A reading list of crypto industry reports

What do all of the crypto industry's 2024 recap/2025 prediction reports have in common? And what are they all missing?

For the sake of brevity and holiday cheer, this issue will round up a series of recently published crypto industry reports.

Some of the reports look back at what happened in 2024, while others look forward and try to predict what will happen in 2025.

They are all useful to varying degrees. Some are entertaining in the way that fortune-tellers are entertaining. At the same time, some are informative in that they give us a glimpse of what crypto firms and operators are thinking about.

I’m sharing them because I think they will make good holiday week reading. As we enjoy the time between the old year and the new year, it feels like a chance to recheck our bearings and look at some of this stuff with a unique perspective.

Here are a few high-level observations about themes that resonate across all of them:

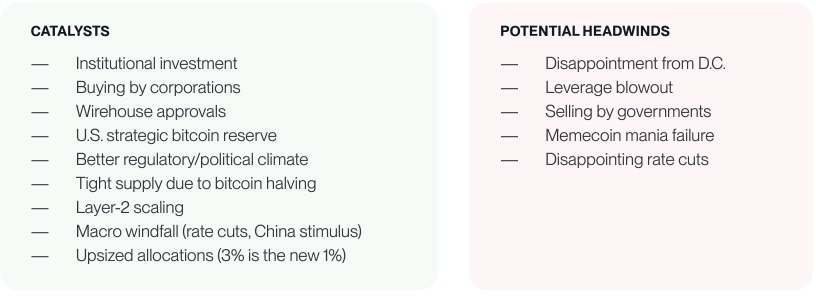

- Everyone is super bullish that the crypto market cap will continue increasing in 2025. While there are some differences of opinion about how high the market goes, it is a shared sentiment that major crypto assets will reach new all-time highs, peaking in Q425. My take on this is to be cautious and skeptical.

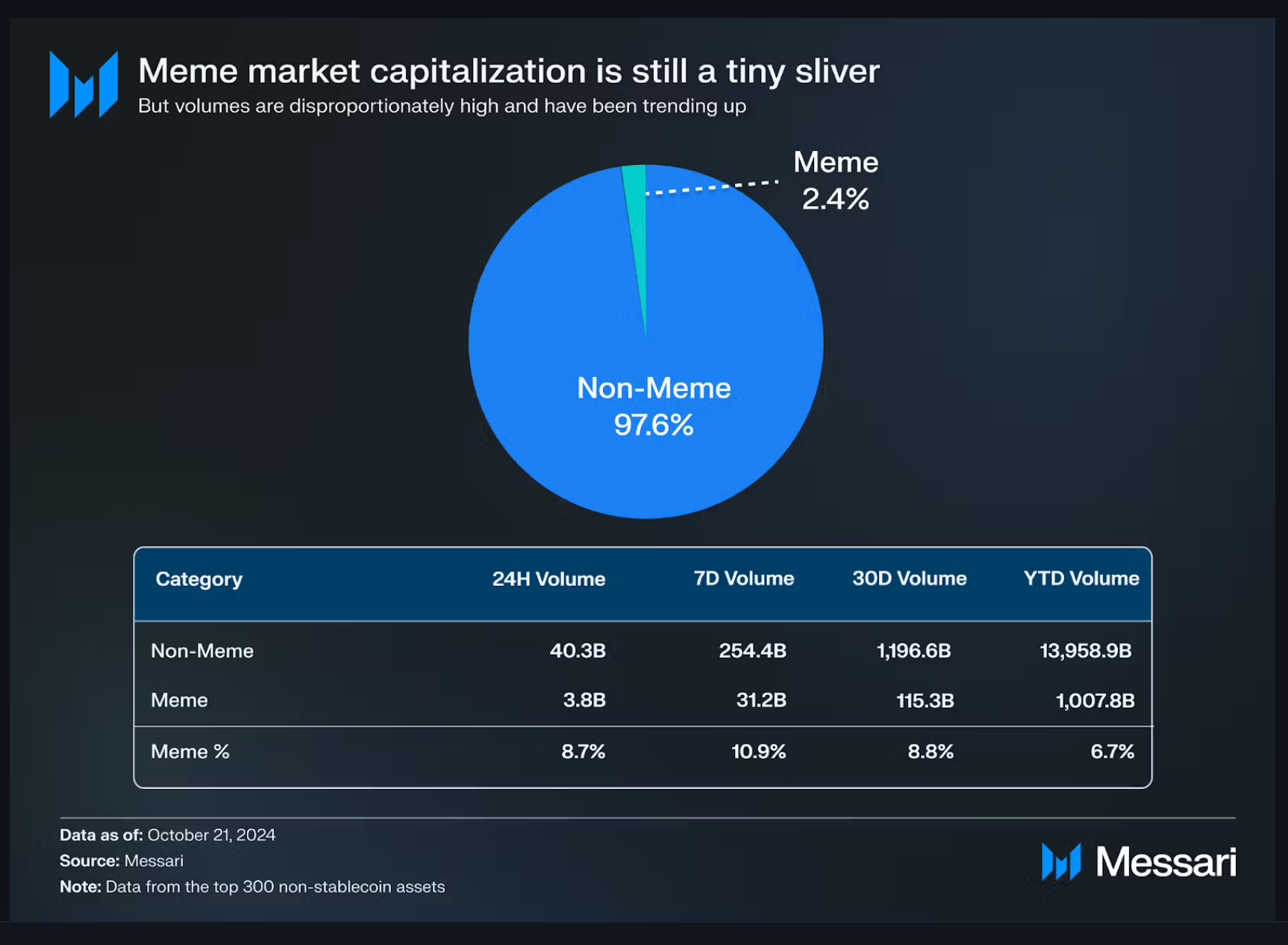

- Memecoins were a big story in 2024 and will continue to be a story into 2025. One thing element to the memecoin mania that we haven’t covered yet, but we will soon, is the combo of memecoins (or the monetization of attention) with AI agents (or the ability to automate finance), which will likely give rise to an entirely new way of deploying capital and follow trends with robot-like speed. Sidenote: Despite the hype, memecoins only represent a small fraction of the crypto market.

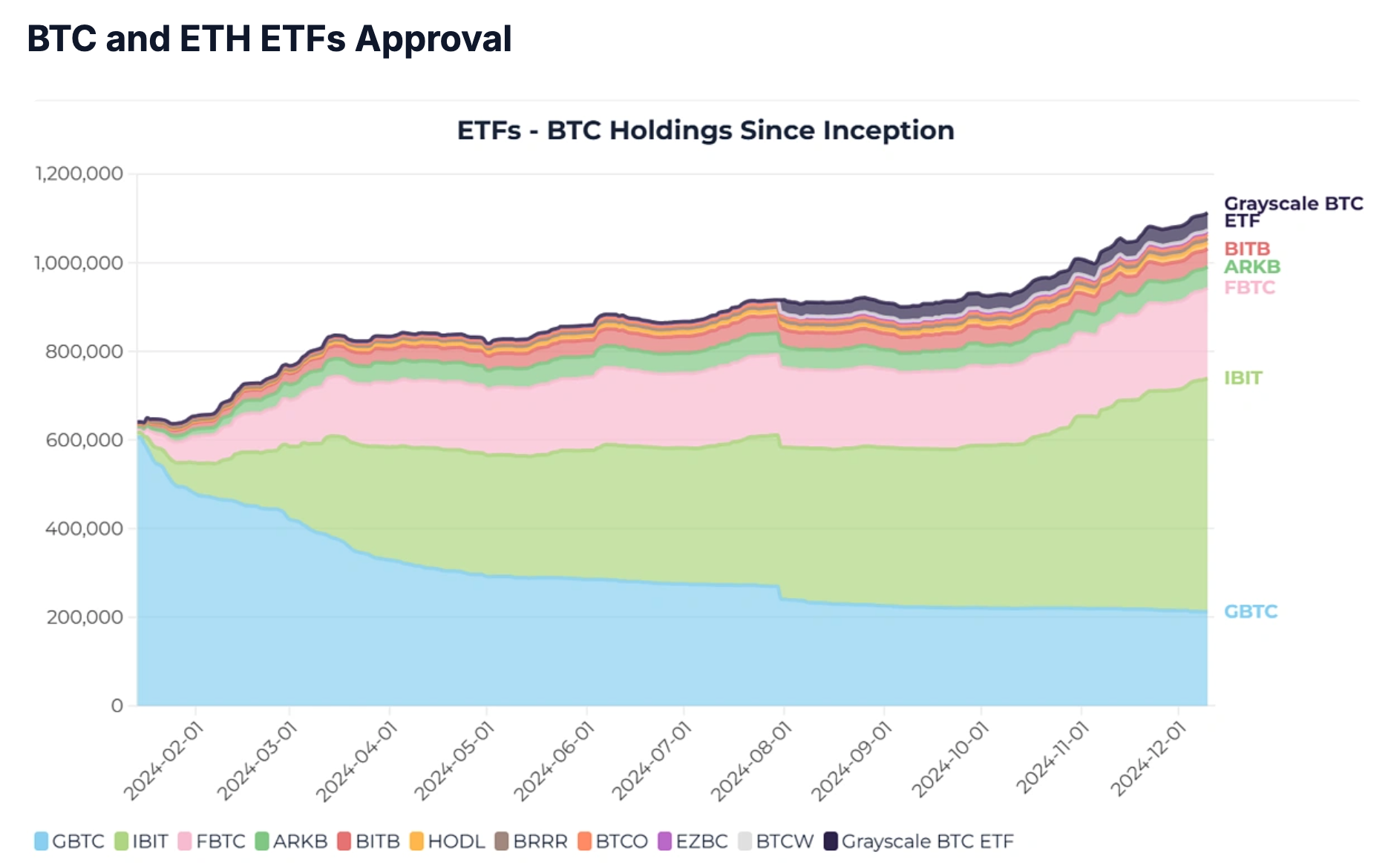

- Institutional finance will enter the crypto markets. The reports all give good reasons for this—more crypto ETFs, friendlier regulations, a sense of the inevitable—but like the bullish sentiments shared above, plenty of things might derail the flood of new capital. We’ve certainly seen that in previous cycles. One wrinkle that gives this point more weight this time around is that governments now appear interested in acquiring crypto to create national bitcoin reserves, which feels like a new dynamic.

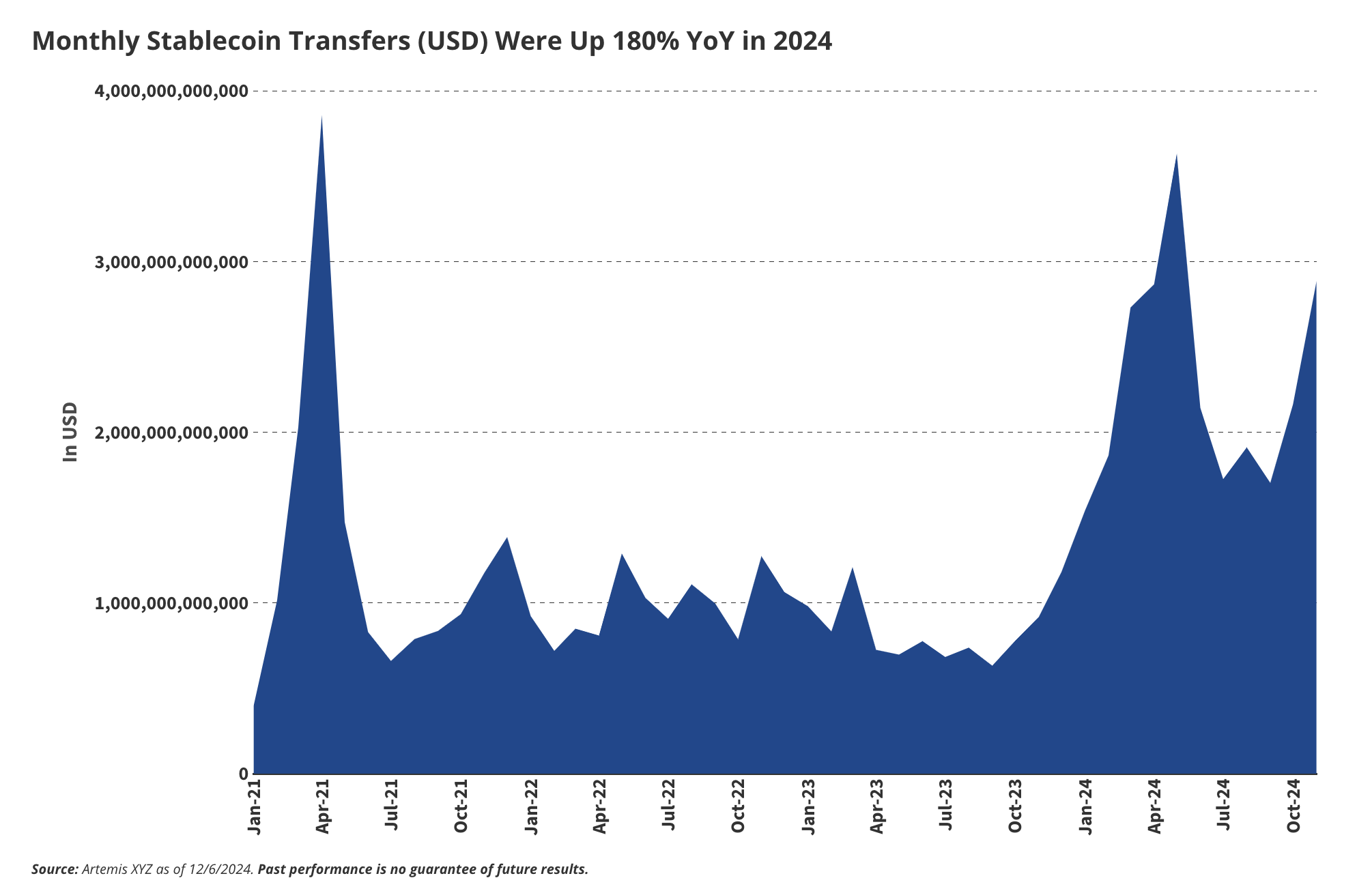

- More global economic activity moves to stablecoins. The utility of stablecoins became a pronounced trend in 2024 and will likely continue into 2025. We’ve covered this trend before and talked about how interesting it is that one of crypto’s best use cases is also the most tame. VanEck predicts that stablecoin daily settlements will reach $300 billion/day in 2025.

The reports are interesting as one-offs. Collected together, they provide at least a pretty good guide of the things we should be watching or the general themes that will impact the Open Money framework.

I’m sure this list is incomplete, and I’ve missed some valuable reports. Please share your favorites with me so I can update this collection.

The best way to share a link is to reply to this email or message me @danielmcglynn on Twitter or Warpcast.

Happy holidays.

A collection of the 2024 year-in-review and 2025 predictions reports for the crypto industry

Links to additional reports

- Bitwise – The Year Ahead: 10 Predictions for 2025

- Coinbase Institutional: 2025 Crypto Market Outlook

- VanEck: 10 Crypto Predictions for 2025