Managing Bitcoin's block size

As Bitcoin becomes more popular and more in demand, the debate about how to best manage bitcoin's block space is becoming more heated.

By design, Bitcoin’s block space is limited. The limitation is enforced or imposed to manage for things like efficiency, data integrity, and overall security.

But the imposed limitation comes at a cost. Bitcoin’s block size is kind of like having a speed limit on a popular street.

Some people are in a hurry and they want the speed limit increased.

Meanwhile, others are worried that if you increase the speed limit to help with congestion then you’ll wind up with more accidents and more headaches.

Using blockchain is about tradeoffs. Decentralized computing and permissionless networks aren’t always the best fit for all applications. Because of the blockchain limitations and the need for transactions to move through a consensus mechanism (which is what enables trust-less computing) blockchains are slow and intensive.

As demand for block space increases, transaction costs also rise. Since miners are responsible for validating transactions to confirm blocks, they can be incentivized to prioritize transactions willing to pay more fees to confirm and settle faster.

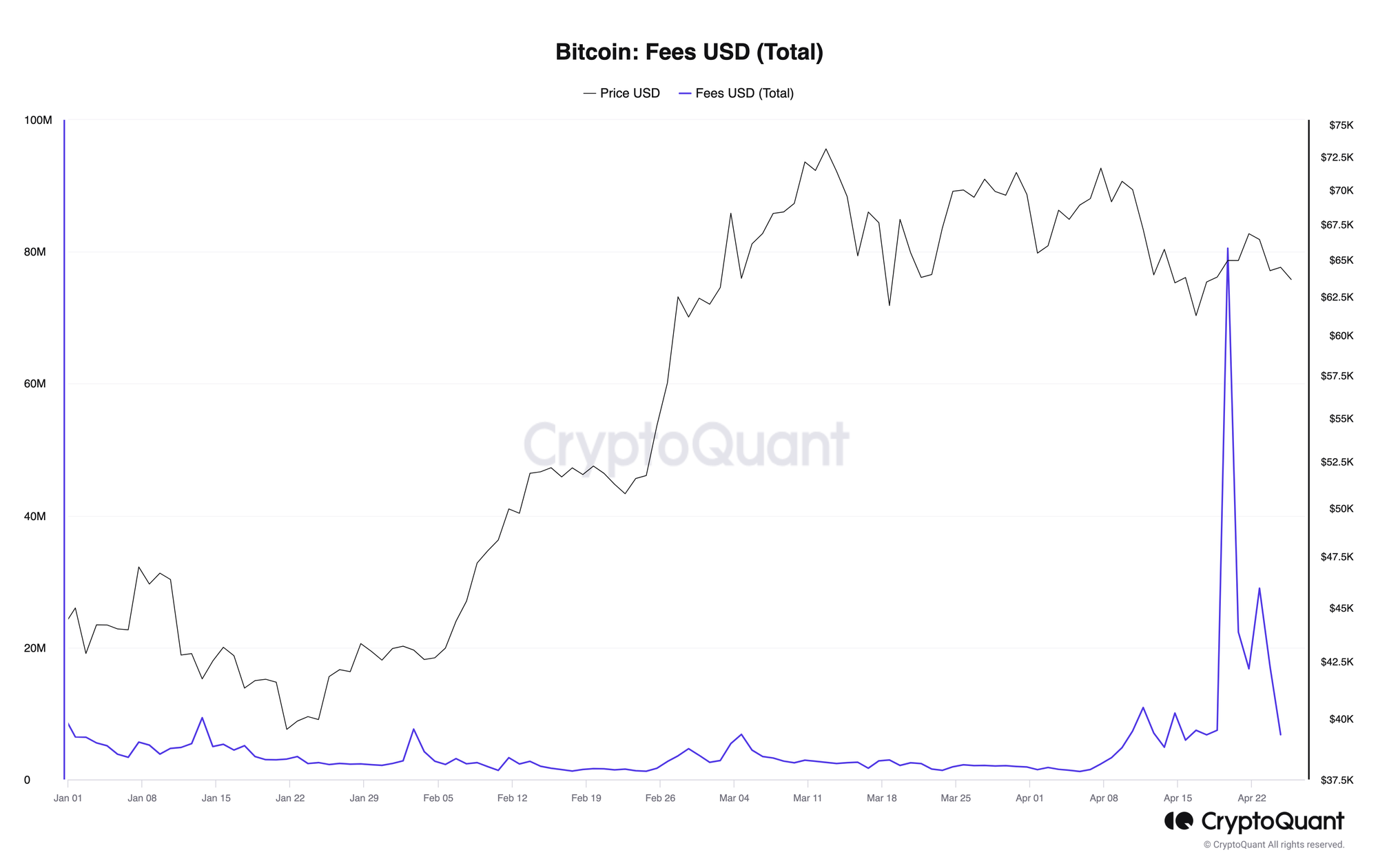

This system generally leads to more efficiency, but when there are spikes in demand, as with the recent launch of Runes, there can be bottlenecks, which lead to fee spikes (illustrated in the chart below).

If the introduction of Runes and the resulting pop in transaction fees on the Bitcoin Network tell us anything, it’s that how best to manage an increasingly scarce resource like block space could lead to fierce in-fighting in the future.

The debate about the right size for Bitcoin’s block sizes has been a source of contention for years now and has caused big divisions in the Bitcoin community (more on this below).

But the launch of Runes coming right on the heels of the launch of Ordinals adds a new wrinkle to the block size debate.

Some people view Bitcoin-based NFTs as frivolous or silly, and very much echoing the ethos of the memecoin movement. Meanwhile, other people believe that Bitcoin should be for the builders and there is no right or wrong way to use Bitcoin’s block space.

READ MORE ABOUT RUNES

The biggest difference between the block size debate brewing now versus in previous years is that the focus before was on finding the right size of Bitcoin block space. But the debate now is starting to focus more on what is the best use of Bitcoin’s block space.

Runes and Bitcoin’s block size crunch

In the early days, the block space congestion was a hindrance or an annoyance. At the time, Bitcoin and its offshoots were still very much considered novelties or experimental.

But as Bitcoin and the rest of the crypto sector go mainstream, the scaling issues created by the scarce block space are starting to become more of an issue. The risk is that high transaction costs or long transaction times could prevent widespread mass adoption.

Or else, the need for speed will drive people to adopt new structures that sound like they are onchain but aren’t — and are little more than centralized databases that operate outside of the control or guidance of financial regulators.

In the past, and a highly controversial move, the Bitcoin community voted to modify the way that Bitcoin transactions were handled onchain.

Called Segregated Witness or SegWit for short, the 2017 upgrade separated the way that data was handled for individual transactions, which made it possible to add more transactions per block.

The previous Bitcoin block space debate also led to a major split in the Bitcoin community and the creation of Bitcoin Cash, which is an alternative Bitcoin-based chain, but with bigger blocks to create cheaper network fees.

How does the Bitcoin block size issue get resolved?

This is the billion (or trillion, maybe) dollar question.

On one hand, Bitcoin represents an alternative to the traditional financial system. One of the biggest differences between Bitcoin and any other kind of financial network that’s come before it is that Bitcoin is permissionless.

I mentioned this at the top, and it’s coming up again here because it is important. Anyone can join, build, or participate in the creation and running of the Bitcoin network.

That means occasionally things are going to happen — like the launch of a new kind of Bitcoin-based token standard — that uses network resources in a way that not participants agree with.

It’s one thing to disagree or have an opinion. But it’s another thing to try and censor network usage or decide what should and shouldn’t be built on Bitcoin.

If enough people don’t like what’s happening and they just want Bitcoin to be some kind of digital gold, with low but cheap transaction volumes, then they are free to fork (or create an alternative) to Bitcoin and proceed on their way, just like with the Bitcoin Cash example mentioned above.

At the same time, limiting innovation on Bitcoin might also limit the development of future scaling solutions, such as more layer two protocols specifically designed to solve scaling issues — the Lightning Network is a great example.

But really, the best mechanism for solving what’s best for Bitcoin is the free market.

Over time people will decide if they are willing to pay high transaction fees for the novelty of collecting NFTs on Bitcoin — or whether some other kind of lower cost onchain alternative makes sense.

Over time people will decide if it makes sense to pay high transaction fees to store digital assets in a very secure and well-tested manner, or whether some other method makes sense.

After all, we have been here before, and while solving differences in a decentralized environment might not be elegant or even efficient, it is at least, fair.