Introducing the cryptoasset.

Cryptocurrency is sometimes treated like digital cash and used as a peer-to-peer payment method. Other times it’s held like a security and buying cryptocurrency is like buying shares in a company.

But wait, cryptocurrencies are also called digital gold — and seen as the commodities of the future.

So which is it? Is cryptocurrency a security, a currency, or a commodity?

While the various labels are somewhat useful, it’s probably most accurate to consider cryptocurrencies as their own kind of asset.

Viewing cryptocurrencies as cryptoassets is useful for traders and investors, and for people learning about how crypto-finance works, but it’s important to understand that in the U.S., the SEC, IRS, and a handful of other financial regulators each have a different interpretation of what a cryptocurrency is, and how it should be treated. Not to mention that cryptocurrencies are regulated differently in other countries.

So while the cryptoasset definition helps clarify what a cryptocurrency is, it doesn’t necessarily change (yet) how cryptocurrencies are regulated.

Making the case that cryptocurrencies are a new kind of cryptoasset

I’ve been looking at this research paper published by New York City-based ARK Invest, an investment management firm that compiles interesting research on large-scale disruptive technologies.

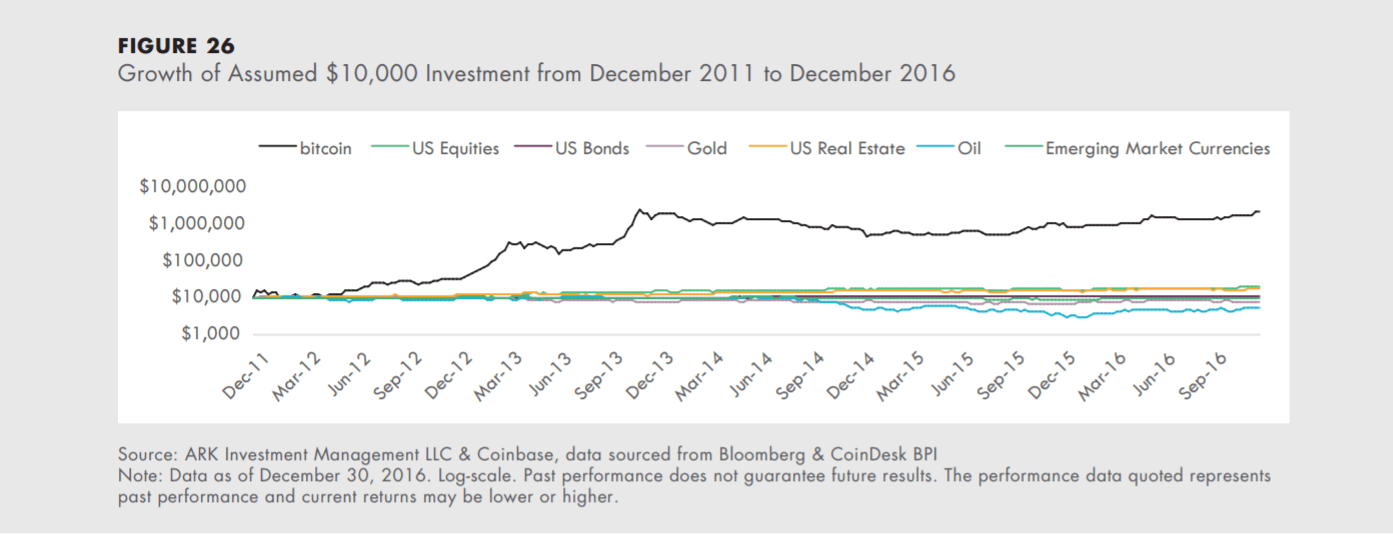

In collaboration with the San Francisco-based cryptocurrency exchange Coinbase, ARK published a paper last year outlining how bitcoin and cryptocurrencies compare to other forms of traditional wealth-building tools, such as real estate investments, oil, gold, and the stock market.

Roughly summarized, the purpose of the comparison was to see if there are similarities between the way bitcoin (and bitcoin, in this instance, was used as a stand-in for cryptocurrencies more broadly) behaves in relation to traditional investments.

Financial assets usually fit into one of three broad categories: capital assets, consumable or transformable assets, and store of value assets. The distinctions are important to understand when talking about what cryptocurrencies are and aren’t.

An investor purchases capital assets with the idea that there will be some kind of ongoing return or production of value. Equities, bonds, and incoming-producing real estate are all examples.

The next category is consumable or transformable assets, think commodities like oil and gold. These assets can be traded or used, and they retain their value.

The third type of big bucket asset class is store of value assets. They do not generate returns, and they can’t be consumed. These assets, such as gold, and fine art, are stable places to store wealth (and in some instances are more portable and liquid than the other asset classes).

Cryptocurrencies can share characteristics of all three asset classes while also adding other emerging benefits, such as micropayments and the execution of smart contracts, which are foundational for increased automation and the Internet of Things.

What makes cryptocurrency a cryptoasset?

There are four basic characteristics that all assets share, according to the ARK paper

Investability: In this case, investability signifies sufficient liquidity, meaning an investor can purchase or sell the asset relatively easily and at a time of his or her choosing; and opportunity, meaning investors have access to the market where the asset is traded.

Politico-Economics: This characteristic relates to how an asset is created and controlled. For example, bonds and equities are both securities, but they are different kinds of assets (and investors hold them in their portfolios for different reasons) because of how they are defined and how they derive their value. Cryptocurrencies fall into a completely new politico-economic spectrum because they are a form of value controlled by algorithms and not by traditional institutions (like governments or corporations). The value of cryptocurrencies are not tied to faith in political leaders or finite resources, but to perceived worth of the technology’s applications (smart contracts, international payments, security, etc.)

Correlation: Investors often evaluate assets in comparison to other forms of value. The interesting thing about cryptocurrencies is that they do not correlate well to other assets. Instead, cryptocurrencies have a certain level of price independence. So if the price of gold, or oil, or real estate rises or falls, cryptocurrencies are minimally impacted. This is not the case with other asset types, and this feature is a good reason to include cryptocurrencies in a well-balanced portfolio.

Risk/Reward profile: We’ve all heard this before — high risk, high reward. But it’s important to know how the reward might compare to the risk, which for investors is something called the Sharpe Ratio. The idea is that you want to make sure risky investments have the potential to result in high rewards. By now, cryptocurrencies have proven that despite various issues related to regulatory struggles, public perception, and developing exchange and trade infrastructure, digital assets like bitcoin and ether have been good investments over time. The returns on bitcoin, for example, over the past five years, are orders of magnitude larger than any kind of traditional investment.

In some ways, thinking about cryptocurrencies as a new kind of cryptoasset is helpful. By comparing cryptocurrencies to traditional assets, cryptocurrencies have a lot of potential. The comparison is also useful to help explain what a unique opportunity crypto assets present for creating, storing, and moving value.