Four competing digital money frameworks

Here’s a breakdown of the strengths and weaknesses of tokenized deposits, fiat-backed stablecoins, algorithmically-backed stablecoins, and CBDCs. Sometimes, some of these systems are conceptually used interchangeably, but they are all different. And how they are distinctive is important.

One of the main advantages of open, permissionless money is that it is programmable. Another way to think about this is that money can and should act more like open source software and less like a locked down spreadsheet.

Programmability allows for the creation of composable money systems, tools, and applications that are modular and interoperable. Money systems should be fast, efficient, and cost effective — all things that are made possible if money acts more like computer code and less like a proprietary resource.

Let’s say we agree on that basic premise, that programmable money is the future. It will enable more functionality and make money more accessible as a building block for other kinds of services.

Right now there are a few different kinds of programmability money. Sometimes these systems are referred to interchangeably, or at least lumped together for convenience. But they are all really different.

Another important concept: Programmable doesn’t necessarily imply open or permissionless. This distinction is becoming more important as the conversation about the future of money and money systems heats up. And sometimes it’s a distinction lost in the crowd.

So let’s unpack four major frameworks emerging about the future of digital money. Each has their own costs and benefits, and their own applications or utilities.

Tokenized deposits

Large commercial banks are working on new systems to bring their operations on-chain, or at least take advantage of some of the aspects of using distributed ledger technology (blockchain) to make their operations more efficient and cost-effective.

If you’ve used crypto or digital assets to quickly move money between wallets, then you’ll understand that waiting hours for a bank wire or days for an ACH transfer feels antiquated.

After all, banks are a perfect fit for blockchain. A properly functioning blockchain prevents double spend, making it ideal as an accounting layer that can scale, be vetted, and operate across timezones and jurisdictions without any issues. Add to that programmability and the ability to execute smart contracts, and you start to wonder why banks aren’t hurtling themselves toward a blockchain-enabled future.

Tokenized deposits are one version of digital money that legacy financial institutions are exploring. Put simply, a tokenized deposit is a way to move fiat currency on-chain. Like the name implies, as banks take in customer deposits, they add the money to the digital ledger, effectively making the money digital.

In this context, we mean digital as in programmable — for use in smart contracts for things like credit and lending or for fast payments to digital wallets — we don’t mean simply electronic and still constrained by legacy financial systems like clearing houses, etc.

The upside of tokenized deposits is that it provides an easier on-ramp to more open, permissionless money. The downside is that the tokenized deposits themselves are likely going to still be closely controlled by the issuer of the tokens.

Also, for banks, the tokenized deposit system creates new kinds of security challenges and changes risk management profiles.

Central bank digital currencies

By now, you’ve probably heard about central bank digital currencies (CBDCs). They’ve been in the news recently as a political issue and are quickly becoming something of an issue for the upcoming election cycle in the US.

The basic idea with with CBDCs is that central banks will issue fiat directly to a digital ledger. The fiat will flow to other parts of the economy via digital systems, but the central bank will use the digital ledger as a final settlement layer.

How this will actually be implemented — like whether CBDCs will be issued on a permissioned blockchain or some other kind of digital ledger technology is still not clear. Different central banks are exploring different ways of creating CBDCs, so right now one clear model does not exist and many projects are still in the planning/research phase (although there are live examples to learn from, such as the Bahama Sand Dollar, an account-based CBDC launched in 2020 and designed to make banking and payment services more efficient for the population of roughly 400,000 spread over 30 islands).

A promo for the Sand Dollar

Some of the advantages of CBDC is that central banks could have more fine-tuned control over economic policy, get better data on money movements, and make access to money easier.

For all of the efficiencies gained by making central bank currencies programmable, digital currencies, there are also drawbacks or major concerns. For governments considering the pivot to digital currencies, security and overall system integrity is a major concern.

For the general public, questions about the ability to use money as a means of surveillance or control are very real.

But CBDCs in various forms and fashions are coming. According the the International Monetary Fund, about 100 governments are currently in various phases of figuring out how to create a central bank digital currency.

Fiat-back stablecoins

In the world of volatile cryptocurrencies, stablecoins play an important role of maintaining a fixed price. Stablecoins are useful to traders, or people trying to make big purchases with digital assets, or for just parking assets and waiting for markets to change directions, without losing value.

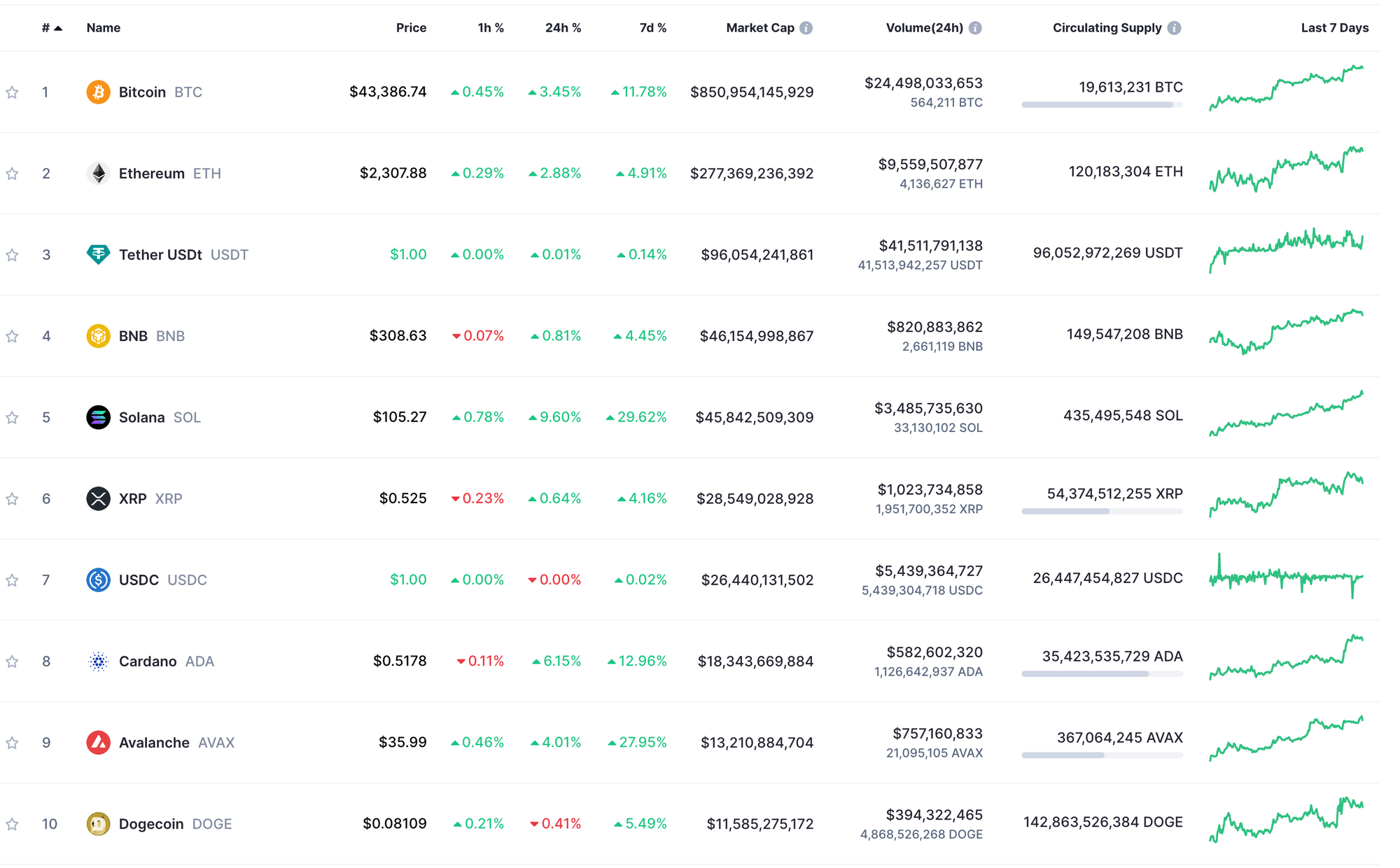

While they are seemingly boring — the price never moves — especially when compared to the price movements of the rest of the crypto market, the role of stablecoins, as viewed by their share of the overall crypto market cap is a testament to their role.

The mechanics that make it possible for fiat-backed stablecoins to exist are also one of their biggest vulnerabilities.

Fiat-backed stablecoins are backed by a treasury or a reserve that is held by the issuer (using the chart above as an example, Tether and USDC both maintain treasuries to back their peg to the dollar). Based on the assets in the reserve (usually a combo of Treasury bills or dollars), the stablecoin issuer creates a 1:1 digital representation of those dollars.

There are a bunch of reasons why stablecoins are useful, but primarily they provide people using digital assets for trading or purchasing the ability to stay within the digital ecosystem without having to constantly exchange digital currencies for fiat, but at the same time not have to worry about major market swings (especially to the downside).

The biggest downside of fiat-backed stablecoins is that in order for them to work, a third-party, like the issuer of USDC or Tether, has to hold the reserve. While the reserves are regularly audited by outside firms, the entire system creates a new kind of dependency, or at least reliance on third-parties to vet and report on the integrity of the peg to the underlying fiat currency.

Decentralized stablecoins

For proponents of purely peer-to-peer digital money, decentralized stablecoins are like a holy grail. The idea behind a decentralized stablecoin is to have all of the benefits of a stablecoin, but without any of the tradeoffs of a centralized reserve, or the need for a third-party audit to confirm reserves.

The biggest issue with decentralized stablecoins is how to create and maintain a peg between the stablecoin and whatever is backing it, like fiat currency — and do it in a trustless manner.

So far there are two different kinds of decentralized stablecoins:

- Crypto-collateralized stablecoins: Like the name implies, these stablecoins maintain their peg to fiat currency through collateral that is locked to maintain the peg.

The whole system is based on smart contracts and in order to maintain the acceptable level of decentralized-ness, they are controlled by a decentralized autonomous organization (DAO) that a makes and enforces the rules about collateral.

This kind of setup is risky — if the peg fails the collateral goes away — but it allows access to the utility of stablecoins without the need for a third-party, making it a good fit for decentralized financial applications. - Algorithmically-backed stablecoins: Rather than holding a treasury to back a stablecoin, this model uses an algorithm to adjust supplies to demand in real-time, keeping the price at a constant level. Sounds simple, right?

The actual inner workings are complex, and while this model has been tried a few times, it has also failed dramatically. TerraLuna is the most recent example. Its implosion was one of the triggers that sent the broader crypto market into a tailspin in 2022 — triggering other collapses.

Despite past failures, there are projects still pushing to create and perfect the performance and overall safety of algorithmically-backed stablecoins. After all, programmatically controlled stability would pair well with programmable money, and largely make third-parties and intermediaries obsolete.

Digital money doesn’t always mean open money

One thing is for sure: Innovation is coming to the traditional banking and money issuing space. What’s less clear is how well traditional, centralized money systems will dovetail with newer, decentralized money systems.

On one hand, newer version of decentralized finance make it easier and more cost-effective to move lots of money quickly. On the other hand, opening up centralized systems creates other cost-incurring issues such as security, risk management, etc. And of course, regulatory compliance is still a massive question mark.

Nonetheless, despite the innovation, one key component to not lose sight of is that the move to digital money doesn’t necessarily mean that these new systems will be open, or even created with the end user in mind. Instead, digital money that is controlled by commercial banks or central banks might create issues related to privacy and control.

So while politicians, bureaucrats, and bankers are discussing the future of money, it’s important to understand the distinctions of the different systems as well as the cost and benefits of each.