Reserve in name only

Notes on the bitcoin reserve and the digital asset stockpile

If you’ve been reading this newsletter for any length of time, you know I’m bullish on the idea of bitcoin reserves.

The compelling aspect of a bitcoin reserve is that it makes sense at all levels of scale — from a family or company to a state or federal government. The data is in: there are sound reasons to buy and hold bitcoin.

A bitcoin reserve functions much like other strategic commodity reserves. The goal is to hold a valuable asset — defined here in a single dimension of price appreciation — and leverage that value in the future.

The United States has a Strategic Petroleum Reserve, as do most major economies. We also stockpile gold, medicine, and other critical materials. Other nations maintain different strategic reserves, often centered around commodities. In Canada, there’s even a Strategic Maple Syrup Reserve based in Quebec (réserve stratégique mondiale de sirop d'érable).

Thinking beyond single-dimensional value, an optimal reserve asset for a government is financially valuable, is backed by data predicting future price increases based on past demand, and holds some level of strategic importance.

In this context, reserves of gold and oil make sense. Even a maple syrup reserve has strategic value if you are among the few places in the world capable of producing it, like Quebec (the maple syrup reserve was last tapped during the global pandemic of 2021 to mitigate shortages).

With this multidimensional framework in mind, we’ve previously examined arguments advocating for a bitcoin reserve for both financial and strategic purposes. A government should want to own a share of one of the most valuable information networks in the world — for reasons beyond just "number go up."

Bitcoin has been the best-performing financial asset of the past decade. Full stop.

Bitcoin will have significant ramifications for national cyber-defense and future geopolitical power. Full stop.

Given those truths, a well-articulated national reserve strategy makes sense. As with other reserves, the government should take a long-term approach: buying when prices are low and selling fractions when prices are high to fund operations that sustain the reserve’s health and relevance.

To be clear, last week’s executive order on bitcoin reserves does not reflect a strategic reserve. There is no plan detailing how to build it, why it is a worthwhile investment, or how it aligns with broader economic and defense objectives.

In other words, last week’s bitcoin reserve announcement was a letdown and a missed opportunity. Rather than building something innovative or world-leading, the reserve as currently devised is merely an accounting entity consolidating the bitcoin already owned by the federal government (acquired through seizure or forfeiture). The idea is to maintain the reserve without taxpayer expense, likely meaning that any additional bitcoin seized by the courts will be added to the centralized reserve.

Additionally, a separate executive order from earlier in the week introduced the “digital asset stockpile.” It appears similar in management to the bitcoin reserve, but the underlying assets do not function as stores of value or digital commodities in the same way.

While a bitcoin reserve makes sense for multiple reasons, including other digital assets does not — mainly because they don’t score as well on the multidimensional matrix outlined earlier. Selecting assets for the stockpile without clear justification or supporting data is potentially damaging both to the assets themselves and the broader industry.

Here’s a thought: Why not sell all other digital assets controlled by the federal government and use the proceeds to acquire more bitcoin?

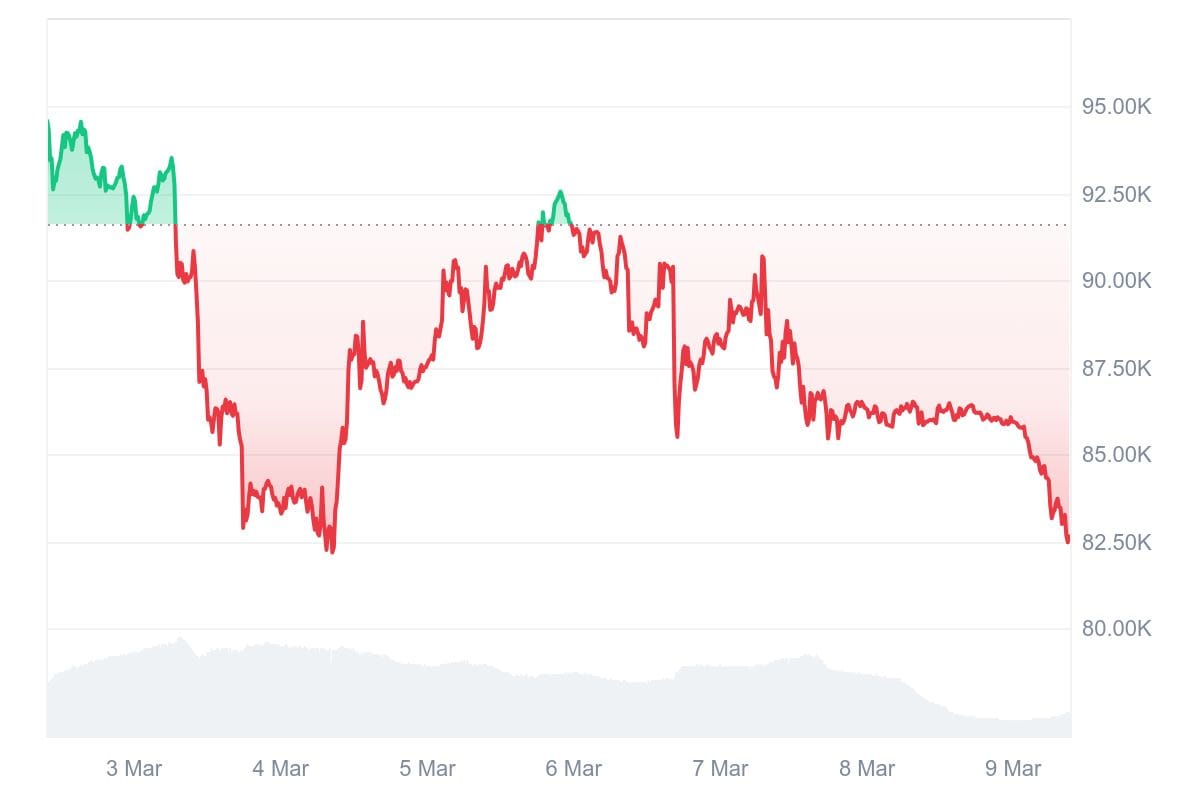

So far, the markets seem to share this sentiment. Since the announcement, both bitcoin and the broader crypto market have declined, and the fear and greed index is at its lowest level in months.

Open Money project updates

Section four of the Open Money project is currently under construction. The writing has come slower this past week, mainly because the material is a bit more dry – or maybe more tactical is a better way to say it.

I'm writing about key infrastructure components that make Open Money possible – things like exchanges, and wallets, and addresses, etc. My take is that understanding these components is important context to understand bigger picture stuff like new systems of identity and authentication or new methods of decentralized governance.

But my concern is that including this info in the larger project might slow down momentum for the reader (it's certainly slowed down my momentum with the writing), so we'll see if this section actually makes the final cut.

As always, feedback is super helpful.

Recent project updates