Crypto’s paradox of success: How political wins could threaten long-term innovation

Recent events — from a pulled Solana ad to a presidential crypto speech — highlight a growing tension in the crypto industry. Is mainstream legitimacy coming at the cost of innovation?

This week was punctuated by a couple of non-market events that seem to illustrate the current state of the industry. More importantly, they provide shading or context for where we are now — and might help partially explain why the crypto market feels like it’s losing momentum.

The two events were: a big, splashy ad launched by the Solana Labs, only to be taken down hours later — and a recorded presidential address to the Digital Asset Summit in New York.

The Solana ad was styled like a TV spot, presumably to build excitement and intrigue around an upcoming conference (the tagline was "America is back — Time to accelerate." The premise featured two actors in a therapy session — one as the therapist, the other as “America.”

The ad’s central tension was that America was awakening from an awkward phase and realigning with its core identity of innovation and prosperity. It was controversial for using identity stereotypes and cringe generalities, repackaging today’s radical political talking points as a rallying cry for building a new wave of tech.

The ad was eventually pulled after it was poorly received on crypto Twitter and elsewhere. Beyond the politics and lack of awareness, from a business perspective, the ad likely alienated many developers, artists, and collectors who actively use Solana apps and products. In that sense, it drew attention — for all the wrong reasons.

The second major event was the president addressing the Digital Asset Summit. There was significant hype around a sitting president engaging with the crypto crowd. The speech did happen, though only via a few minutes of recorded video.

Still, the basic message was clear: the United States intends to “dominate crypto and the next generation of financial technologies.” And, as we’ve heard before, America is poised to become the “crypto capital of the world.”

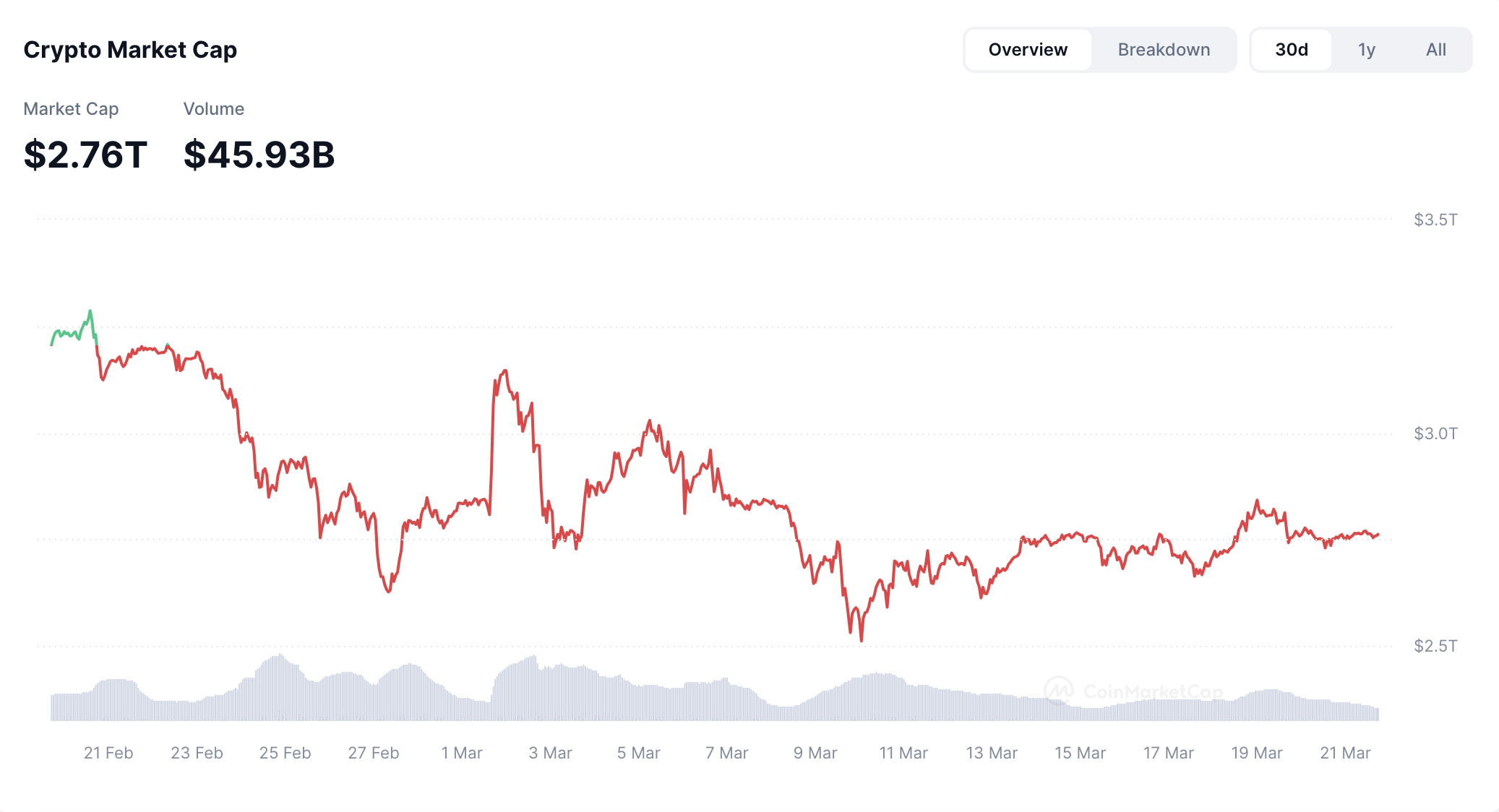

Meanwhile, the market continues to trudge through a valley of apathy. While dynamics could shift — and the great bull market of 2025 could return (it’s still early in the year) — the market’s reaction to all this political posturing feels more like a gradual retreat or at best, a long sideways slog.

The paradox of success: Can two things be true at the same time?

What’s most interesting about these developments is how they highlight the complexity of crypto’s current position.

Remember, crypto began as a protest movement — or at least, an attempt to create an alternative to the dominant financial system. It was conceived to build money and information networks native to the internet. The original goal was peer-to-peer digital cash.

As crypto gained market share and mindshare since Bitcoin’s launch in 2009, its conflict with traditional systems of power — especially on regulatory and legal fronts — intensified. Most recently, during the last presidential administration, that conflict became a major focal point. The government (specifically, the SEC) began investigating crypto companies and projects from all angles.

The regulatory environment over the past several years has clearly slowed innovation and made it harder for digital asset companies to launch new products and services.

In response, the crypto industry organized its capital and resources, throwing support behind Trump as a pro-crypto candidate. The industry even became one of the most powerful lobbies during the election.

Since taking office, the current administration has dropped existing proceedings against major crypto firms and fulfilled campaign promises, like establishing a Bitcoin reserve.

By many markers, this looks like success. Crypto has clearly gone “legit” from a regulatory standpoint. The president is making virtual appearances at industry events. Big crypto companies are aligning with political leaders in a way that signals… what, exactly?

If we take a step back from current events, it’s clear the industry faces a massive risk. In the short term, things might appear to be working. But long term, today’s alignments might look like selling out — at the very least, they’re a philosophical departure from what made crypto so interesting and innovative to begin with.

And that brings us to the paradox of success. Put simply: what worked to achieve a goal may not be what sustains continued success.

Or, to say it differently: the thing that made something successful might also be what leads to its downfall. In crypto’s case, aligning with a polarizing presidential administration might result in favorable regulatory conditions. But in the long term, that success could hinder crypto’s broader growth and adoption.

The paradox of success is rooted in systems theory or dialectic thinking. At its core, it suggests that two opposing ideas can be true at once. A quick breakdown in the crypto context might look like this:

Thesis: Crypto is internet-native money designed to eliminate the cost, time, risk, and interference of third parties.

Antithesis: Crypto is a financial technology operating in a highly regulated environment which means it requires the support of governments, corporations, and institutions to succeed.

Synthesis: Crypto is an innovation that supports an alternative financial system — it will be most successful if it can operate within the rules of the current financial system.

The challenge with this framing is that it demands more than the binary thinking — good or bad — that dominates today’s discourse. The real risk is that aligning too closely with today’s politics could suffocate long-term adoption.

We’re already seeing the public attach symbols to this administration’s actions. The backlash against Teslas is one example. A turn away from crypto could be the next.

Open Money Project update

The Open Money Project continues. I decided to expand (for now) the section about various parts of the system that makes Open Money possible. I still feel like this section is both important and potentially boring.

Your take and feedback is always welcome.

Here are last week's project posts: