If I had to guess, I would say that online sports betting will be featured during this year’s Super Bowl ads.

I think this is the case, but I don’t know for sure. I’m guessing based on some lead-up ads I’ve seen and because it seems like online sports books are having a moment. Also, the Super Bowl audience seems like a good market to get in front of if your product is geared toward betting on sports outcomes.

But here’s the thing: If I wanted to get a better handle on if online sports betting will be a theme of this year’s Super Bowl ads, then I could use a decentralized prediction market.

On the surface, a decentralized prediction market sounds like a place where you can bet on just about anything.

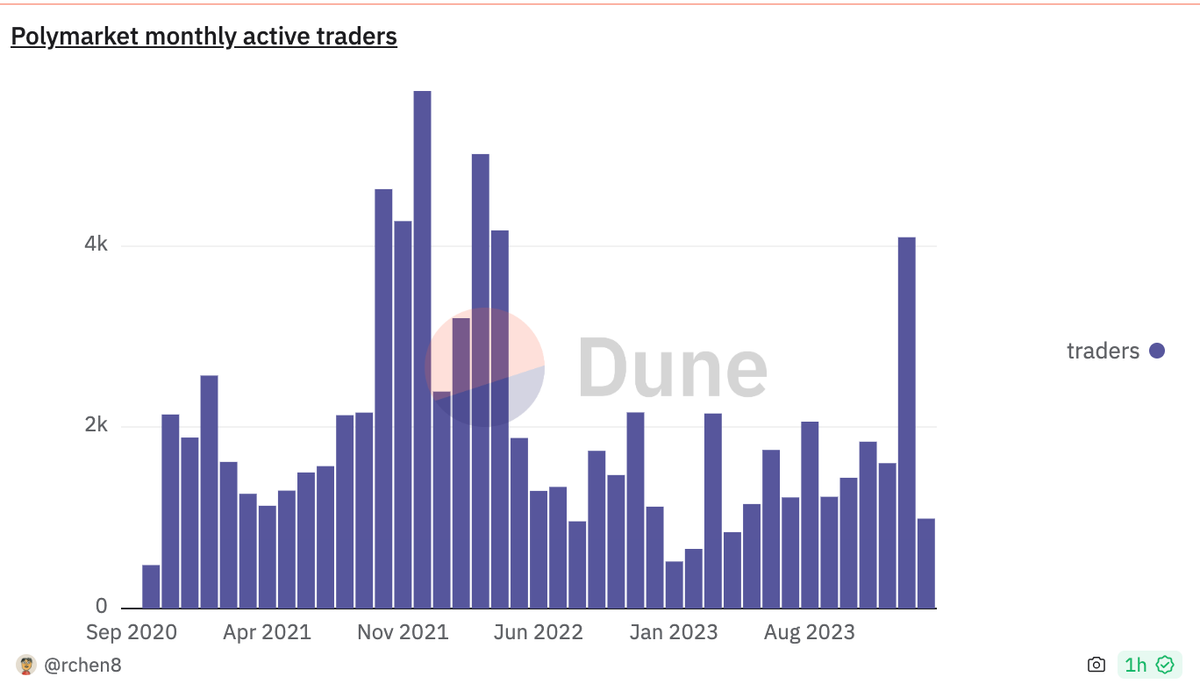

I mean, take a quick look at some of the predictions on Polymarket, which runs on Polygon and is Ethereum-based and you’ll see not only are people making markets about the outcome of the Super Bowl.

The market says the 49ers will win, but the predictions are close. Other predictions are about the first song of the halftime show, whether Taylor Swift will endorse President Biden during the game, the color of the Gatorade shower, and other facets of the game that people have strong opinions about.

The first post this week takes a deeper dive into decentralized prediction markets and goes into a little bit more depth about the role they play and why they are important beyond just making a market for people to bet.

Check out the full post to learn more about decentralized prediction markets 👇

The biggest takeaway is that incentivizing and creating a platform to gather information from multiple points of view and multiple sources of information does have a lot of value.

The wisdom of the crowd is a real thing. And the wisdom of an incentivized crowd only makes it more interesting.

So here’s a prediction for you: I bet that in the future, news gathering and news reporting will at least partially rely on decentralized prediction markets. In some ways, it could be a more accurate barometer of sentiment than anything that’s come before.

Open money and the three-legged stool framework

Cryptocurrencies have an unfortunate name. If you think about it, the name sounds sketchy, or even creepy. Not the best foundation to build on from a branding or adoption perspective.

The other naming/branding challenge within the crypto space is that the names of things continually change or else the names make concepts more obscure.

I’m not trying to add to the pile of names or jump on the trend of renaming things every market cycle, but after years of writing and thinking about crypto, I’ve come up with a simple framework to talk about decentralized digital assets.

I call it open money. This shouldn’t be a surprise, because it’s the name of this newsletter. I also refer to open money frequently in my posts.

So, what is open money?

Check out this post for a deeper dive. But I’ll outline the three basic criteria below.

Read the full post outlining the basics of open money 👇

The three legs of open money:

Accessibility: Open money is accessible both at the protocol or code level and at the level of the end consumer. Also, anyone can participate in running, maintaining, and profiting from consensus activities (like mining or staking).

This level of accessibility also means that the operations and workings of open money protocols are transparent and can be vetted via public accounting (like on-chain analytics, for example).

Control: To use the consumer financial products and the consumer internet, you have to give up a lot. Mainly the cost is identifying details, data, and privacy.

Open money fixes control issues via public key cryptography (this is where the naming troubles mentioned above start).

Public key cryptography uses a system of keys and wallets that allows users to connect with apps and services in ways that preserve identity, give users more agency and ownership, and put value and control back in consumers' hands instead of the other way around.

Programmability and composable: Open money is programmable and composable. At a very basic level, this makes future money systems more modular and interactive.

Since open money is programmable, it will be far more useful and way more interesting than traditional money and will allow for new kinds of financial services and applications that will be able to leverage access and control.

Some interesting things are happening in the decentralized finance space regarding collecting, vetting, and bringing real-world data on-chain via a system of data oracles. This is a great example of programmability and composability.

If you know of anyone looking to learn more about crypto, DeFi, and related topics, please share this with them: https://www.danielmcglynn.com/newsletter/

The takeaway: As software meets money, the combo will be synergistic, and will unleash incredible utility. What that all looks like is still fuzzy, although it does feel like a new product cycle is just getting underway (more on that next week).

The ultimate outcomes?

Who knows, maybe someone should create a prediction market about it.

Until next week,

Bet: Decentralized prediction markets, Super Bowl Sunday edition | Welcome to Open Money

This issue of the newsletter helps with some conversation starters on Super Bowl Sunday. We cover the role and growth of decentralized prediction markets. We also dive into a simple open money framework.