Ethereum staking ETFs

Marketing recommendation: Hold bags. Earn yield.

Things got interesting in institutional crypto land this week when two Ethereum exchange traded fund (ETF) managers filed for approval from the SEC to allow staking from right within the fund.

On February 12, 21Shares Core Ethereum ETF managers submitted a filing to the SEC to introduce staking activities.

On Friday, Grayscale Investments, via the New York Stock Exchange, filed for approval from the SEC to stake ETH in its ETFs.

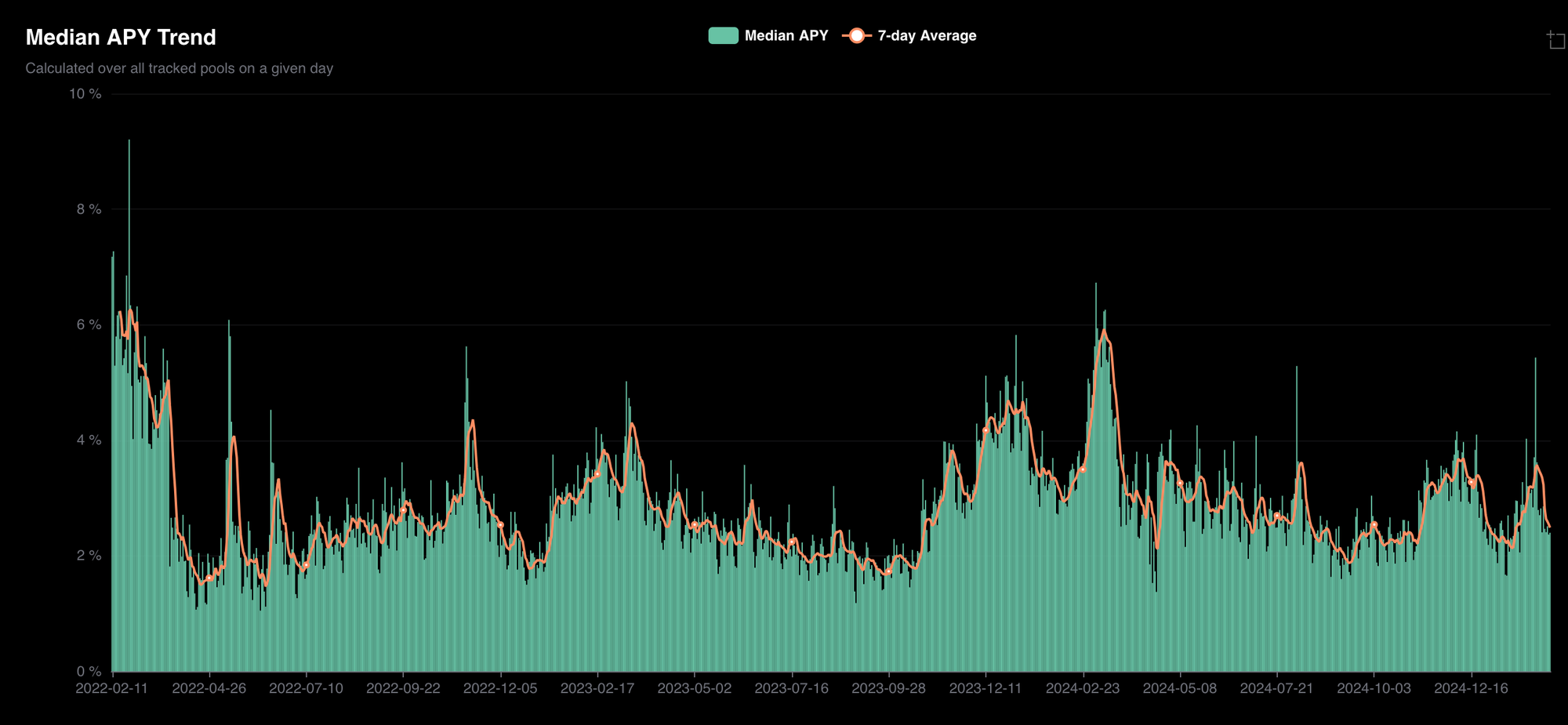

Ethereum’s staking yields fluctuate, so funds can’t guarantee any yield. Here’s what performance looked like over the past few years.

This development is interesting for fund managers because it combines old-school investing tactics with more avant-garde financial functionality (making money while staking a decentralized consensus mechanism).

It’s also interesting for investors because they can now earn yield while holding bags in a more straightforward investing environment. Or, put another way, a whole new crop of “stakers” can participate within a more suit-and-tie environment.

The potential of creating a traditional fund for proof-of-stake protocols is likely to catch the attention of other blockchain builders. The ability to capitalize on institutional investment to secure protocols could be a massive growth lever.

For more context, here’s a brief overview of what proof-of-stake is and how it works:

As pointed out in the 21Shares filing, one of the most significant advantages is that the creation of Ethereum staking ETFs makes it possible for all kinds of investors to participate in protocol governance through a “point and click style staking approach.”

In other words, staking ETFs makes allocating more capital to staking activities easier. The downstream result should be more staking activities and greater overall network security.

The takeaway is that staking ETFs might be an excellent product for people and institutions looking to hold long-term bags. The advancement is that they make participating in the latest forms of digital finance easier.

But are staking ETFs Open Money?

The introduction of staking ETFs raises interesting questions about where this would fit on the Open Money spectrum.

At one end of that spectrum, we have entirely Open Money formats in the form of permissionless money that allows for self-custody and features advantages such as programmability and composability. Holding Bitcoin or Ethereum in a non-custodial wallet is a perfect example of Open Money.

At the other end of the spectrum, we have centralized money with caveats or restrictions on access. Money held in a bank account or a brokerage falls into this category.

These distinctions were clear for years, mainly because there wasn’t a middle ground. Then came the crypto ETFs.

On one hand, Bitcoin and Ethereum ETFs allow for exposure to crypto markets in a style and format that wasn’t possible before. The new kind of access opens up new opportunities for people and institutions that might not be able to participate previously.

While access is the whole point of the Open Money framework, crypto ETFs fall short of the other criteria. Mainly, what’s missing from the ETFs is the ability to self-custody and the fact that they rely on centralized brokerages and account setups that require permission.

The development of staking ETFs is interesting because they make it possible to participate in Open Money activities (staking a decentralized network) without having to hold the naked asset. The issues with custody and centralization still exist, but staking ETFs represent a new hybrid model.

While crypto ETFs in their current format are not quite Open Money, but these new products are trending in a new direction. And more options mean more adoption, which is healthy for the entire system.

Updates to the Open Money project

The project last week mainly focused on the first principles of Open Money. We are covering a bunch of the concepts mentioned above, such as what it means to have money that is interoperable, programmable, composable, etc.

This section of the project may feel dry or annoyingly bouncing through jargon. The flip side is that these concepts are essential to building the framework. Without them, some later distinctions in functionality and results won’t make sense.

At least, that’s what I think. Let me know what you think (all you have to do is respond to this email).

Here are a few recent posts: