The headline this week — and one a long time coming — was the launch of the Bitcoin exchange-traded fund (ETF).

For the past ten years, major players both within the crypto space and at traditional financial institutions have made several attempts to get a Bitcoin ETF approved by the Securities and Exchange Commission (SEC).

Over the years the SEC has denied approval, citing a number of issues, but mainly the regulators were concerned that the price of Bitcoin is frequently manipulated. So, the SEC worried that exposure to the crypto space was risky for institutional investors and people investing through products such as retirement funds.

It's not clear what exactly changed for the SEC, but after years of attempts and near misses, the arrival of the ETF is a big deal. It signals, on some levels, that Bitcoin is becoming a more mature asset class, at least enough to allow ETF providers to create funds and allow exposure to BTC on US exchanges.

Right on the heels of the approval, eleven spot Bitcoin ETFs started trading. Although not all financial outfits, like Vanguard, for example, are making the ETFs available to their clients.

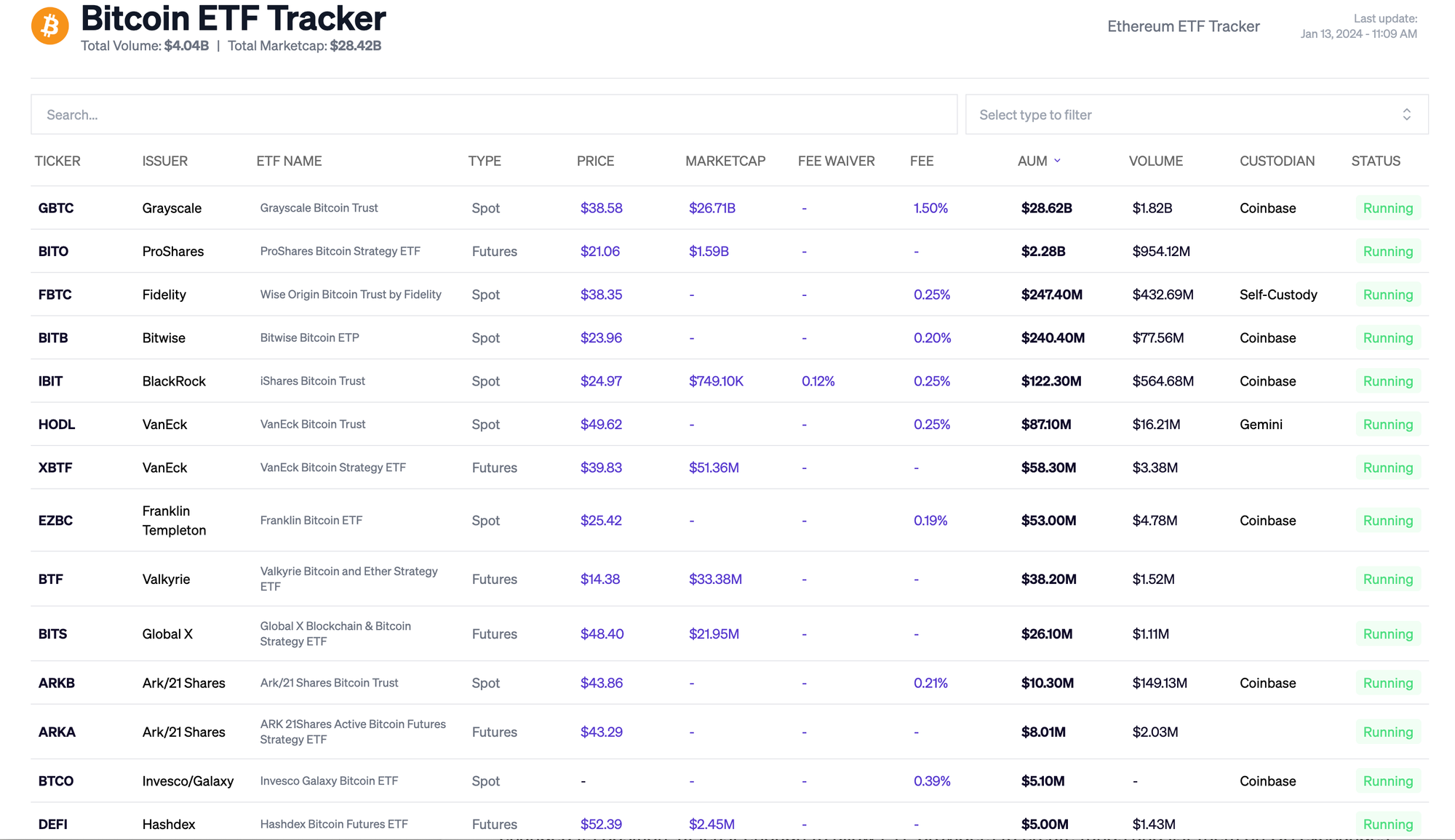

Here’s an easy to use tracker from Blockworks to get a handle on the current status (and price) of all of the approved and pending funds.

While there is a lot of excitement within the industry regarding the potential for the inflows of institutional capital that has largely been sitting on the sidelines in regards to bitcoin investing, there are also some other considerations to think through.

This biggest one: Is access to an ETF really good for Bitcoin? Or is it a distraction from the original vision of what Bitcoin could be (an alternative to the traditional system) and who its for (people trying to transact peer-to-peer without intermediaries).

Either way, the arrival of the ETF is an interesting development and likely one that we’ll be unpacking for some time.

Get the full story:

Decentralized physical infrastructure is having a moment

In other news, I put together a table of year-end/year-ahead reports coming out of the crypto space. This is a great place to start to get an overview what some of the major players are thinking about, and where investments in terms of human and financial capital might be headed.

Here’s that resource if you are interested:

One thing that I noticed in multiple reports was that there is general excitement about the idea of decentralized physical infrastructure or dePIN.

The basic concepte behind behind dePIN is to use public blockchain and tokenomics to incentivize the building and maintenance of massive infrastructure projects.

The idea is that the open source, distributed systems might be more efficient for certain kinds of projects. And building massive infrastructure without the need for corporate, government, or bureaucratic oversight in certain situations could lead to more efficiency.

Instead of traditional power structures, open networks can connect people, resources, and financial incentives to build big projects, such as community-based energy grids, renewable energy infrastructure, or alternative wireless communications.

Here’s more on dePIN:

Help get the word out

I could really use your help getting the word out about this newsletter. Please share this with anyone you think would be interested.

Until next week,

Is the ETF bad for Bitcoin? | Decentralized physical infrastructure (dePIN)

This issue of the newsletter features a look at the Bitcoin ETF approval news and unpacks the suddenly trendy decentralized physical infrastructure.