Memecoins are having a moment

What are memecoins and why do they matter? In this post we'll dive into what a memecoin is, why they are useful, why they are a distraction, and try to get to the bottom of what it means to meme.

Maybe a better headline for this piece is that memecoins are having a moment, again.

Memecoins are part internet culture, part naked speculation, part community organizing, and part entertainment.

At any given moment the dosage and recipe for memes changes. While it might be easier to take crypto seriously if memecoins didn’t exist, the market cap would start to get and sound a little bit boring.

And, as you know, crypto is anything but boring.

Memecoins have been a part of crypto since the beginning, and while sometimes it seems like they make no sense, (or maybe they make perfect sense if we think about human psychology and what makes the internet tick), they do provide a utility for the broader sector, kind of like the way hardcore fans are good for a professional sports team.

The big takeaway here is that memecoins aren’t just a flash or something that will go away as the market matures. For now, at least, it looks like memecoins are a permanent fixture, like part of the crypto establishment.

In this post, we’ll unpack what memecoins are and then look at why they are “good” and why they are “not so good.”

Remember, nothing that follows is financial advice. After all, we are talking about memecoins, so this should go without saying, but just want to make sure.

What are memecoins?

Memecoins at any given time can be a trend, a lottery ticket, or an internet flex.

Memecoins are built on a variety of chains for a variety of reasons. Recently, the blockchain Solana has been home to a lot of new meme lords. Why that’s happening is not clear, but likely it could be a follow-on from Solana’s general popularity at the moment and/or that pretty devout communities are developing on Solana.

Memecoins riff on larger issues or events happening in the world, from politics to internet culture, people are now creating memecoins as a way to capitalize on or highlight current events.

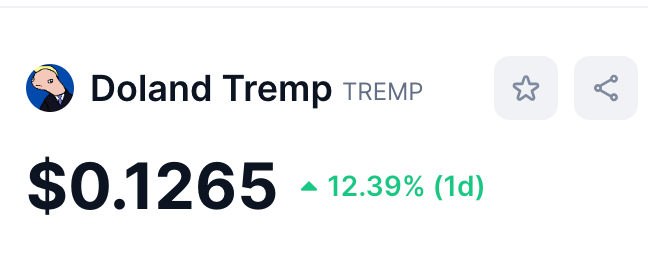

The presidential election might not have any public debates this year, but it already has its memecoins:

Political memecoins SOURCE Coinmarketcap

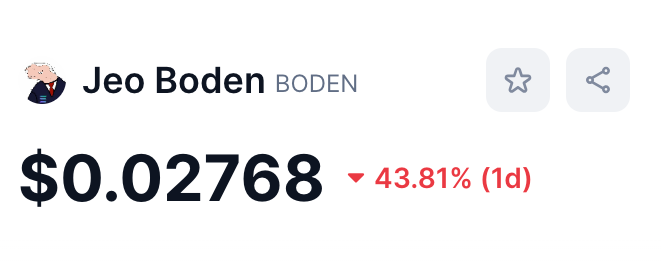

Different species of dog coins are also really popular. Dog coins, which became popular during the last market run, are almost like meme children of the first (and some might say greatest meme coin judging by its enduring place at the top of the crypto market cap) of its kind, Dogecoin.

In some ways, the dog coins are kind of like secondary threads or derivative artwork. They make sense only if the original meme that they follow makes sense.

As someone who has explained crypto to a lot of people, when Dogecoin comes up, as it frequently does, it often raises more questions than it answers. But, if nothing else, the story of Dogecoin and the memes it has since inspired is fascinating from an internet culture point of view.

Not that long ago it was easier to track memecoins, or at least the ones that mattered in terms of “importance” or at least influence. These days, it feels nearly impossible, especially since now the memecoins feel layered, or memes of memes.

Why memecoins are “good” (or at least interesting)

Ok, now that I’ve muddled my way through a vague definition of what a memecoin is, it’s important to talk about what role they serve, or why they are significant. Despite the fuzziness about what they are, they do serve a purpose within the crypto sector.

Memecoins are financial phenomena that generate interest and enthusiasm in the form of coordinated movements. Fans gather, vote, share, and brag about memecoins and in the process generate attention and draw in more memecoin buyers and more memecoin creators.

In some ways, memecoins are better at drawing people into crypto and coordinating movements (that’s how memecoin bubbles start) than other crypto products like non-fungible tokens.

Maybe the biggest untapped area or the thing that is most interesting about memecoin movements is that they prove the concept of distributed coordination and organization.

Right now, that coordination and organization is tongue-in-cheek. But the same mechanics that make memecoins pop and flourish can also be applied to social movements protest movements or other activities that require coordination. Who knows when and if that happens, but the idea is there.

The big thing about memecoins is that they challenge our ideas or concept of what money is — and how long a currency or asset system should endure. The idea that assets can come and go quickly and have values that bubble and disappear — and do so in a way that is sustainable to the underlying system (in this case, the blockchain that the memecoin is built on) — is novel.

So in a way, you could say that memecoins are barrier-breaking in terms of a new kind of technology to rapidly deploy and sync up money movements. And while that’s cool, the current iterations are limited and so far seemed designed mainly to entertain.

Why memecoins are “bad”

Memecoins are like the mullet of the crypto world. If the top of the crypto market capitalization chart is like the business in the front, then the memes are the party in the back.

Not that long ago, the shades of gray between a memecoin and a newcomer crypto project were hard to tease apart. Projects got off the ground by generating hype or buzz and early speculation. There was an entire period of crypto when this happened — and new coins were launching almost daily using tactics known as initial coin offerings (ICOs).

The whole pump-and-dump casino-like elements of memecoins don’t seem like that big of a deal if people knowingly enter the market understanding that they are playing a game — like buying a raffle ticket or rolling the dice that they can enter and exit before the crash.

Where things start to get weird is when new or less experienced investors enter the market and play the role of the greater fool. Ultimately, the memecoin game ends when someone gets rekt, or loses money.

The bigger risk of the memecoin game is that it helps extend the popular narrative that “crypto is worthless,” that emerging digital assets serve no purpose, and that the entire sector is built by tech bros looking to defraud people.

That’s a popular narrative right now. And based on recent history (the FTX collapse, Terra Luna implosion, etc.) there’s already plenty of ammunition for the continuation of that narrative in the mainstream media. Stories about coins with the name dogwifhat don’t really help create a sense of legitimacy.

So the biggest risk that memecoins present is that they help underscore all of the canned arguments against the move to permissionless digital assets. Sure, people are having fun by creating memecoin communities.

Some people are even making a fortune. And the whole point of open money is to create the freedom for people to build what they want to build and make markets how they want to make markets.

But, when the existence and performance of memecoins start dominate the conversation or the attention (like right now, for example) things become problematic.

What’s it all meme?

I’ve gone full circle on the memecoin situation. In fact, at this point, I’ve probably gone around the circle a few times.

I don’t invest in memecoins because, to me, they are not an investment. They are fun, they are part of the wider crypto culture, but they are not a serious financial tool.

I’ve learned that having an extreme position on anything isn’t productive longterm, and I think that’s especially true with memecoins.

If nothing else, memecoins are fun and someday they will be an artifact of the way we live now.