Crypto: Macroeconomics, Emmy awards, and staking for all

What do easy staking, an Emmy award nomination, and the mechanics of macroeconomics all have to do with each other?

There’s always a lot going on with crypto. Sometimes there’s so much going on, that it’s hard to keep up, or keep track.

Part of the reason for creating this newsletter was to dive deeper behind the hype and the headlines and explain bigger concepts or trends.

We will continue in that spirit in the future, but for this issue, I wanted to try a slightly different format. Below, I’m going to feature trends that emerged this week and talk about what they mean and how they fit into the big picture.

Let me know how you feel about this format and if it works or if you prefer the other style better.

The best place to reach me is via DM on Twitter or Warpast, I’m @danielmcglynn in both cases.

Summertime (market) blues

The kids are out for the summer!

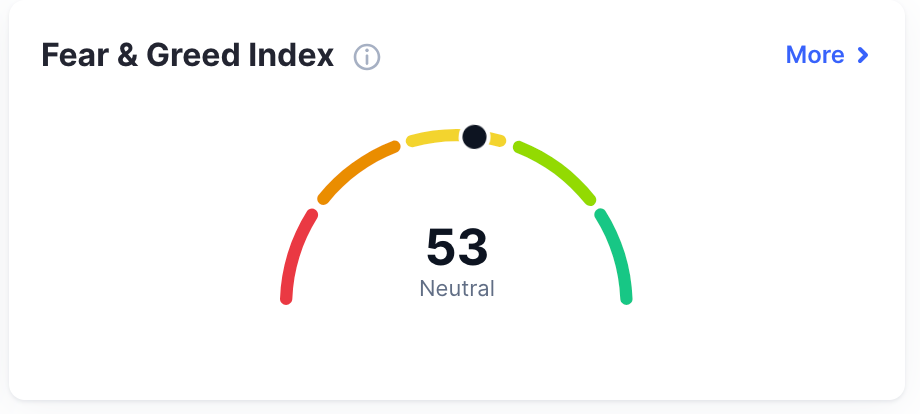

Unfortunately, the crypto market pulled a major U-turn and erased the past few weeks of price growth.

Part of the reason is the typical retracement — the crypto markets don’t grow linearly or follow a steady grade.

Instead, the growth looks more like a printout of an EKG, with peaks and troughs. Or big gains and then price reversals that happen within a larger up or down trend.

Bitcoin is down almost 8% on the 7-day chart, while Ethereum is down almost 10% over the past 7 days.

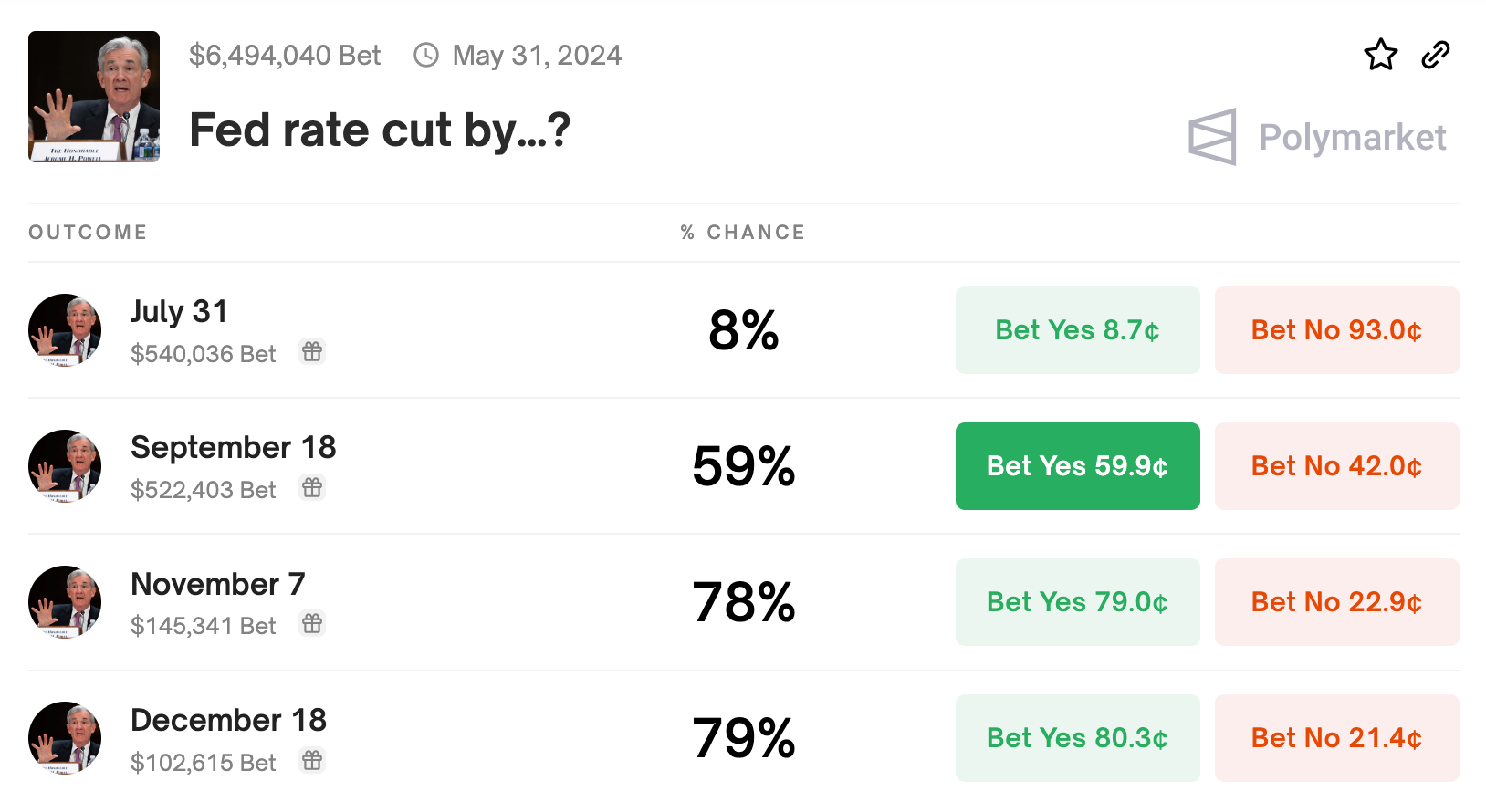

The other reason for the pullback was a one-two punch of economic news in the US. We’ve said it before, and this week proved it, the crypto markets are really sensitive to macroeconomic movements.

Midweek, market watchers and investors faced a “Macro-Wednesday” when both the latest Consumer Price Index (CPI) report and the latest meeting of the Federal Reserve happened.

In both cases, the crypto market (considered risk-on assets) reacted by pulling back. The pullback started earlier in the week based on the anticipated results of both macro events.

The CPI report showed improving but persistent inflation. The price of gasoline and auto insurance dropped for the first time in years, but employment rates and other inflation indicators are flat.

The CPI data impacts the Federal Reserve’s decision on whether to cut interest rates after raising them to slow inflation.

In previous meetings, the Fed has signaled they are open to a rate cut if inflation looks like it has slowed. However, the most recent CPI data shows that inflationary forces are still lingering.

As a result, the expected rate cuts from the Fed by the end of the year are now in question. If a rate cut does come, it will likely be less significant than previously forecasted.

All of this info impacts the near-term outlook for crypto and other risky investable assets. The result, as we saw last week, is that the market retreats.

Staking made easier

There’s a lot of focus on crypto’s front end — on its utility or market dynamics — all of which is distilled down to an asset price.

But most of the interesting stuff about crypto, and what makes it so different from traditional finance — is happening on the back end.

One of the biggest and most fascinating backend components is crypto’s consensus mechanism.

Talking about the computer science involved can get dry and boring quickly, but the result of consensus is the ability to build permissionless decentralized networks, which is what makes crypto so unique.

There are several ways to achieve consensus on a decentralized network without having a referee or umpire in the form of a corporation or government entity. But the two clear leaders in decentralized consensus so far are proof-of-work and proof-of-stake.

Bitcoin operates using proof-of-work (POW). Put simply, proof-of-work requires a system of miners, or machines running complex computations to power the network and confirm transactions.

Ethereum runs proof-of-stake (POS). Instead of miners, proof-of-state networks rely on a system of validators, or people who pool capital to “stake” the network. It’s a different kind of skin-in-the-game approach.

What’s so interesting about Ethereum’s proof-of-stake model is that the network switched from POW to POS in 2022. But, immediately after the switch, staking the network, or participating in the underlying consensus was complex, expensive, and technically challenging.

In order to not just replicate the corporate monopoly internet model, and to ensure proper decentralization, it’s really important to make staking more accessible.

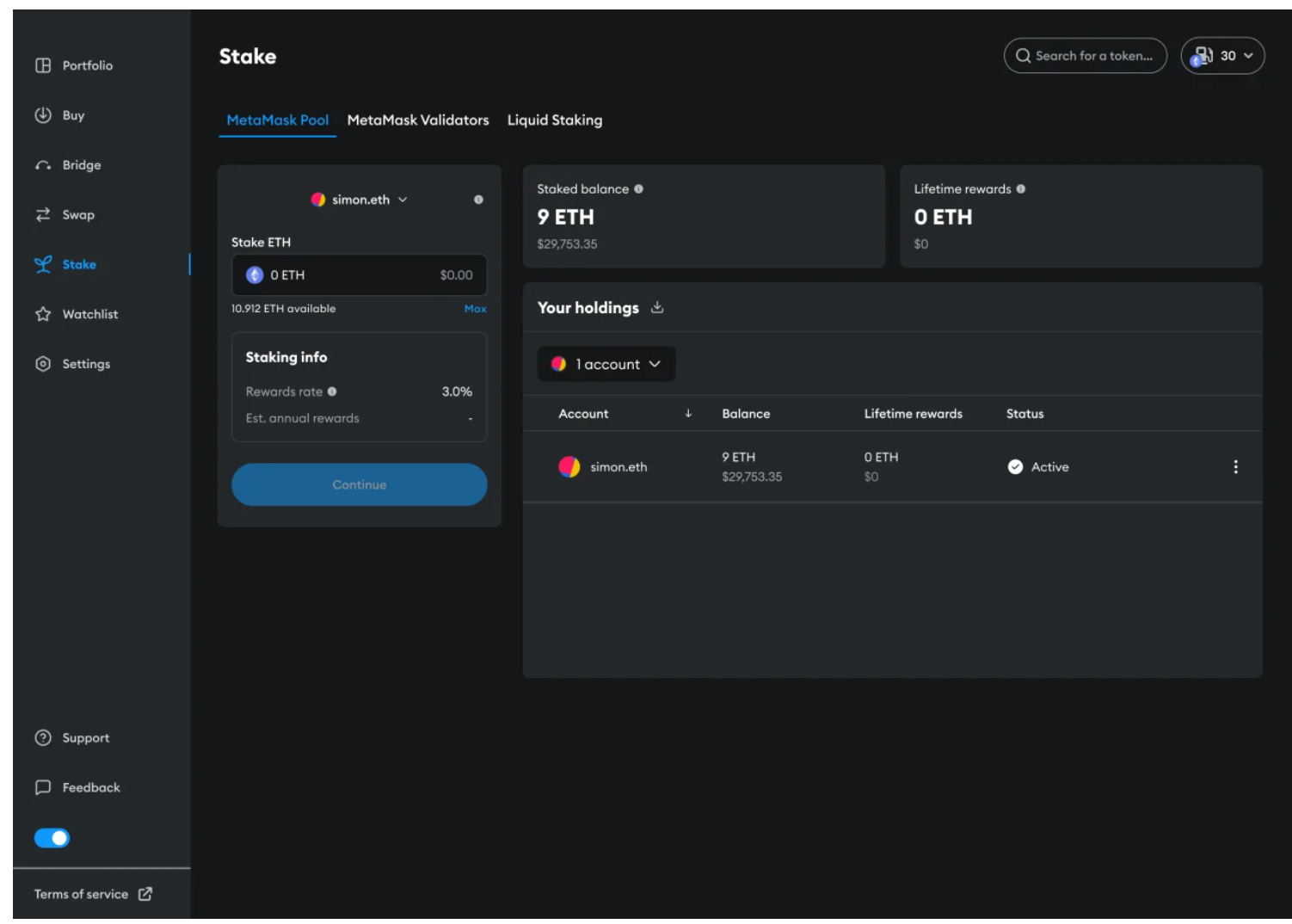

That’s where another big announcement from this week comes in. The major web3 wallet provider, MetaMask announced the rollout of a pooled staking feature.

The idea behind the new product within the non-custodial wallet is to make it easier for everyone to participate in an industrial-grade Ethereum proof-of-stake pool (in this case hosted by Consensys, the company behind Metamask).

Right now, participating in staking with a small amount of funds is possible elsewhere, but the more diversified pools the better. It’s better for the Ethereum network, and it’s better for individual users.

We are seeing a mega-trend of crypto becoming more user-friendly on the front end (the newsletter last week was about this topic). So it’s promising that crypto’s backend, at the level of consensus mechanism, is also becoming more accessible.

Crypto media gets Emmy nod

Another theme that’s been dominant this year is that it feels like crypto is on the cusp of a mainstream moment.

Maybe more accurately, it will be a series of smaller moments that all add up to a mainstream feel.

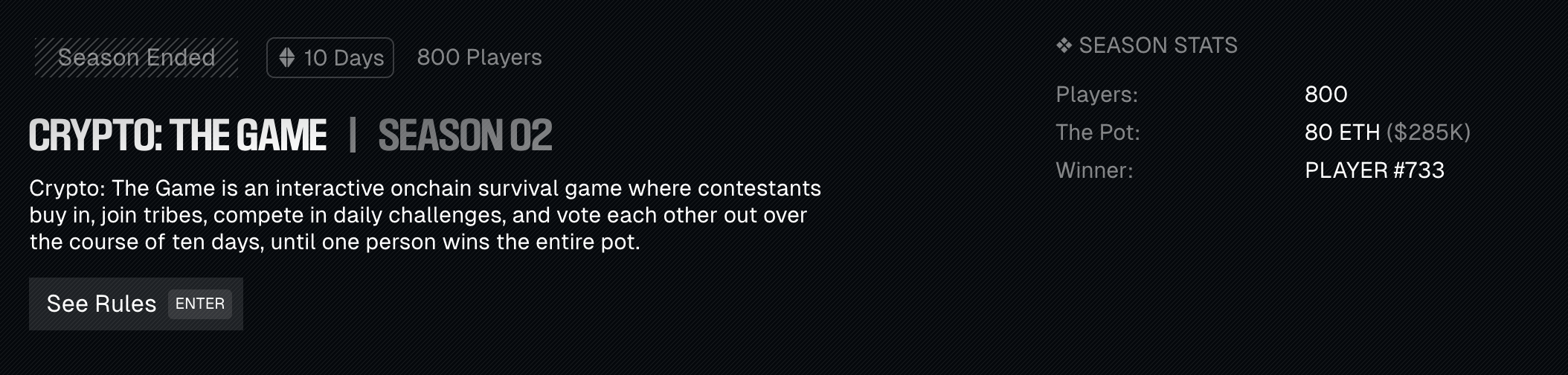

You could file the announcement that Crypto: The Game was nominated for an Emmy for Outstanding Emerging Media.

Crypto: The Game is a community challenge competition built on Base that pays out prizes in Ethereum. It’s kind of like Survivor for people who are terminally online (or onchain).

The game has run through two seasons, and kind of blew up in certain circles during its last run.

Now, because of its interactivity and viral nature, Crypto: The Game is up for an Emmy and being recognized as a new form of media.

The takeaway is that as crypto enables more kinds of onchain activity like the creation of teams, tokens, or digital events, likely more and more media — even things like courses or magazine features will become more interactive and game-like.

Theme from the roundup

If there is a through-line here it’s that crypto is becoming more visible and more accessible.

The crypto markets are becoming more mature and more sophisticated and have represented such a valuable asset class that they move up or down along with other facets of the global economy.

I remember a time when crypto was completely uncorrelated from other public markets — and they were viewed as a hedge or an alternative because they moved differently.

Looking back, the uncorrelated phase was likely because of the inconsequential size of the crypto market. But now, as crypto becomes a bigger part of how the world works, it becomes more sensitive to macro trends.

Meanwhile, as crypto becomes easier to use, it will start to become a no-brainer for more people. Making staking more accessible will enhance the overall strength of the Ethereum network while also allowing people to earn yield as small-time stakers.

That’s a win/win. It becomes an easy win/win when it can all happen with one click within a non-custodial wallet.

Lastly, one way to look at the onchain movement is as a new media movement.

Breaking the confines of traditional mass media is a big issue for digital media. The tools and methods (attention algorithms) and selling ads on digital media properties are getting tiresome for many.

An alternative — built on new kinds of digital identities, new kinds of user-driven interactions, and new kinds of interactions — is forming, and crypto will be the cornerstone.