Is crypto still a protest movement?

Bitcoin hits $100k. Now what?

Open Money is protest money.

Or, put another way, Open Money is whatever you want it to be that's not the dominant narrative.

OK, what does that mean?

Watching how crypto is vilified or championed by politicians and corporate leaders has been interesting.

Usually, you hear something like crypto having no value or that it's only money for criminals.

Or, at the other extreme, you have people launching pointless meme tokens or vacuuming up bitcoin in a way that feels, well, more like betting than it does like a financial strategy.

Crypto, or more specifically, Open Money, isn't really about either of those extremes. It's really about people finding their own alternatives to what isn't working for them.

Legitimate and in-demand use cases for Open Money could include easier cross-border payments, a better way to find yield or store value, or monetizing creative work without having to become an affiliate or an influencer.

Open Money is not about having an extreme position. Instead, it's the middle way.

The main advantage of having an alternative financial system that works parallel to the establishment is that it offers a different kind of fulcrum to hold things in balance, especially during disruption or chaos.

Open Money is a means of navigating the extremes of our times and building personal financial and information products that provide individual control and more global access (sometimes simultaneously).

But as crypto becomes part of the establishment, will it lose part of its utility?

Use case ambiguity as an asset

Not that long ago, it was easier to understand crypto—or at least what it wasn't.

The early adopters and builders were generally interested in creating alternatives. The narratives in the early years were positioned in opposition to the status quo.

Interestingly, in the last 12 to 18 months, crypto has started to feel more like a new product line in the legacy system rather than something completely different.

Here are just a few examples:

- The launch and demand for crypto ETFs and the arrival of institutional money.

- Crypto as part of presidential politics — and crypto leaders and influencers embracing the attention of political leaders.

- Crypto has mainstream moments — crypto-based prediction markets compete with legacy media during the presidential election cycle.

While all of that is underway, there's also a sense that the best of crypto—the people, developers, and teams pushing the bounds of what's possible—will always need to operate at the edges.

Open Money against a hedge against [/insert]

It's that time of year when people start to get both reflective and forward-looking simultaneously.

In my case, looking at headlines about the appointment of a new crypto czar, the power of the freshly organized crypto lobby, and whether or not the incoming SEC chair has enough crypto experience (or not), it's stunning to see how quickly crypto has moved from fringe to spotlight.

And yet, somehow, it feels like a pivot towards "legitimacy" is missing the point. It feels important not to get wrapped up in it all—and not to create another "too big to fail" situation at the cost of losing the plot.

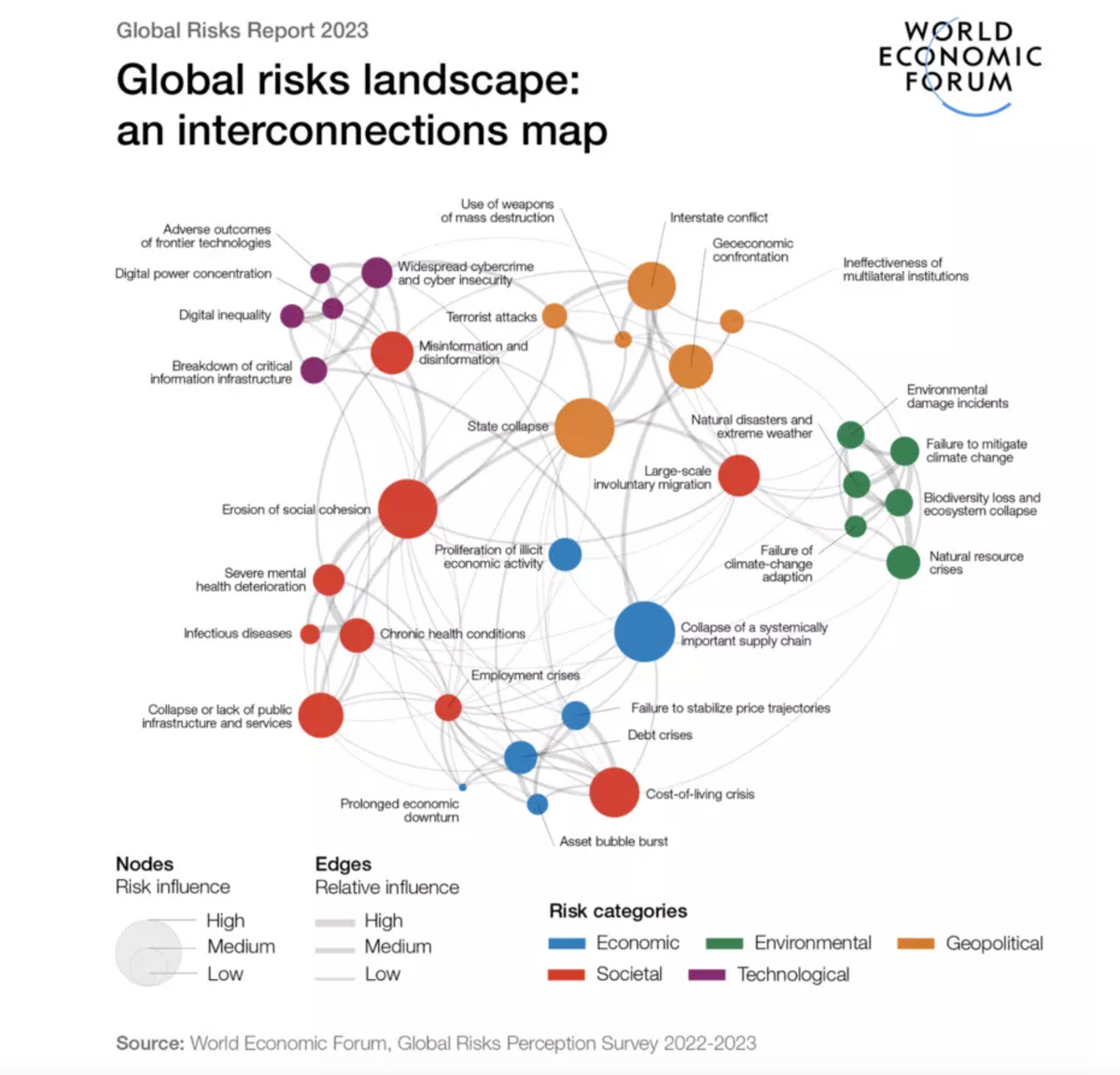

The world is changing.

And it's changing fast.

Alternatives, backups, and systems that can scale from the individual to the global are a good idea.

We've covered how the big shifts in demographics, information technology, and economics will accelerate change and how decentralized, permissionless, and non-custodial assets will become even more important in the future.

To summarize, we face a future that includes uncertainty, transition, and change.

While some of that change will be disruptive, and some of the change will bring new opportunities, we also need a middle way.

Open Money gives people more options to insulate against change in a few basic ways.

- Permissionless systems allow people to opt into systems (financial, information, identity, creative) that best suit them.

- Non-custodial wallets or key management means that people have control over their assets (this is good for liquidity, portability, and privacy).

- Interoperable and programmable systems enable deploying digital assets for many use cases (peer-to-peer payments, cross-border or cross-jurisdictional movements, digital store of value, etc.

Open Money allows people to preserve individual freedom while leveraging tools and networks at an internet scale.

These attributes will only become more critical as we enter a period of reorganization and dramatic change.

We still need protest money.