Issue 10: Moving onchain | Base and real-world assets

In this issue of the newsletter is all about the building energy driving more activities onchain. We talk about how the interest in Base and the tokenization of real-world assets are part of the same movement.

Another whipsaw week of crypto market action is in the books.

In the last issue of the newsletter, we covered what a big deal the Ethereum upgrade was. There was a certain bullishness across the space as decentralized apps and services started to see transaction fees come down.

But the vision of faster and cheaper Ethereum-based transactions paving the way to global mass adoption was quickly tempered by news that the SEC is still unsure of how to deal with Ethereum. The news that regulators are asking questions of the Ethereum Foundation made the fate of an Ethereum ETF approval later this spring feel faded.

On the Bitcoin side, one exchange experienced a flash crash during the week, leaving the already wobbly BTC to slip deeper to the downside. The slide triggered outflows from the ETFs, which earlier in the month felt like they were eating up all BTC in sight and responsible for historical levels of ETF frenzy.

But this is all kind of normal in the wild world of crypto. It’s why I constantly remind people that no one knows what the future of the crypto markets will look like. But for some reason, maybe it’s the increased attention recently, the shakeups of last week felt a little bit more dramatic.

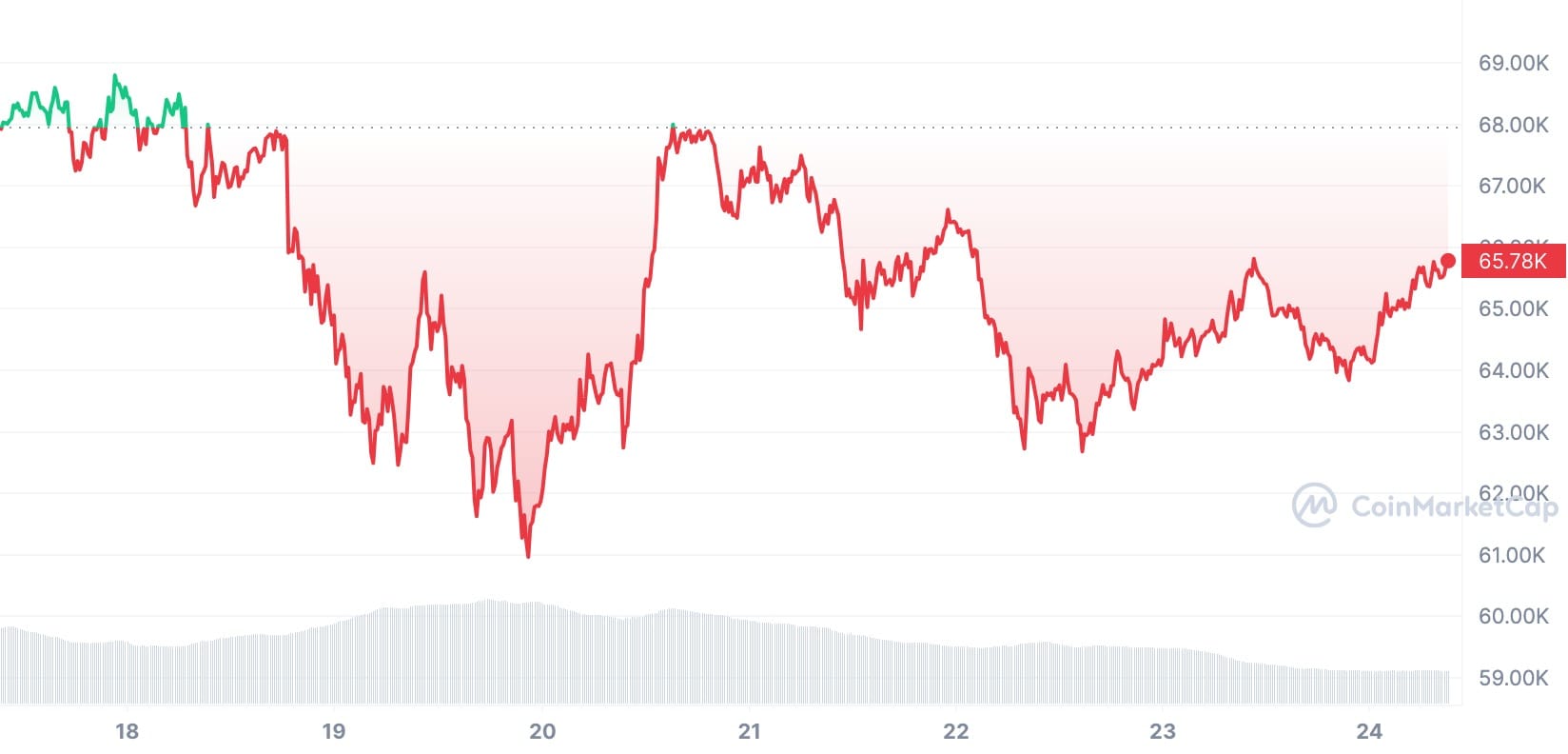

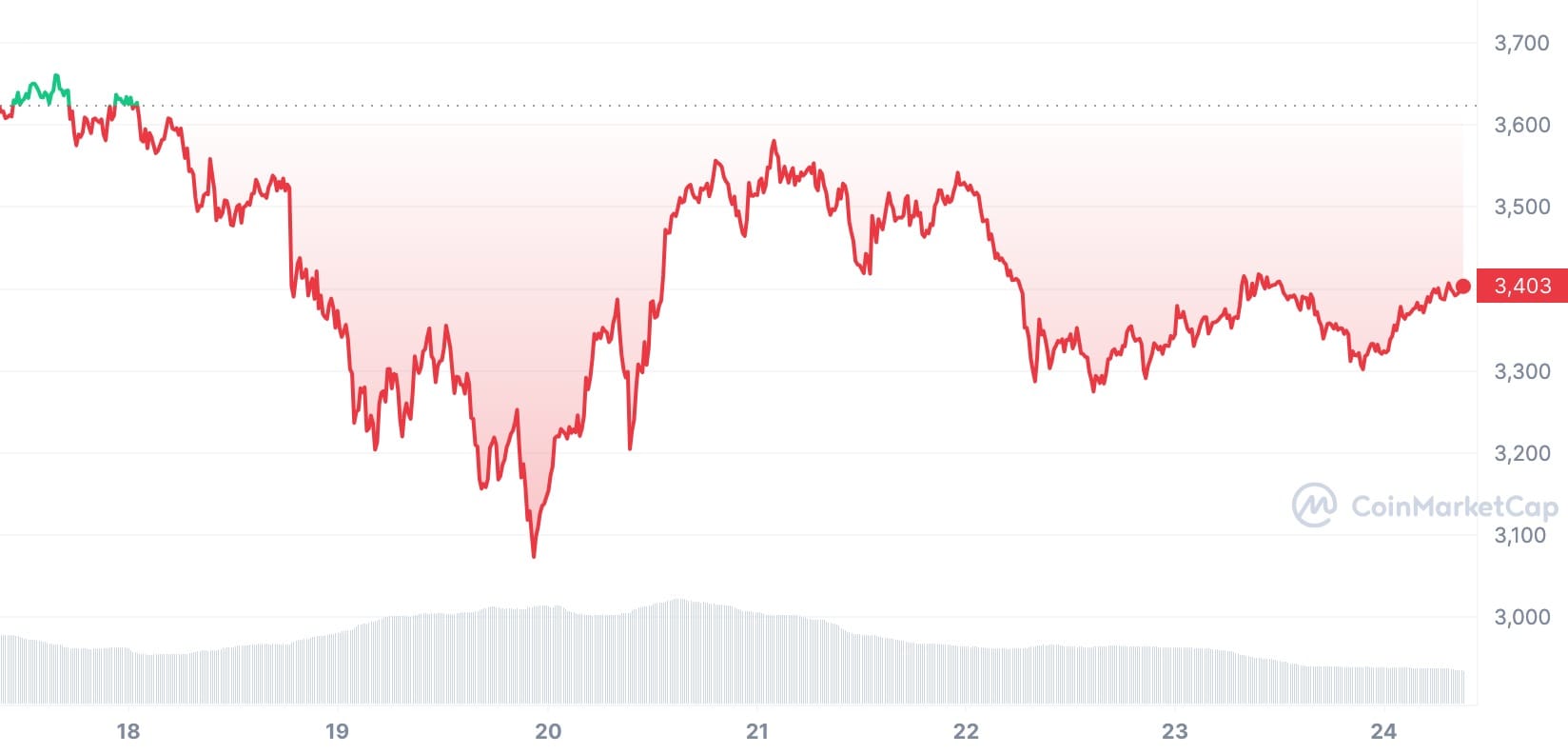

Bitcoin's 7-day chart and Ethereum's 7-day chart. Both resemble roller coaster tracks. SOURCE

Even though we expected the unexpected, it still felt like a curveball.

One of the biggest pieces of news from last week was the announcement that BlackRock plans on following up on its successful launch of IBIT (the most well-funded Bitcoin ETF) with plans to create a tokenized fund representing real-world assets on Ethereum). More on the news down below.

Follow the trend: Moving onchain

At first glance, it might seem like the two posts I wrote this week aren’t closely related.

The first post was about Base, a rollup (a specialized blockchain scaling tech stack) designed to make it easier for more people to start using blockchain.

Base is a project incubated and funded by Coinbase (the only publicly traded crypto exchange) and fits into the company’s continued and ambitious plan to be vertically integrated across all facets of the emerging digital currency sector.

In the post, I compared Base to Wordpress.

Read more about Base and the move onchain

You might remember when the internet first launched its utility was pretty limited for most people. It was good for email and surfing for information, but it was hard to build anything unless you had specialized coding skills. Then Wordpress launched and made it simple for anyone to launch a blog, website, and eventually an e-commerce storefront.

Today, a huge chunk of the internet is powered by WordPress, and there is an entire category of the internet economy dedicated to building apps and services that support WordPress and its users.

In the post, I make this comparison and say that rather than making the internet or the “online” experience more accessible, Base is making “onchain” or the blockchain experience more accessible.

I still think that comparison works as an explainer. After all, Base is providing the infrastructure for developers to spin up apps, side chains, and all kinds of experiences that will bring people into crypto.

I could have just as easily compared Base to Amazon Web Services (AWS) which runs a huge chunk of the backend of the internet, or to Apple’s app store, which enabled a new developer-based economy and has enabled millions of startups to deliver new products and service through and easy to use platform.

The takeaway is that Base is quickly becoming a big deal. It’s also a quirky project in the way that it launched – as part of a larger company, raising concerns about it being decentralized and that it doesn’t have a native token, which is different than other rollups.

There’s a fund for that

When I wrote that second piece this week, about BlackRock announcing a new kind of investment vehicle — a tokenized fund based on Ethereum, I didn’t immediately see the connection to Base.

In my mind, one post was about new infrastructure or access and the other was about institutional investors, or Wall Streeters embracing crypto.

Some quick context on the new fund: BlackRock is one of the world’s largest investment firms. They recently made waves by launching IBIT, which is the biggest of the handful of Bitcoin ETFs to hit the market on January 11. The ETF news is huge for a lot of reasons. I cover it in this post and this post.

IBIT currently has $122.85 billion in the ETF. Coming on the heels of the market interest and excitement, BlackRock announced BUILD, or BlackRock USD Institutional Digital Liquidity Fund (BUIDL), which will make cash and US Treasury bills available on Ethereum as tokenized assets.

Check out the full post on real-world assets moving onchain

The news by itself isn’t too crazy. After all, we are talking about tokenized T-bills and the fund will only be available to qualified investors. But the launch of BUIDL could signal the beginning of the tokenization of real-world assets, which could be massive for both fund issuers, like BlackRock, everyday investors (eventually), and for the crypto space.

After all, in the case of BUIDL at least, the tokenization is happening on Ethereum. The new use case will undoubtedly create more onchain businesses and opportunities.

And this leads us back to Base. The more I thought about the two posts this week, the more I realized they are more closely related than I originally thought. In the end, they are both about moving onchain and the ongoing (and inevitable) digital transformation.

After years of talking about the possibilities of what things could be like onchain, it’s refreshing to see it happening — and to see all of the hypotheticals, like an app store for decentralized products or a massive Wall Street firm making the functionality of a permissionless digital ledger more accessible, become reality.

We are likely in for more interesting times ahead and definitely more times where the 7-day market charts looks like roller coasters.

Until next week,