Is crypto dead? Understanding the Fear and Greed Index

Issue 25: How the Mt. Gox hangover triggered a major market slide

Some weeks it’s fun to watch the crypto markets. Other weeks it’s painful. This past week was uncomfortable.

The entire crypto market took a massive nosedive. It wasn’t pretty.

The slump dragged Bitcoin down 5% on the week and Ethereum almost 10% on the 7-day charts.

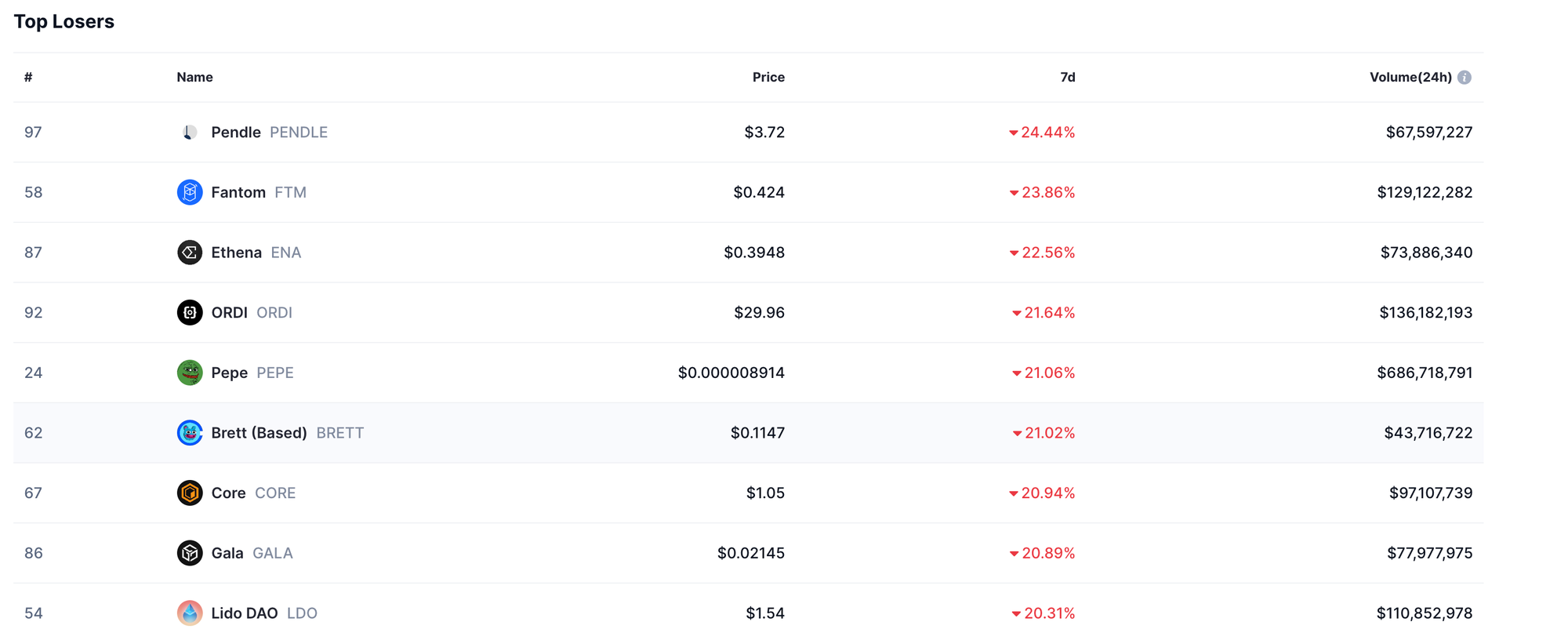

But it’s lower down on the market cap charts that got hit harder.

Memecoins and layer2 tokens, both the darlings of the recent market uptick, in some cases suffered even bigger losses.

Fear and loathing in the crypto markets

Retreats (and gains for that matter) are a pretty regular occurrence. After all, the crypto markets are notoriously fickle.

But one useful metric for checking up on the status of the crypto markets is the Fear and Greed Index. I often include a snapshot of the Fear and Greed Index in this newsletter when covering market changes.

The Fear and Greed Index is like a dashboard tool or a helpful way to visualize or encapsulate what is happening in the market.

It’s like sentiment analysis or a sentiment overview.

This week, as the market kept dumping, the Fear and Greed index moved deeper into the fear zone. This makes sense. After all, overall market sentiment is a big driver of whether things are moving up or moving down.

Sometimes market sentiment can be a more useful gauge of what’s going on than just price movements.

The Fear and Greed Index from CoinMarketCap takes into account five different factors, including:

- Price momentum: In the case of this index, the price movement of the top 10 non-stablecoin assets is analyzed.

- Volatility: More volatility, which implies more people changing positions, means more fear in the market. Less volatility means more greed.

- Derivatives market: Traders use derivatives like puts and calls as bets on which way the bitcoin price is headed. Analyzing which kind of options traders are currently deploying can give a market signal. More puts, for example, is a fear signal because it shows traders think the market is trending down.

- Composition: A couple of weeks ago we talked about the value of stablecoins as a safe harbor. The Stablecoin Supply Ratio compares the market cap of major stablecoins to bitcoin. The idea is that the relationship between those two assets can indicate risk appetite in the market. If the market cap of bitcoin is up compared to the major stablecoins then it's a greed signal, if the opposite is true, then it's a fear signal.

- Social media keywords: The last factor in CoinMarketCap’s formula is fuzzier. It looks at several “social trend keyword search data” to help decide if overall sentiment is positive or negative.

To come up with a score, each of the five factors above is given a weight of 20% of the overall index score which ranges from 0 (extreme fear) to 100 (extreme greed). A score of 50 is neutral.

This week the Fear and Greed Index score fell into the 30s, representing a fearful market outlook. But why?

The Mt. Gox hangover leads to an overall market slump

It doesn’t help that it feels like there is uncertainty everywhere. There are some big trends that we keep touching on are untethered macroeconomics, global conflicts, and silent but fast-moving demographic shifts.

Add to this list the current situation in US politics, which feels like a backdrop to a Tom Clancy novel, and we are really cooking.

To summarize, things are weird on multiple fronts. All of the weirdness does not favor investing in risky assets, including cryptocurrencies.

But backdrop stuff aside, this past week was particularly unusual because about $9 billion in bitcoin started hitting the market following repayments made by Mt.Gox.

If you are not familiar, Mt. Gox was one of the first exchanges that made Bitcoin accessible. It was the main exchange for the entire bitcoin market between 2011 and 2014.

It was also sort of like the original FTX and suddenly went offline in 2014 following a series of hacks. At the time, many early bitcoiners had exposure to the Mt. Gox and lost access to their BTC as a result. Tens of thousands of bitcoin (it’s still unclear exactly how much, but estimates put the number at the equivalent of about $9 billion using today’s values) got locked up for the last decade.

Now, following a settlement and a decade-long process, some of the funds lost to the Mt. Gox closure are hitting the market again.

Bitcoin still leads the crypto market, and as bitcoin investors get jittery about the selling pressure that comes with the introduction of so much bitcoin, the rest of the market follows. We’ve seen this trend happen with other big trades and whale movements, so it’s not totally out of the ordinary.

Nevertheless, the uncertainty can create market drag.

In a lot of ways, it will be healthy for the markets for this Mt. Gox hangover to finally be cleared from the system.

A matter of perspective

Of course, rumors of the crypto’s demise are always greatly exaggerated.

But the big question on everyone’s mind is where are we post-halving?

Traditionally, or at least over the past three cycles, crypto markets behave a certain way after the Bitcoin halving, which is up and to the right.

But so far, this market cycle is behaving differently than previous cycles. This might be attributed to the launch of exchange-traded funds, or overall market maturity, or a lack of retail interest following the hacks and heists of 2021 and 2022.

Regardless, there is still a lot of uncertainty about where this all goes from here.

There is also a lot of non-bitcoin-related stuff that doesn’t feel all the way priced in:

Prices down bad, but…

— Kyle Reidhead | Milk Road (@KyleReidhead) July 5, 2024

- stablecoin activity at ATH

- onchain prediction markets taking off

- defi rev through the roof

- even web3 gaming picking up bigly

- and early stages of rate cut & liquidity cycle

Could there be a bigger separation in fundamentals vs price right now?

If nothing else, we should be in for some interesting times ahead.