The emerging taxonomy of blockchain and cryptocurrencies, and what it means for future projects

It appears difficult for the mainstream media (especially during weeks when the value cryptocurrencies have moved dramatically) to really find ways to talk about blockchain and cryptocurrency as anything other than speculative or alternative investments.

Either people are for crypto as a digital gold rush, or they are against crypto, claiming it to be some kind of Ponzi scheme.

But really, underlying the current crypto craze is the emergence of a new technology, and new protocols, that will guide how the future of the internet is built.

In my last post, I wrote about blockchain as a means of environmental protection and conservation. And while I’m optimistic that projects (such as the tuna tracking) will one day have an impact, the whole blockchain as a tool concept still feels out somewhere on the horizon.

Part of that detachment is likely my own vantage point. I don’t work in the blockchain/cryptocurrency space so I don’t have an everyday sense of the state of the art. Instead, I’m like millions of others just trying to piece this all together into some kind of coherent picture.

I would bet that if you are reading this, you share the same sense that blockchain and cryptocurrency technology will have a profound impact on the way we conduct everyday business. And everything from digital democracy to access to banking services for the poor might become possible.

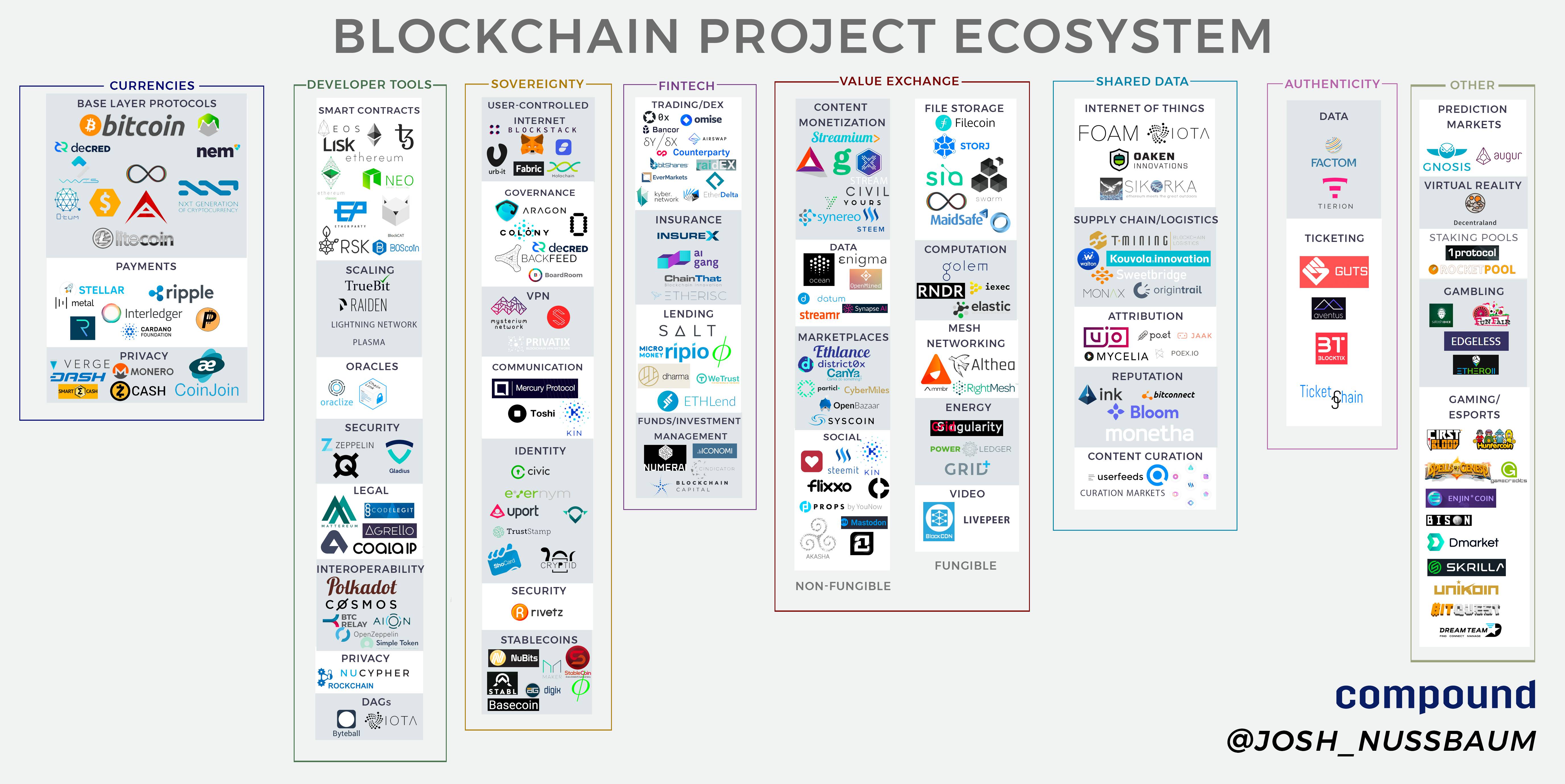

But, how do we keep up with the rapid developments and movements in the blockchain and cryptocurrency space? I know this is a shared sentiment. This week, Josh Nussbaum, a partner at the NYC-based venture capital firm, Compound, put together a useful chart that helps give some definition to the emerging blockchain/cryptocurrency space.

“There are many exciting developments coming to market both in terms of improving existing blockchain functionality as well as the consumer’s experience. However, given the rapid pace at which projects are coming to market, I’ve found it to be difficult to keep track of each and every project and where each one fits into the ecosystem,” he writes.

Having some kind of organization or architecture is one way to help understand all the new and emerging blockchain and cryptocurrency companies and systems.

As a starting place, Nussbaum created a useful infographic that divides current projects into functional categories. Some of these projects could exist in more than one category because they address more than one need.

While the graphic is helpful, it’s maybe more important to track the high-level categories that Nussbaum has developed. Defining and thinking about these categories gives some sense of bearings for wayfinding and ultimately understanding how this new blockchain-based economy is coming together.

The blockchain breakdown: What blockchain and cryptocurrencies are being used for, and why it matters?

Currency: Perhaps the most well-known so far, the most popular cryptocurrencies (like bitcoin) are being used to represent a store of value, a medium of exchange, and a unit of account. Of note, is that there is also a significantly important subcategory of these new digital currencies that focus on privacy, such as Monero.

Developer tools: These are building blocks for decentralized apps. Ethereum fits into this category. Some of the biggest advantages of decentralized apps are interoperability, or the ability to share data across platforms. So far, a major challenge facing decentralized app projects is that they are unproven at scale, and so don’t really present that much of a disruptive challenge to traditional business models (yet).

Fintech: This category refers to the decentralized tools being developed to operate as exchanges for digital assets, as well as new companies that will offer new investment and lending products.

Sovereignty: This word gets thrown around a lot in the crypto world, but really, in this instance, it’s just a fancy way of saying trust. Companies focusing on sovereignty are trying to remove layers needed for users to have trusted and legitimate interactions. Currently, interactions on the internet (like buying and selling things) require trusted third parties, which drives up cost and introduces other security issues. Sovereignty projects range from the user-controlled internet to more secure social networks.

Value exchange: New economies of scale are being created to compete with traditional corporations. Blockchain and cryptocurrencies hold the promise of allowing people to create contracts and agreements that can allow for the creation of new industries and commodities (like data, digital storage, and new energy markets for example) without the need to organize — with the hierarchy and overhead — like traditional corporations.

Shared data: Right now the massive amounts of data being generated and collected (such as customer data) lives in walled gardens, owned by specific companies. Facebook, for example, owns the data generated by its platform users, eBay owns data about its customers. But blockchain is creating systems that allow companies and organizations to share secured data. More accurately, what blockchain allows is for users to have more control over their data and be able to share parts and pieces (like address, or payment info) when and where appropriate.

Authenticity: One of the biggest problems that blockchain solves (and what makes peer-to-peer payment networks like bitcoin possible, or ethereum’s smart contracts work) is the ability for decentralized, permissionless networks to execute trusted and verifiable transactions. Companies and organizations built on the back of blockchain that can vouch for the integrity of the data that a user is representing, which could range from a ticket purchase to some kind of vital record.

The still emergent blockchain use cases

I really appreciate Nussbaum’s work and his method of laying some kind of taxonomy over the rapidly growing blockchain space. It is helpful to me, and I’m sure others, to think about breaking down projects and how they fit (and identifying competitors) in general.

I am also curious to see how this blockchain taxonomy changes and grows over the next year and beyond. As I’ve written about before, I think one of the biggest growth areas will in the internet-of-things (IOT) and how machines and devices share data and execute smart contracts.

In some ways, I see the emergence of meta-uses, where blockchain and cryptocurrency projects harness multiple parts of the above outline to build new kinds of secured data infrastructure, giving rise to projects and ideas that will change the way we conduct business and hopefully improve any kind of internet-connected services.

Where do you see the biggest impacts are you most excited about? Please let me know.