Unpacking the Electric Capital Developer Report 2023

This a look at some of the highlights from the Electric Capital Developer Report 2023.

One of the main attributes of open money is that it's built on open source infrastructure.

There are a multitude of costs and benefits of building open source financial and information networks, but one major attribute is by their nature of being built in public, we are able to access important data points like developer activity.

In this case, Electric Capital, a crypto-focused venture firm, looks at open source data such as code commits on public code repositories to come up with a data set that reveals interesting insights.

Every year since 2019, Electric Capital studies and reports on developer activity across all crypto ecosystems. For their latest report, they were able to study 485 million code commits across 818,000 repositories to come up with a picture about the overall health and current projects happening dev-wise in the crypto space.

Some data gleaned by Electric Capital includes:

- Where the developers are dedicating their time (sometimes its on multiple chains)

- Which projects are getting the most love developer-wise

- Projects that are growing in terms of developer activity, especially in the last 12 months.

Five key insights from Electrical Capital’s Developer Report 2023

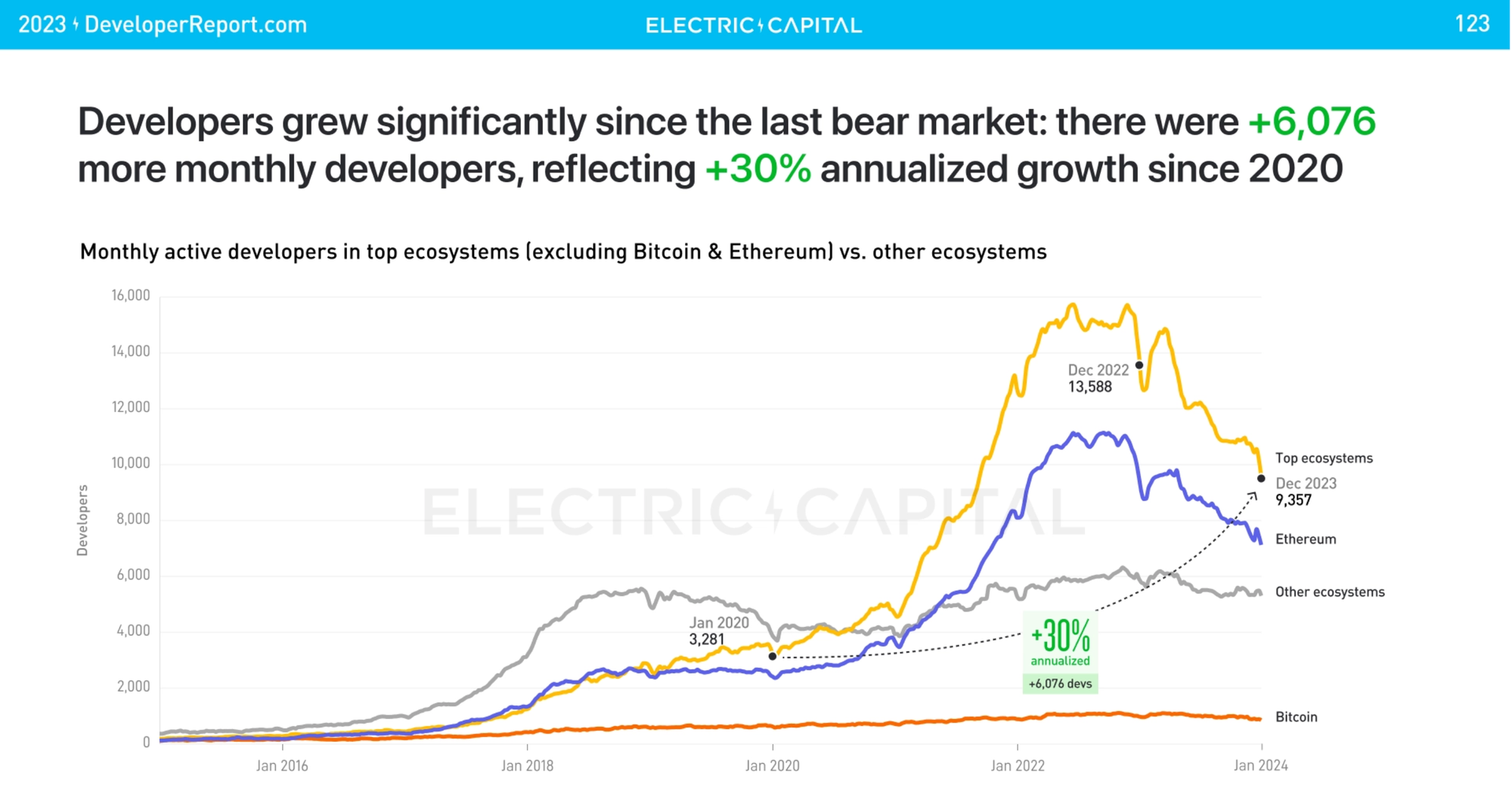

The biggest takeaway from the Electric Capital Developer Report is that the crypto-related developer space is strong, and growing and maturing in different ways, despite the challenges to the industry over the last 18+ months.

While the number of overall developers is off its peak (which followed the all-time market highs of late 2021), the number of experienced developers and the number of developers working across multiple chains is growing.

Here are a few other key insights:

Developer activity is growing

At a very high level there are 22,411 active open source developers contributing to crypto as of December 2023. While the number of active developers is constantly fluctuating, the data shows a steady growth in experienced developers.

Experienced developers, defined in the report as someone who has a year or more of active experience push more code, and provide more consistent commits versus new developers.

Not surprising that surges of devs coming and leaving crypto track to price, which also tracks to overall interest in crypto markets across all verticals such as media and investment.

It was a rough year in the crypto markets during 2023. The year was largely defined by negative sentiment and the continuation of a prolonged bear market. These market conditions were reflected in the overall number of crypto developers, which dropped 24% from the end of 2022 to the end of 2023, or from 29,611 in 2022 to 22,411 in 2023.

Most of the crypto development work continues to be concentrated at the top of the market. Of all crypto dev work in 2023, 79% of it was contributed to Bitcoin Ethereum and and the top 200 crypto projects by market cap.

Within that number, most of the distribution of devs is focused on Bitcoin and Ethereum (more on that in the points below). Interestingly, there are 17 ecosystems that have 1,000 or more developers working on them.

Global networks benefit from a global development community

One of the main attributes of permissionless, open blockchain networks is that they are global, easily spanning borders and political territories.

One year-over-year trend documented by the Electric Capital Developer report is that the number of blockchain developers based in the US is shrinking. At the same time, other parts of the world are seeing a noticeable increase in developer activity.

While the overall number of developers has grown, the United States has lost 14% of its developer force. Meanwhile, places like South Asia, Latin America, Eastern Europe, Western Africa, and Southern Europe have experienced a 20% growth in active developers since 2018.

Bitcoin dev work on scaling and ordinals growing

By the end of 2023, 1,071 active monthly developers are working on Bitcoin. That represents a 20% decline in bitcoin-specific devs when compared to 2022.

However, most of the developer loss was attributed to newcomer developers. This resulted in an overall slight increase (7%) in the number of experienced Bitcoin developers, who now make up 80% of active developers when compared to the number of overall devs.

How best to scale the Bitcoin network is an ongoing conversation and controversy within the Bitcoin community. So it’s noteworthy that roughly 40% of all Bitcoin dev work in 2023 was focused on layer two and scaling solutions.

One big Bitcoin innovation of 2023 was the introduction of ordinals (smart contract-like functionality), now roughly 3% of Bitcoin developers are working on ordinals.

Last point, here, and I think this one is significant in terms of looking at the overall sustainability and durability of the crypto market, is that 40% of all dev activity is focused on Bitcoin and Ethereum. Despite all of the fluctuations and changes of developer composition, that number has remained consistent since 2015.

Ethereum dominates

There are a lot of threads to pull out of the developer activity data, but one thing that emerges is the logic used to build smart contracts leaves behind clues about origins.

In other words, it’s possible to look at the logic of a smart contract and figure out where it came from and if its native to the chain that is using it or if it was pulled in from elsewhere.

Turns out that Ethereum is the biggest exporter (or has the greatest influence) of on-chain logic. Put differently, 71% of all smart contract code powering things like DeFi and NFTs, etc., is initially built on Ethereum and then reconfigured to fit other ecosystems.

In 2023, 85% of all ETH transactions were DeFi-related, and 51% of DeFi developers are working on stablecoins and decentralized exchanges. Most DeFi devs report working on multiple blockchains.Also noteworthy, most newcomer developers start with Ethereum. In 2023, for example, there were 16,747 newcomer Ethereum developers. Second place was Polygon with 6,208.

Crypto is a collaborative space: Multi-chain builders

They crypto ecosystem often feels fragmented, or fractured in some way. Sometimes that’s related to issues like interoperability. Other times, it’s related to some of the tribalism and flexing by industry insiders on social media an elsewhere.

But judging by developer activity, the crypto ecosystem is actually collaborative. In fact, 34% of crypto developers work across multiple chains.

The percentage of multi-chain builders has been growing since 2015, with a big uptick in the market cycle between 2018-2021 (while not emphasized in the report, this growth of multi-chain builders is likely largely driven by the intro of decentralized finance and related activities, which took place during that time period).

While public blockchain activity isn’t something you see covered on a daily basis, it is a great metric to understand and keep tabs on. As developer move from ecosystem-to-ecosystem, or as more (or less) developer activity becomes focused on on project or new applications, it can reveal a lot about the over health and trajectory of the space.

Read the complete report

The full report consists of 180 slides and is extremely visual and easy to consume: