Issue 8: New all-time high, crypto crime, and the world according to memecoins

This issue of the newsletter covers the recent crypto crime report from Chainalysis. It also takes a look at why memecoins are stealing so much of the spotlight.

In last week’s newsletter, we opened by talking about the renewed energy in the crypto markets, driven in large part by the steady bitcoin ETF inflows.

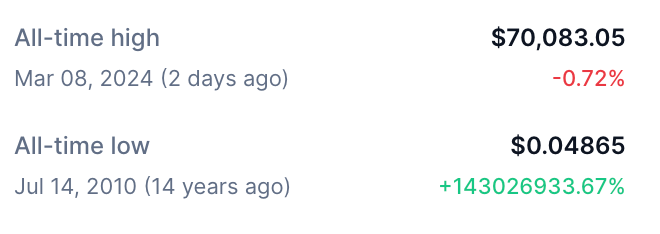

That trend continued this week, pushing the price of bitcoin to above $70k for the first time, and driving a price uptick throughout the rest of the market too.

Interestingly, bitcoin broke the all-time high (ATH) record earlier in the week before falling 10%, in part due to a wide sell-off. But the dip was short-lived. By Friday, the price came surging back and set another new ATH.

So, it was an interesting week for sure for crypto watchers. Likely the intrigue will continue over the next several weeks at least, while the market establishes new prices. But it’s important to remember that nobody knows what the market will do next.

As we mentioned last week, the Bitcoin halving is scheduled for next month, and Ethereum is due to finalize a big upgrade in mid-March, both events might create more turbulence.

But maybe even more interesting is that the normal retail investor excitement that generally accompanies new all-time highs or major market rallies, still feels subdued, or maybe even non-existent.

It could be a hangover from the collapses and fraud of the previous market cycle, or it could be some other kind of resistance or aloofness. Either way, it’s an interesting dynamic that’s developing.

In other news, this week we covered two different topics: A dive into the Chainalysis 2024 Crypto Crime Report and a look at why memecoins are having a moment.

As always, I appreciate you reading this newsletter. Please share it with people you think might find it interesting. New subscribers help keep the momentum going.

2024 Crypto Crime Report from Chainalysis

Chainalysis is a blockchain analytics firm that is building a suite of services used for forensics and by people in law enforcement to do things like find criminals who use digital assets to fund illegal activities.

For the past few years, they’ve put out an annual report that’s a deep dive into onchain criminal activity. The analysis is interesting for several reasons, but maybe the most intriguing is that this of detail is possible in the first place.

The ability to report on how criminals use crypto cuts counter to one of the major narratives by politicians that appear on network TV and by mainstream media outlets who push stories about how crypto is bad without any kind of critical analysis.

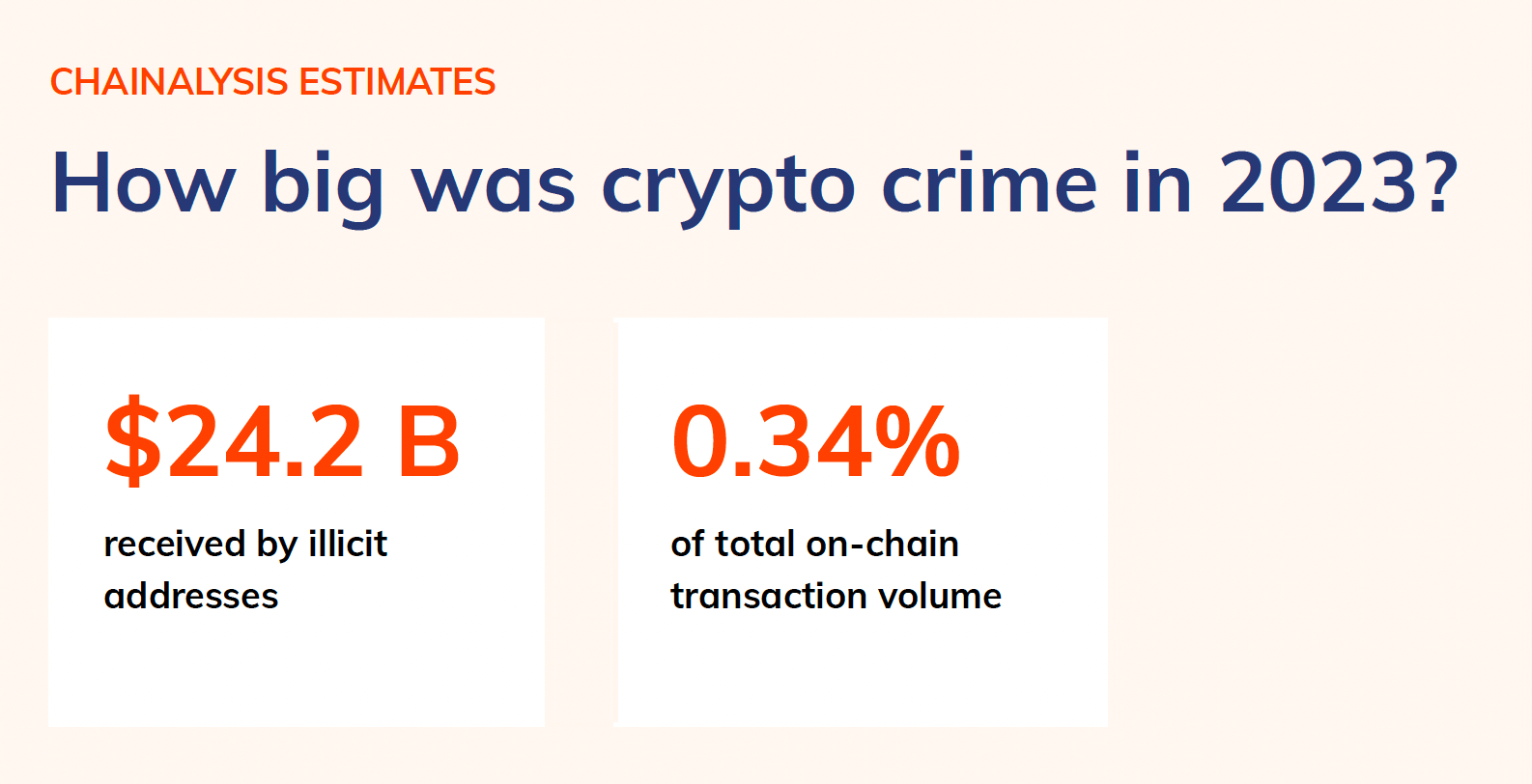

The takeaways from the report? Yes, criminals use crypto for crime. But, known criminal activity happening onchain was less than one percent of all global crypto transactions last year. This number is down from 2022.

Criminals also use cash. Tracking the movement of cash around the globe is not impossible, but it’s way harder than analyzing onchain activity, which by its nature happens on an open, public ledger.

Check out the full post about the 2024 Crypto Crime Report

A couple of interesting takeaways from the report about the kinds of criminal activities that are happening onchain:

One —There’s an increase in ransomware attacks, but a decrease in general hacks and heists (this might also be partly attributed to last year’s down market). Also, attacks on DeFi smart contracts slowed last year, but again this could be more of a reflection of less overall market activity than a tightening of smart contract security.

Two — Stablecoins (assets with values pegged to fiat or commodities to mitigate volatility) are becoming a bigger deal. It looks like criminals didn’t like losing value during last year’s market volatility market either.

Three — Sanctions from the Office of Foreign Assets Control (OFAC) are working. OFAC only developed crypto-specific sanctions six years ago and has since created more detailed and comprehensive crypto sanctions every year. Now OFAC is targeting specific onchain addresses, whereas in previous years the targets were mainly groups or entities like exchanges or mixers.

What’s it all meme?

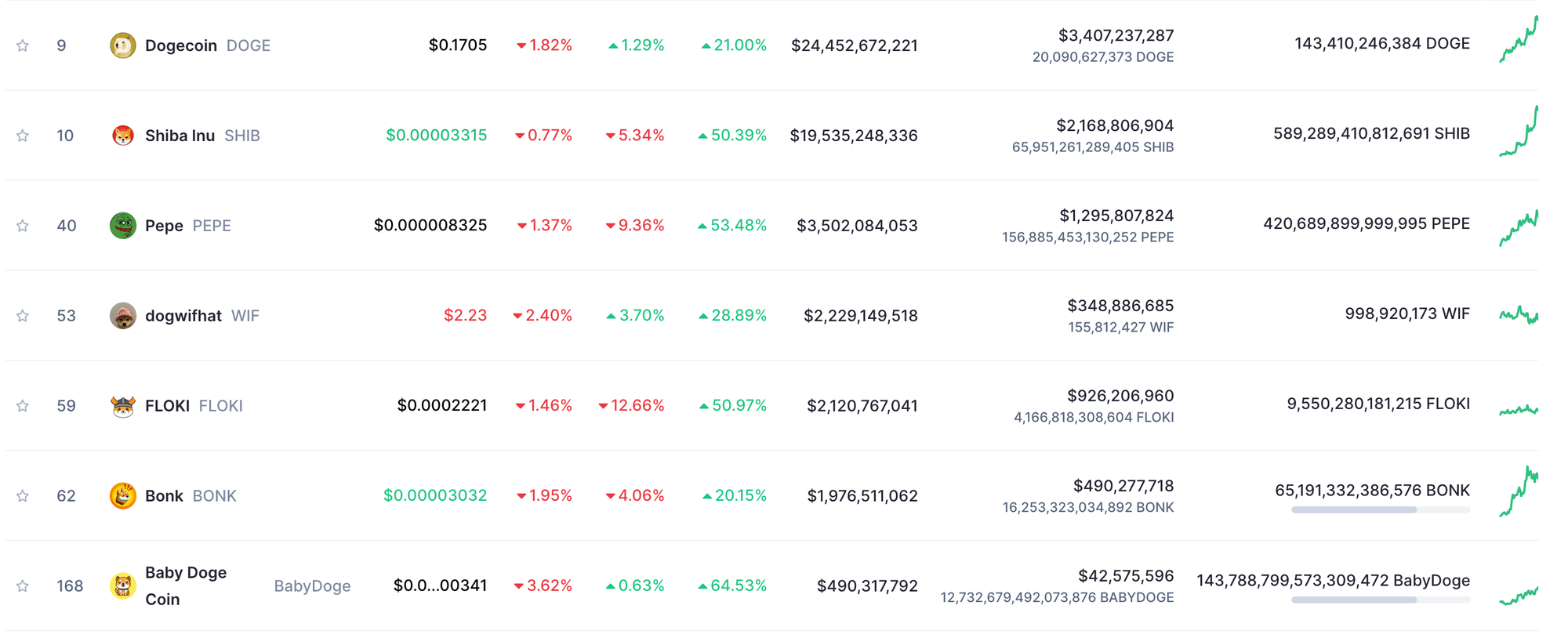

If you thought that crypto was becoming too Wall Street, just take a look at some of the top-performing assets in the past few weeks. Sure, crypto blue chips are making a run, but the best performers return-wise are coming from memecoins.

Memecoins are the perfect one-two combo of crypto plus internet culture.

The most interesting for a bunch of reasons. While it might seem like all fun and games, memecoins are also creating a roadmap for how groups and communities can organize and allocate capital quickly. Maybe that’s all driven by speculation and the number go-up craze, for now, but it also provides a template for other productive projects.

The other thing that’s interesting about memecoins is that they challenge our assumptions and ideas about what money is and how it's supposed to work.

Since the beginning of civilization, humans have only had money sources that worked like mass media. Money was created or minted by a centralized authority and it took a while to become fully distributed through a system. This meant changing, challenging, or creating alternatives to the system was hard if not impossible at any kind of meaningful scale.

Check out the full post on memecoins for more context.

Today, because we have well-established financial networks that are open and permissionless, then anyone can create a new kind of tradeable asset on top of them. While the underlying network might be durable and long-lasting, the actual asset — in this case, a memecoin — might only exist with any value for days weeks, or months. It’s an interesting development and one that will take some getting used to for most people.

Lastly, I think memecoins are one of those trends, like Crocs, that is reflective of how we live now. Memecoins are having a moment, but nobody knows how long the moment will last.

Thanks again for reading. If you found any of this stuff interesting, please share this newsletter with someone.

Until next week,