Crypto dollarization

Why the winning use case for crypto might be a stable digital dollar.

THE WEEK

In this issue

- Dispatches: You can Google an .eth wallet balance, the whereabouts of Satoshi is still a mystery, the FBI creates coins to catch crypto crooks, and the price of hash(rate)

- Resource: More on onchain publishing — check out this onchain zine

- Framework: On the surface, stablecoins feel boring. Behind the scenes, big trends are underway.

DISPATCHES

News from the frontier

- .eth SEO. Now you can google a .eth address and get the wallet balance right in Google search results. This creates an interesting wrinkle in the battle between radical transparency and individual privacy.

- Does finding Satoshi matter? A new HBO movie identifies early Bitcoin developer, Peter Todd, as Satoshi Nakamoto. Todd denies the allegations. The ID of Nakamoto, the creator of Bitcoin, has been a topic of debate for the past 15 years. Part of the strength of Bitcoin is its founding story and the fact that it has no leader or figurehead.

- Crypto without the currency? New comments from the head of the SEC demonstrate skepticism that people will ever use crypto for transactions or payments.

- FBI creates a token to take down wash traders. From the DOJ, “Three market makers—ZM Quant, CLS Global, and MyTrade—along with their employees are charged with allegedly wash trading and/or conspiring to wash trade on behalf of NexFundAI, a cryptocurrency company and token created at the direction of law enforcement as part of the government’s investigation.” It’s like 21 Jump Street but for digital currencies.

- Bitcoin mining dynamics: Sometimes it feels like crypto price movements are only fueled by FUD and FOMO pumped by the media. But, with regards to Bitcoin at least, mining economics backing up the production of hashrate play a quiet but significant role.

RESOURCE

An onchain zine

Are you looking to mint something onchain?

Check out this zine, a collection of writings produced during a June 2024 Farcaster Writing Hackathon.

I participated in the event — and contributed this piece — as part of “Onchain Summer,” which was organized by Base.

You can check out and mint the zine on Zora (aka the Instagram of NFT platforms).

OPEN MONEY

Back in the day, when crypto first started to move out of the shadowy edges of the internet, the early adopters and champions of a new kind of money system were not scheming up versions of a synthetic dollar.

There were never any plans to use the power and scale of the internet to make fiat currency — or government-backed currency more efficient. The goal, for the earliest of cypherpunks and techno anarchists who developed the first cryptocurrencies, was to create an alternative system — not a digital overlay for the existing system.

But that’s the thing about technology. Most times when new tech is created, the downstream implications are different than anyone could have imagined.

I mean, the internet was first envisioned by the Department of Defense as a means to communicate in the event of a nuclear attack.

Look at us now.

And so it goes with crypto. Despite all of the innovations and interesting products across layer ones and twos, or across decentralized finance or NFTs, it appears that the came-out-of-nowhere winning crypto use case might be stablecoins.

Stablecoins, as the name implies, were created to be a safe harbor in the otherwise volatile world of constant up and down that defines permissionless digital money.

They are, by design, price stable.

One of the only ways to achieve stability in the crypto assets is to peg the price of stablecoins to real-world assets, usually other currencies, and mostly to US-backed notes like dollars and Treasury bills.

As stablecoins become more popular and and more significant part of the digital economy, the predominantly dollar-backed trend starts to get interesting.

We’ll dive into some of those details below, but first here’s some context on how we got to where we are now:

Tether, the first stablecoin with massive market traction, launched in 2014.

But it wasn’t until the major crypto market volatility of 2017 and 2018 that stablecoins gained wider traction.

By DeFi summer of 2020, stablecoins became an important part of the crypto ecosystem.

They became the on- and off-ramps for the ever-widening freeway of digital money.

Over the past year, while the rest of crypto is still trying to find the right narrative or path forward, stablecoins continue to gain traction, investment, and overall utility (more on this in the next section), well beyond the scope of their early days.

A couple of weeks back, we talked about the interest by governments to create central bank-backed digital currencies or CBDCs. The goals of those government projects are similar to what we are seeing with stablecoins right now.

A dollar-tied crypto asset makes things like payments and merchant activity easier. It also provides a great mechanism for storing and saving money, especially in places that have depreciating fiat.

And of course, there’s still the old-school reason for making it easier to move in and out of digital currencies and other forms of decentralized finance.

In the CBDC piece, we talked a little bit about the coming tug-of-war between private money and public money as digital transformation finally comes for currency.

While stablecoins issued by decentralized autonomous agencies, or at least consortiums of actors interested in moving everything onchain are a step towards more open money, the explosion in stablecoin adoption and use also raises questions about how the long-term implications of the dollarization of crypto.

Crypto-dollarization via stablecoins as a trend

Utility fielder

A few high-level takeaways regarding the growing stablecoin popularity.

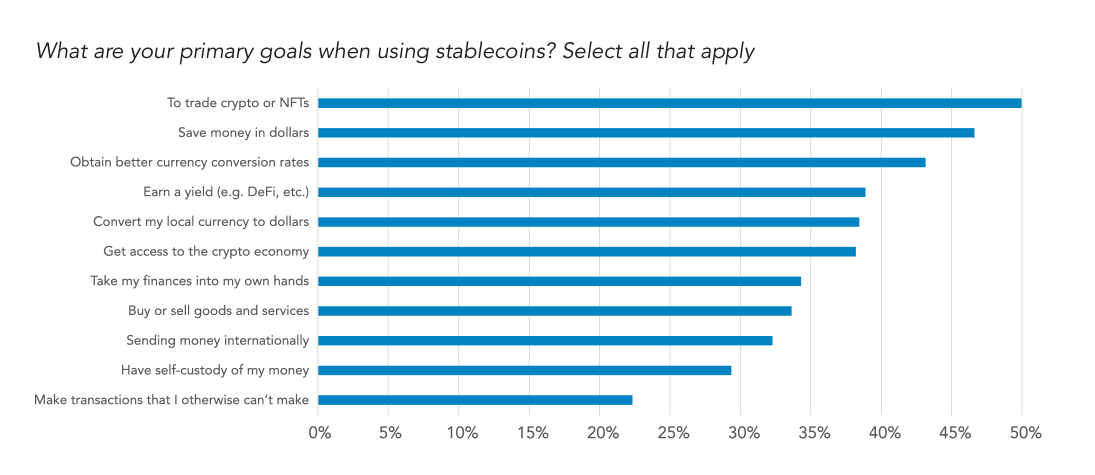

A good place to start is to understand how and why people use stablecoins. So far popular use cases for stablecoins range from using them as a form of savings and sending remittances to aping into NFTs and having self-custody over a dollar-backed account.

Onchain diversity

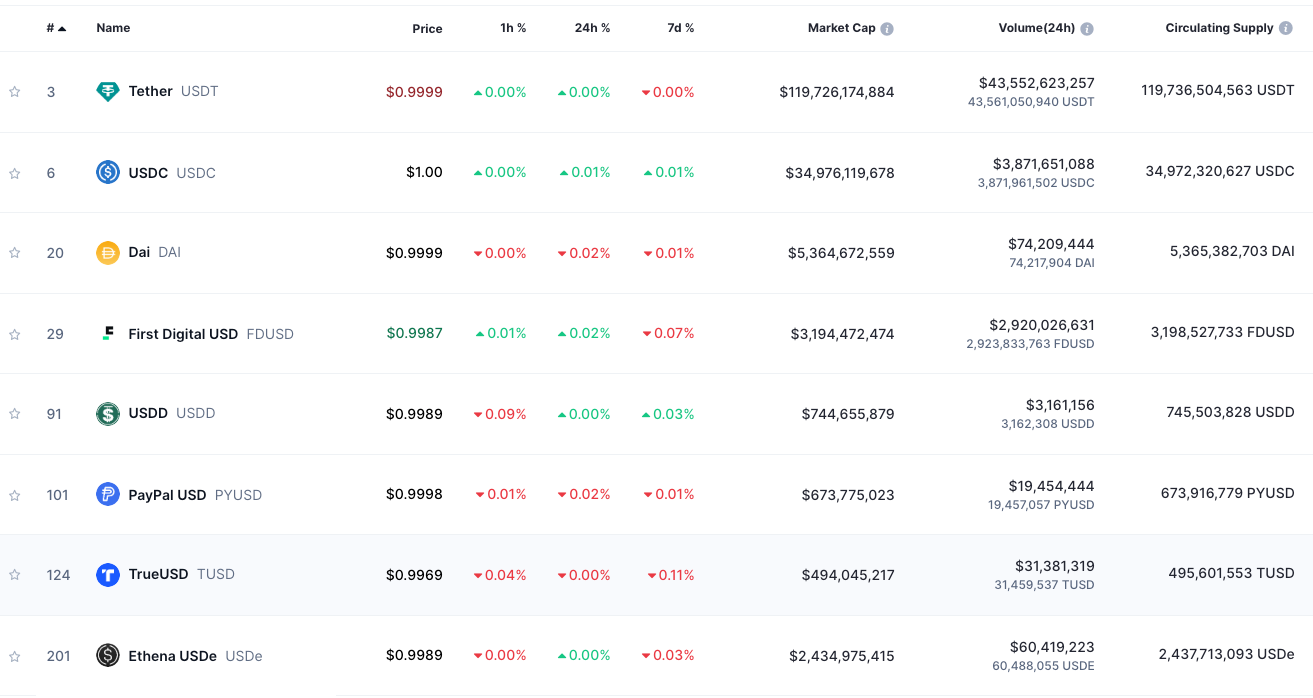

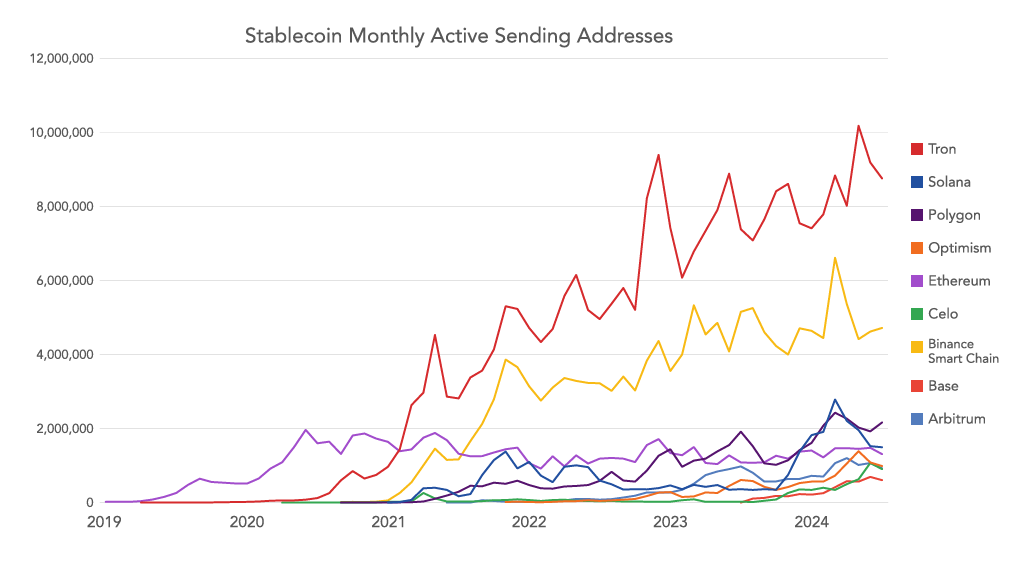

While there are stablecoin winners in terms of stablecoin use (Tether and USDC are the top two by market cap by far), stablecoin use crosses chains.

Stablecoins are also supported by a wide array of wallets. These two factors give stablecoins a sense of universal accessibility, which is probably another feature fueling their global growth.

Influence of the dollar

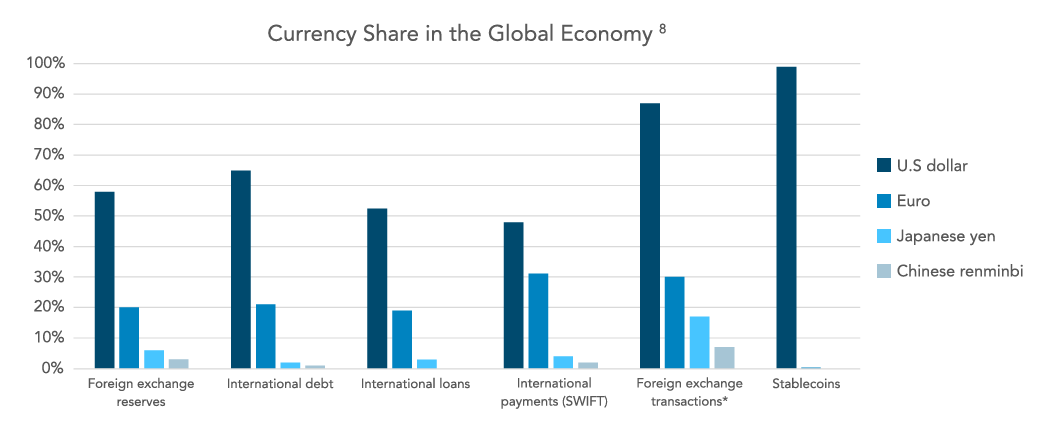

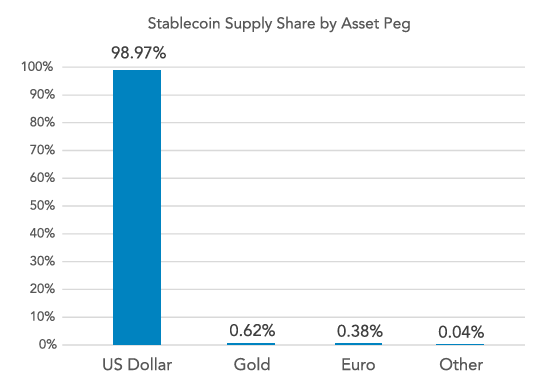

When you look at other types of global financial instruments or investments you see a pattern. Most other major components of the global economy look like a staircase descending in composition from the dollar with the largest share to other major global currencies such as — and usually in this order — euros, yen, and renminbi.

But when you look at the investment in stablecoins worldwide you’ll see that the dollar is in first place and there isn’t a second place or a third place.

This trend is interesting, and if it continues, could have massive ramifications on major economies in the future.

Stablecoins and the known unknows so far

If there is a takeaway here, it’s this: Stablecoins are exploding in utility.

Their properties make them easy to use for a wide variety of financial activities from making traditional payments to moving money in and out of DeFi.

One facet of the current trajectory of adoption is that stablecoins are creating a new and disproportional demand for dollars.

While still in the early days, the dollarization of crypto is underway.

There are probably a bunch of implications or scenarios about how this can play out, but two issues that are starting to jump to the front (probably because they are regularly in the headlines right now) are the correlation between the value of the dollar as interest rates change in the US and how to manage the spiraling national debt.

Despite the basic narratives floating around about crypto, if currency growth rates continue, it doesn’t seem that far-fetched to envision stablecoins, and by extension digital currencies, becoming an important part of the global dollar-backed economy.