-backed stablecoins issued on public, permissionless blockchains come packaged with the deeply American values of freedom and openness.”