Hashrate and the price of bitcoin

Hashrate is an important metric for the overall health and continued growth of the Bitcoin network. The Bitcoin halving has a push/pull force on the network.

The Bitcoin halving is a great time to discuss the importance of hash rate and its impact and influence on the overall network.

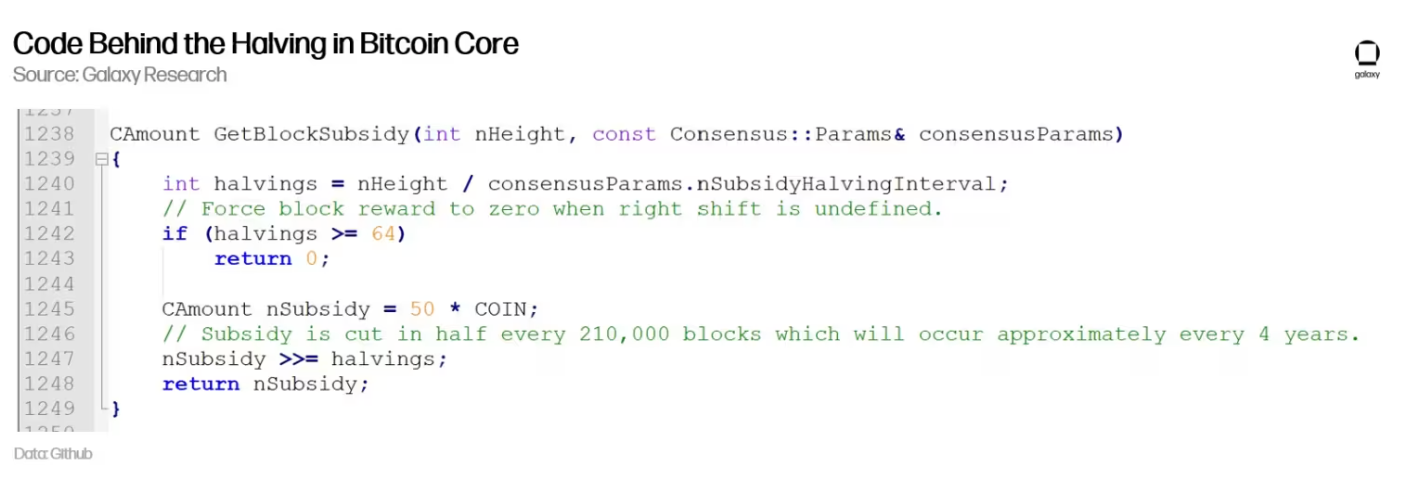

As a reminder, the Bitcoin halving is when the supply of new BTC issued following the successful addition of a block to Bitcoin’s blockchain – also known as a block reward or a block subsidy – gets cut in half.

This is all pre-planned and helps drive the dynamics of growth and upward price of BTC.

One of the biggest outcomes of the halving is that it will make mining bitcoin more expensive.

This expense will have consequences. Some miners might close up operations, while other miners might upgrade equipment to become more competitive, and judging by historical halving events, the hashrate (or the computational power needed to keep Bitcoin running) will increase over time in response to the more intense mining environment.

More context on Bitcoin's 2024 halving and why its so important.

The consolidation or movements on the mining front are fascinating — it’s like watching a global experiment in decentralized distributed systems happen in real time — and a story for another time.

What is important context for this post is to understand that the halving impacts hashrate, and hashrate is important to the overall health and value of the Bitcoin network.

Changes in hashrate and changes in bitcoin price

When talking about the value of a decentralized network, or more specifically, the value of a proof-of-work or computationally-heavy decentralized network, it’s important to look for indicators of overall health.

In the case of Bitcoin, price is certainly used as a health metric. But likely it’s overused and doesn’t tell the full story. After all, how many times has the Bitcoin network been declared dead after a wild price swing — only to come back stronger weeks or months later?

So, while the bitcoin price gets a lot of attention for overall network health, it’s not that great of an indicator.

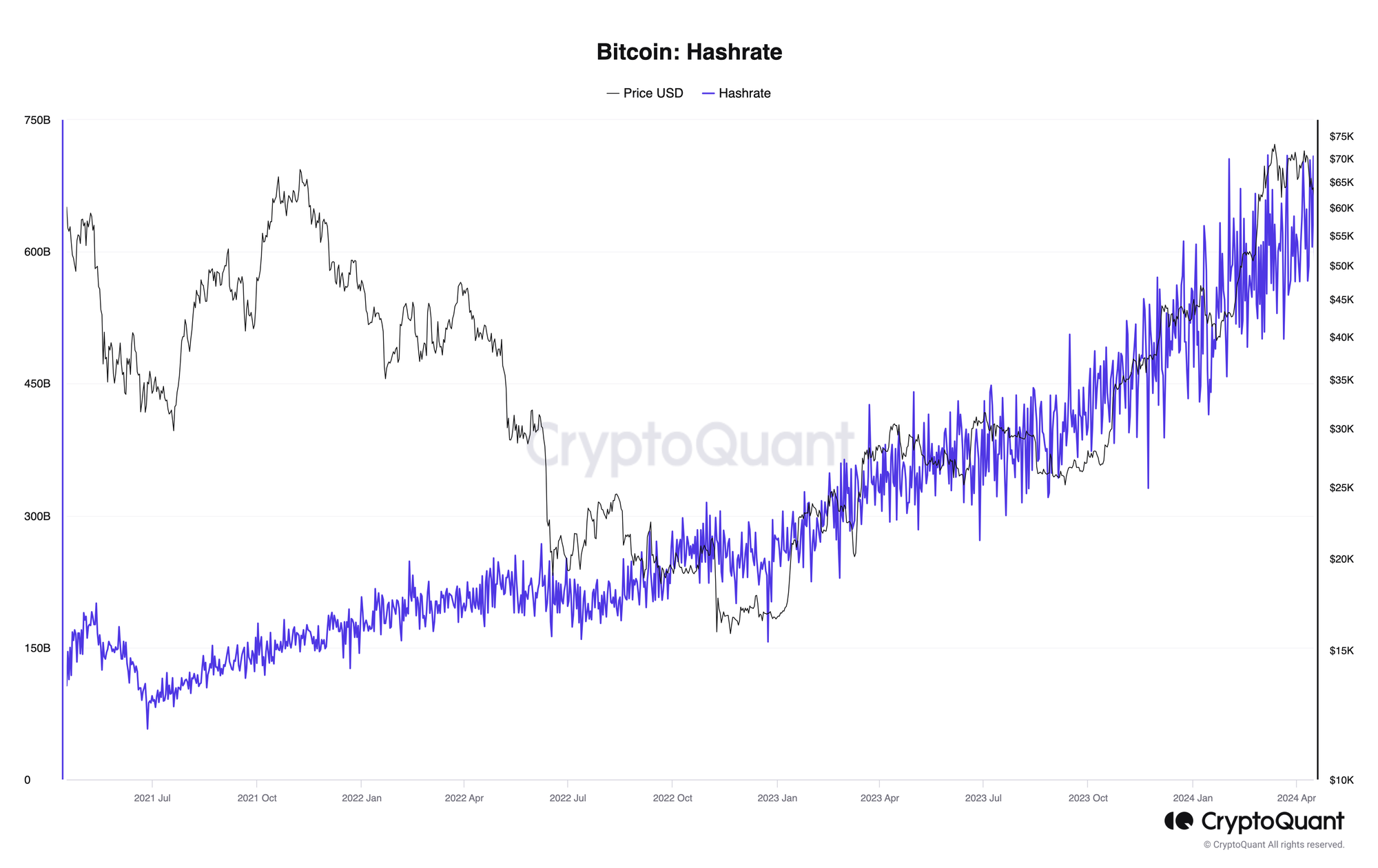

Hashrate, or the overall level of computation contributed to the network, is a much better indicator of health (we’ll talk about why deeper into this post). Interestingly, most times, hashrate and price are correlated (as the hashrate increases, so does the price).

What the chart above shows pretty clearly is that over time the climbing price of bitcoin that asset synced up pretty well with the increase in overall hashrate. When you think about it, it makes sense that these two metrics would move in lockstep.

If hashrate ever fell substantially or for long periods, the price of bitcoin would start to decline and fewer miners would be supplying hashing power (because it just won’t make financial sense).

At the same time, if the price of bitcoin climbs dramatically, then the hashrate would keep up because there would be greater incentives for more and more miners to make the investments required to contribute more hashrate. As new miners enter the market, the competition gets more intense, which can drive up the cost of production.

Bitcoin mining, hashrate, and network security

OK, so an interesting chicken-and-egg situation is happening with the Bitcoin hashrate and price. Sometimes one leads the other, other times it might follow, but there is a correlation between the two.

But beyond valuation at the level of the network, taking a look at hashrate or the production of hashrate can also provide a glimpse into some of the vulnerabilities of Bitcoin.

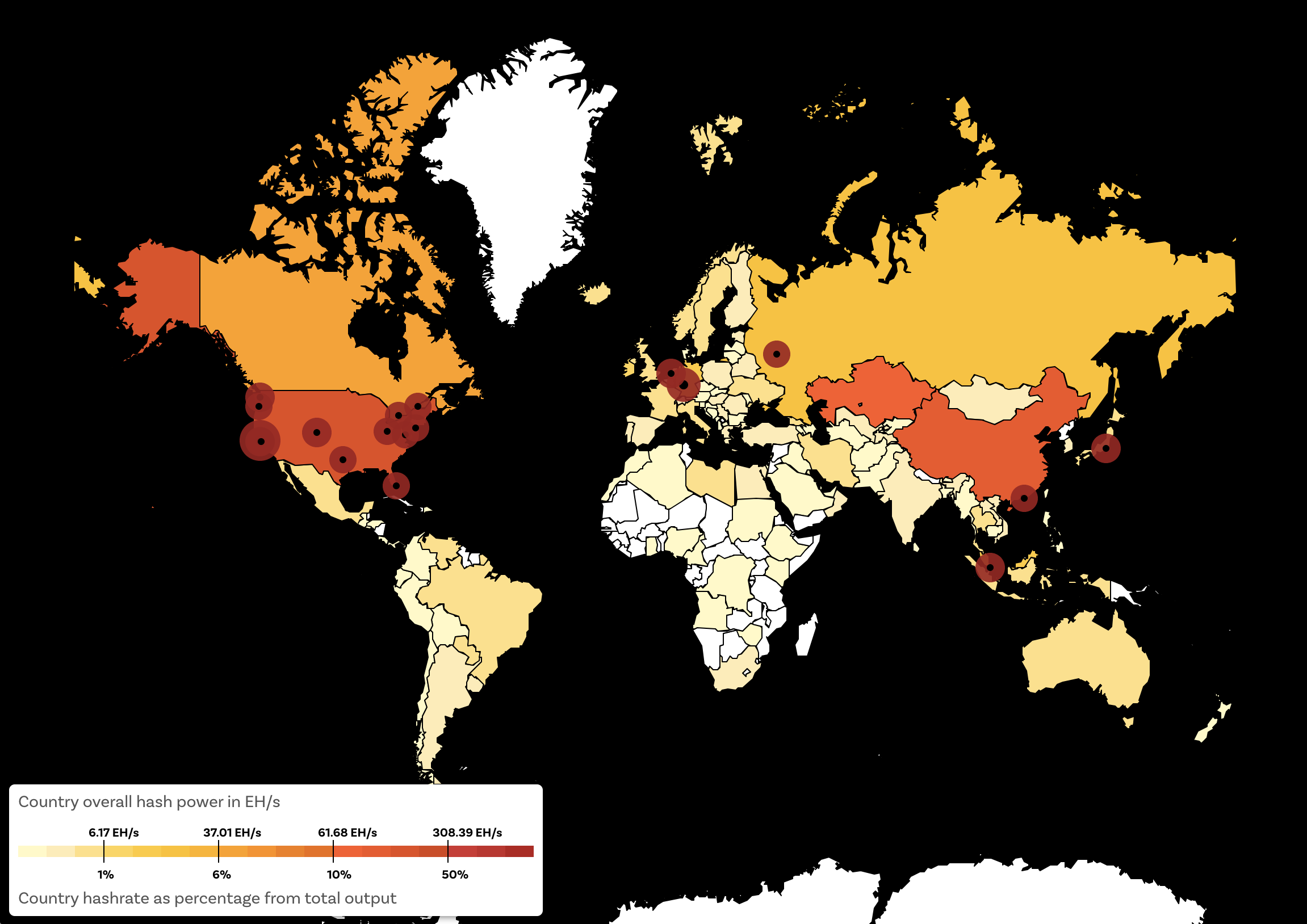

In recent years, one of the biggest issues related to hashrate and overall production across the Bitcoin network is the consolidation or concentration of hashing power to fewer miners and a shrinking distribution of miners to only a handful of geographic locations, which often correlate to cheap energy and/or favorable regulations.

Overall the greater the hashrate, the greater the network security because hashrate is essentially computing power backing the maintenance operations. As more computing power is contributed to the network, it makes it more secure.

Given the decentralized nature of Bitcoin and the fact that there’s no off switch, overall security is super important to maintain the confidence and integrity of the network.

A growing hashrate makes it harder for hackers (or any other centralized powers for that matter) to alter or to surreptitiously gain access to the network.

While the Bitcoin network has shown the power and potential of decentralized computing and networking, there is a very real risk that mining consolidation either through market forces or because of regulations or energy availability could create serious vulnerabilities for Bitcoin.

Impact of halving on hashrate

OK, so this might lead to the question, “What’s going to happen following the halving?”

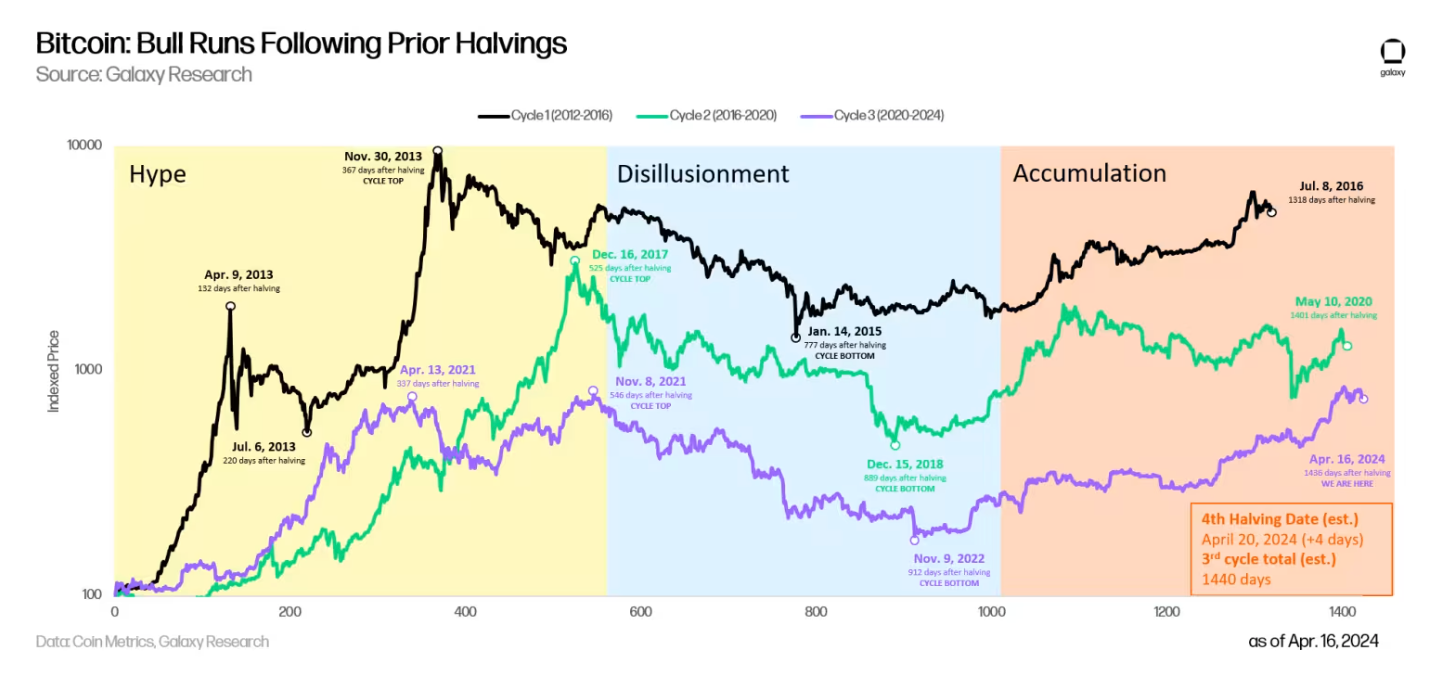

Based on previous halvings, the hashrate will likely retreat a little bit as the cost of mining increases (because the compensation for successfully mining a block decreases).

But eventually, the dynamics of the constricted supply start to kick in, the price of Bitcoin starts to rise, and with it — as the profitability of mining the incentives for the production of more hashrate start to take over. As that happens, both hashrate and bitcoin prices have historically climbed after each halving.

It’s important to note that the dynamics of the network are changing as it matures and just because there have been significant post-halving gains in the past, it doesn’t mean it will always happen — or happen the same way every time.

This market setup certainly has a different setup than previous cycles based on things like the recent approval of a Bitcoin ETF and even uncertain macroeconomic conditions. Even the hype around memecoins at the moment could affect the crypto market’s dynamics.