How to use AI to do crypto research: A DeFiLlama <> ChatGPT case study | DYOR

Using the DeFiLlama plugin with ChatGPT makes performing research about the latest happening in the decentralized marketplace as easy as writing some prompts. This post is a case study on how to use these tools to Do Your Own Research.

One of the most interesting and underrated advances within the crypto and DeFi space right now is the development of research tools and tactics to make vetting on-chain data easier for the average person.

Not that long ago, anything beyond the most basic crypto research was generally considered the realm of “experts” or people with some kind of financial research background — or access to pricey tools or data feeds.

But that’s all changing. In the background, the ability to access and use the transparency and record-keeping of public blockchains is getting easier and more intuitive.

And tools that are simple to use open up a lot of opportunities for interested people to take deeper dives and put together a completely custom Do Your Own Research stack.

In that spirit, let’s take a look at using ChatGPT to access DeFi data using DeFiLlama.

Using ChatGPT to look at DeFiLlama

Background

DeFiLlama is a DeFi analytics platform. Launched in late 2020, the platform was created to give DeFi users, investors, and market watchers and easy-to-use hub to track common market metrics.

The goal of the product is to aggregate basic DeFi data to make it easier to figure out what is going on in the growing universe of decentralized finance protocols, apps, and services.

The kinds of data points that you can track and research on DeFiLlama include:

- Total value locked, or TVL, which describes how much money is part of all of a DeFi protocol’s activities.

- Trading volumes, or how much money related to a DeFi protocol or app is trading hands.

- Liquidity, or how easy it is to buy or sell and asset without causing price movements.

- Status of forks, airdrops, oracle services, and other important DeFi market events.

Maybe one of the greatest things about DeFiLlama is that it is free to use and is open source, which makes it an accessible tool on a lot of levels.

ChatGPT is a conversational AI chatbot that handles tasks like asking questions, creating dialog, summarizing text, or creating code through a simple interface.

The technology can consume large amounts of data and then analyze that data to perform a user request — and then break the answers down into something resembling a conversation.

The company behind ChatGPT, OpenAI, launched several iterations previous to what is available today, but the product went mainstream in November of 2022.

ChatGPT offers a plugin market place that enables a specialized functionality, like grabbing info from the web, or booking travel arrangements. Plugins are created to train ChatGPT on a specific set of information.

One of the plugins available for ChatGPT is the DeFiLlama plugin, which is necessary to perform the functions outline below. As of the time of this writing, installing plugins requires subscribing to ChatGPT’s premium service for a monthly fee.

The problem solved by using AI to look at DeFI analytics

Using conversational AI to vet complex data will be game changing.

As was mentioned at the top, one of the biggest attributes of decentralized finance is that DeFi protocols enable financial transparency and accountability.

But the feature set of public ledgers and public accountability can’t be fully realized if it is too cumbersome or complicated for ordinary people to vet ledgers and get data.

And it’s not about being watchdog, or performing customized personal research. Being able to vet DeFi events and market movements in realtime will also play an important role in the health and longevity of DeFi governance and public participation.

Just like a healthy democracy rests on a fair, accurate, and free press — the true value and potential for DeFi will only be realized when all of the data and market movements are accessible and easy to understand by DeFi users.

Having the ability to interact with massive amounts of financial data using AI will help ease some of the complexity of decentralized finance and maybe even make new financial tools feel more useful.

How the ChatGPT DeFiLlama plugin works

The great thing about the DeFiLlama plugin is that it removes complexity querying DeFi data. Rather than using advanced data analytics skills, or writing something like SQL queries, anyone can write simple conversational prompts into the ChatGPT interface and then get the answers they need.

The speed and repeatability of this kind of research also means that updating market analysis daily, or even several times a day can is super simple.

All you need to do is put the question you want to ask into a prompt format. While the tool is incredibly useful, it’s not perfect. And any time you are using ChatGPT to vet data, it’s always good to double check results (especially if you are using the results for investment or financial decisions).

Sample results

Here are a three examples of queries with the results. In all instances, I asked ChatGPT to show the results in a table.

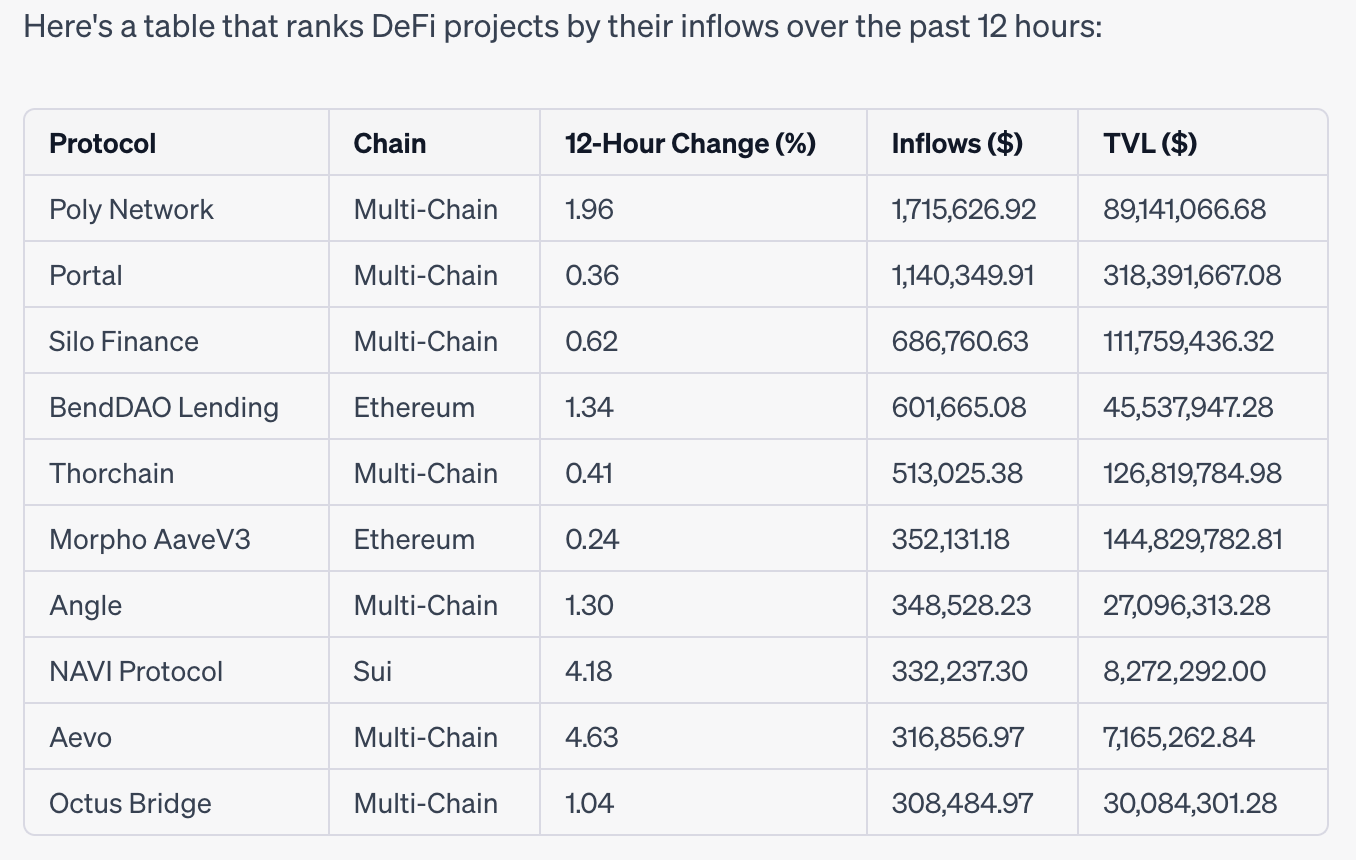

Prompt one: I asked about DeFi projects with the most inflows in the past 12 hours.

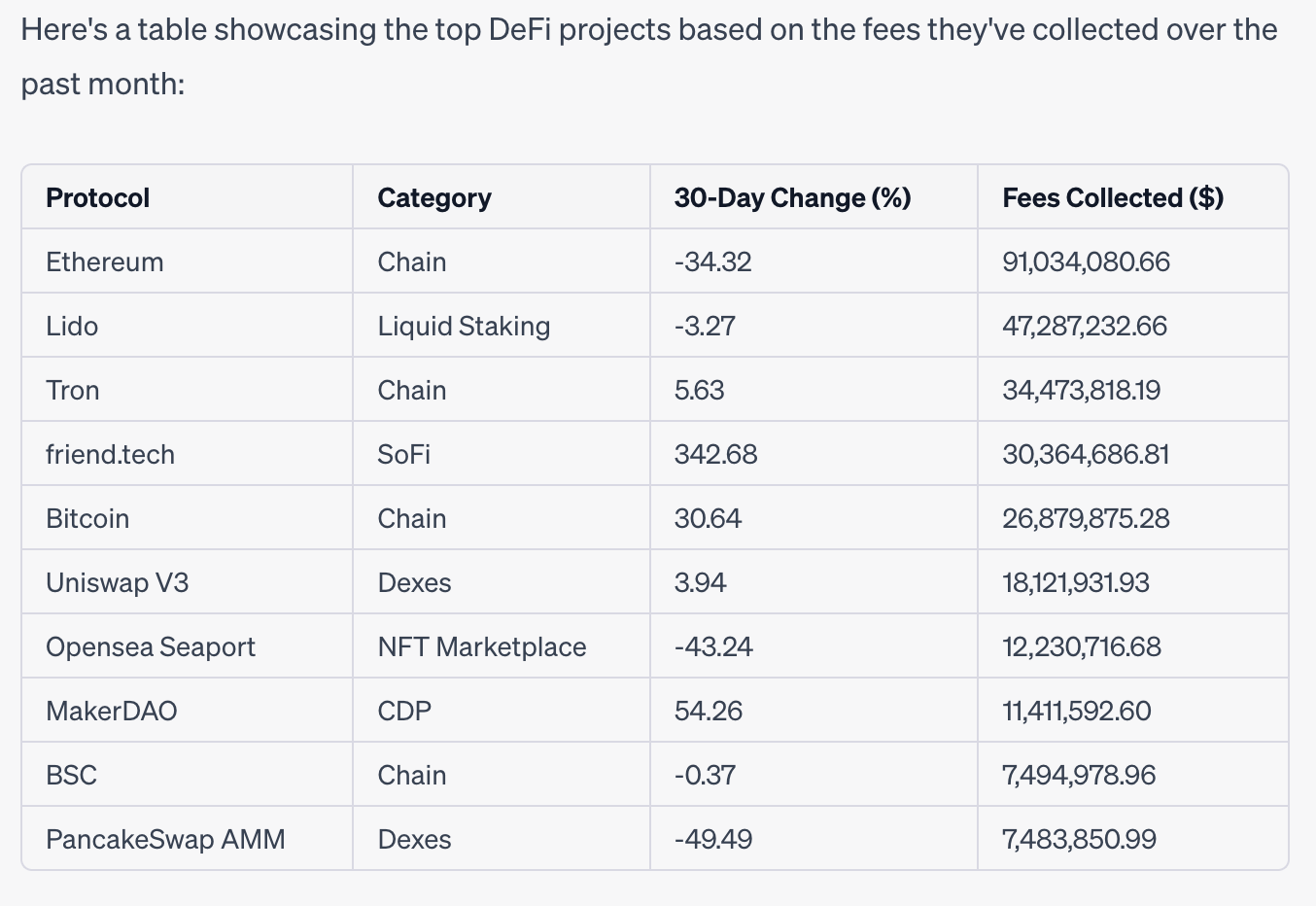

Prompt two: In this prompt, I asked about fees collected by DeFi projects over the past 30 days.

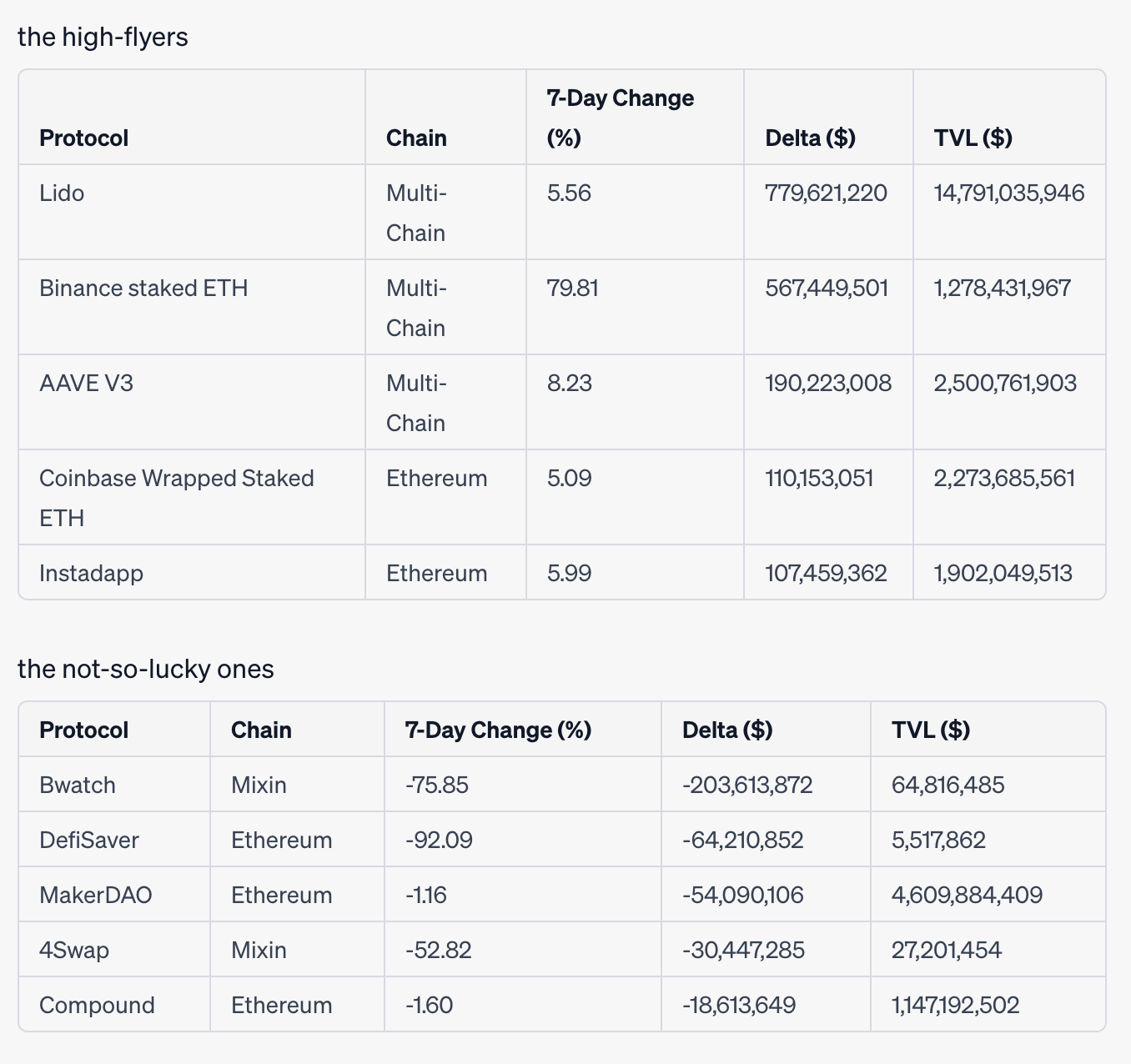

Prompt three: I asked about DeFi protocols that gained and lost the most in the past week.

Analysis

After testing this workflow for a little bit, I think this tool probably has three obvious uses:

- Active DeFi users: For people that use or are invested in DeFi already, this tool could be customized to create a watchlist of sort that can be quickly updated whenever needed. The ChatGPT prompt can be created to act like a filter on specific projects and the metrics can also be inputted, like change in total value locked or the daily inflows or outflows to a project — all useful stuff for people looking to level up their research game.

- The screeners: In the early days of crypto and in the early days of DeFi, it was a little bit easier to keep up with all of the major players in the market. But as the decentralized finance market continues to expand in both projects, use cases, and complexity, having tools to assist in keeping tabs on interesting movements is key. Using the DeFiLlama plugin to look at things like changes in volume, which might surface interesting finds or new projects to check out.

- The new researcher: Still, the biggest advantage of using AI tools to vet something as dynamic as DeFi is that it makes the space way more accessible to people trying to figure out what’s going on. By creating simple prompts and using something like the DeFiLlama plugin, suddenly an entirely new informational ecosystem opens up, which will likely be useful in ways we haven’t even thought of yet. But it’s particularly useful to the DYOR crowd.

Conclusion

Maybe all of the recent advances and innovation happening with the research and on-chain access space won’t truly become apparent until the crypto markets come back to life again. Maybe right now, there’s not enough widespread interest, but I do think that these DIY research tools are moving the needle.

What it all means is that the next big market wave — and all of the stories and attention and excitement that surrounds major price movements will probably happen against a different backdrop. Instead of relying on a constellation of somewhat reliable sources for on-chain information, people can use these new tools to look at the data themselves and make decisions.

While these tools might be built for looking at asset or market performance, at a higher level they also help deliver on another major value proposition of public blockchains. Transparency and reporting — or just making finance public, will have interesting ramifications down the road, and it’s one of the biggest advantages of using technologies like distributed ledgers.