Crypto developer activity as a value metric

Developer activity provides intel about the overall health and innovation happening within a crypto network ecosystem.

When I say crypto value, your first reaction might immediately jump to some kind of number. Likely that number relates to price.

You might be thinking about today’s market cap, or the price of your favorite asset, or how much the price has gone up or down in the last 24 hours… You get the idea.

But using price as a leading indicator for crypto is, well, challenging. it’s challenging for a lot of reasons, not the least of which is that the “price” of crypto has little to do with network value that crypto or digital assets are built on.

Trying to value crypto assets can be tricky, mainly because we are trying to understand the tech stack and the network effects of the tech stacks.

Crypto or digital assets, from a valuation (and eventually price) perspective, are a completely different animal than anything that’s come before, like traditional equities or commodities. In some ways, it's like comparing two-dimensional shapes (traditional financial instruments) to three-dimensional shapes

For a lot of reasons, simply using price to try and understand crypto networks is challenging. Crypto assets are notorious volatile. In some case, the volatility is by design.

Put another way, assets that have a finite and scheduled supply are going to be more sensitive to market movements than something like government money, which can be added or subtracted from the economy to remove volatility.

There’s also a sense, from a valuation perspective, that looking at price or the fluctuations of price is a distraction for the overall big picture. After all, many of the biggest crypto networks by market capitalization have appreciated massively over the past five to ten years, all while experiencing massive volatility.

Price is also a fickle signal because it tells a limited story about what is going on with tech, overall adoption of the asset network, or the direction of the future roadmap.

OK, so price as a proxy of overall network direction is problematic (it’s just that it’s so hard to look away).

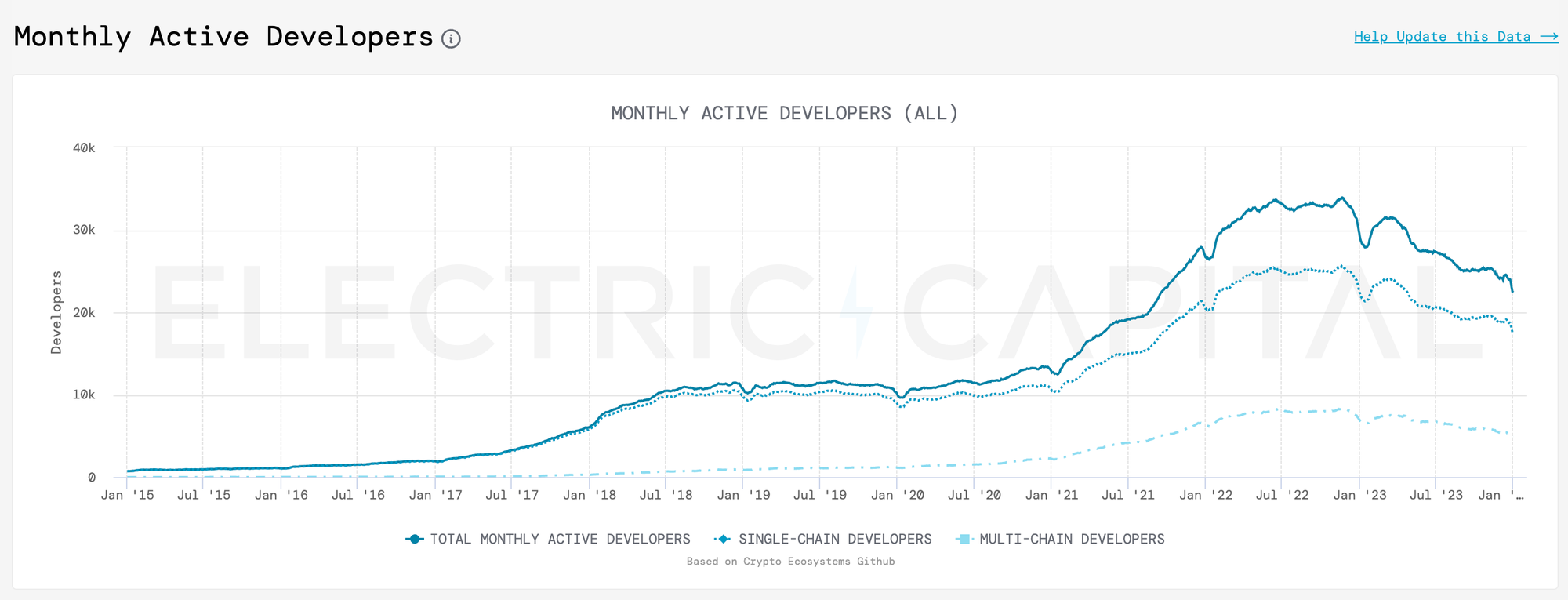

But there are other indicators that are useful — and that can provide us some good information if we pay attention. One of those indicators is the number of people actually working on and building decentralized apps and services using public blockchains.

Developer activity is a leading indicator for growth in terms of users and potential value. This makes sense on an intuitive level — it’s hard to build a valuable network or app or service if the user experience is terrible or if the functionality is bad.

Here’s a related post, looking at some specific crypto developer metrics and provides more depth about how developer activity can tell a deeper story or lead to a better understanding about what’s happening in the crypto space.

An indicator of project health and sustainability

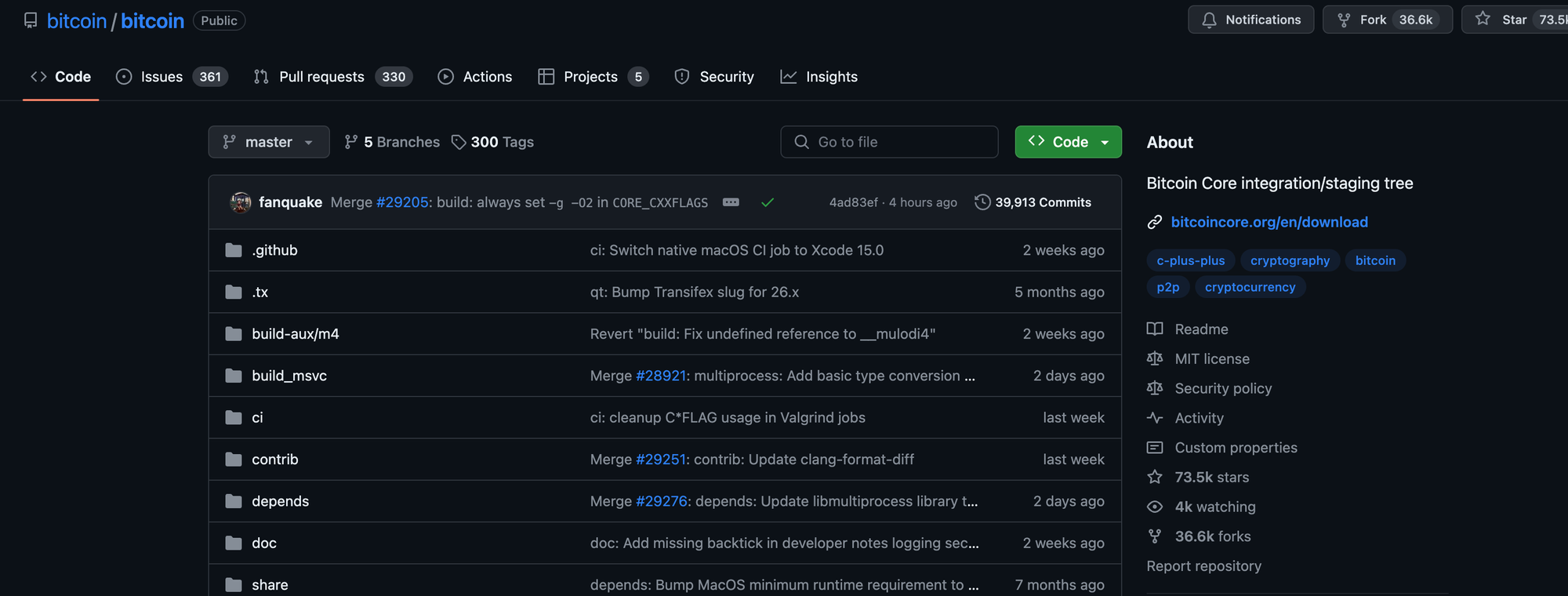

Developer activity refers to the number of people who are working on the computer code of a public blockchain. Developer activity can be measured in overall code commits, or updates to a code base, or by looking at the number of different people working on a code repository where the code lives.

Developer activity can send a very real signal about overall project health. If more developers are joining a project, or if there’s been a recent uptick of code commits related to a project or its infrastructure, then it seems reasonable to assume that the project it in growth mode, or that new features, utility, or improvements are on the way.

The opposite is also true, if there’s a decline in developer activity, or if developers are leaving the project, it could be a sign that something’s up, and it big losses of developers would certainly affect future features and utility. Not to mention, lack of developer interest can also lead to security and maintenance issues.

Innovation

Another place where developer activity and market price diverge is that the market price isn’t really forward-looking. Instead, market price is often a snapshot in time. This is especially true with fast moving crypto assets.

Real innovation, however, whether it’s a new form of decentralized finance, or a scaling solution, or a distributed file storage, is hard to measure in a single snapshot, or even a series of snapshots.

In this regard, more developer activity, especially sustained over time, often leads to innovation and/or the launch or introduction of new kinds of apps or services.

While the market might reward innovation overtime, it’s possible to get a glimpse of innnovation in real-time to paying attention to where developers are moving and what kinds of projects are gaining attention and input.

The ability to measure developer activity in near real-time via code commits and code repositories is one of the massive advantages of building open systems, because all of the work happens publicly and transparently.

Predictive value for adoption and growth

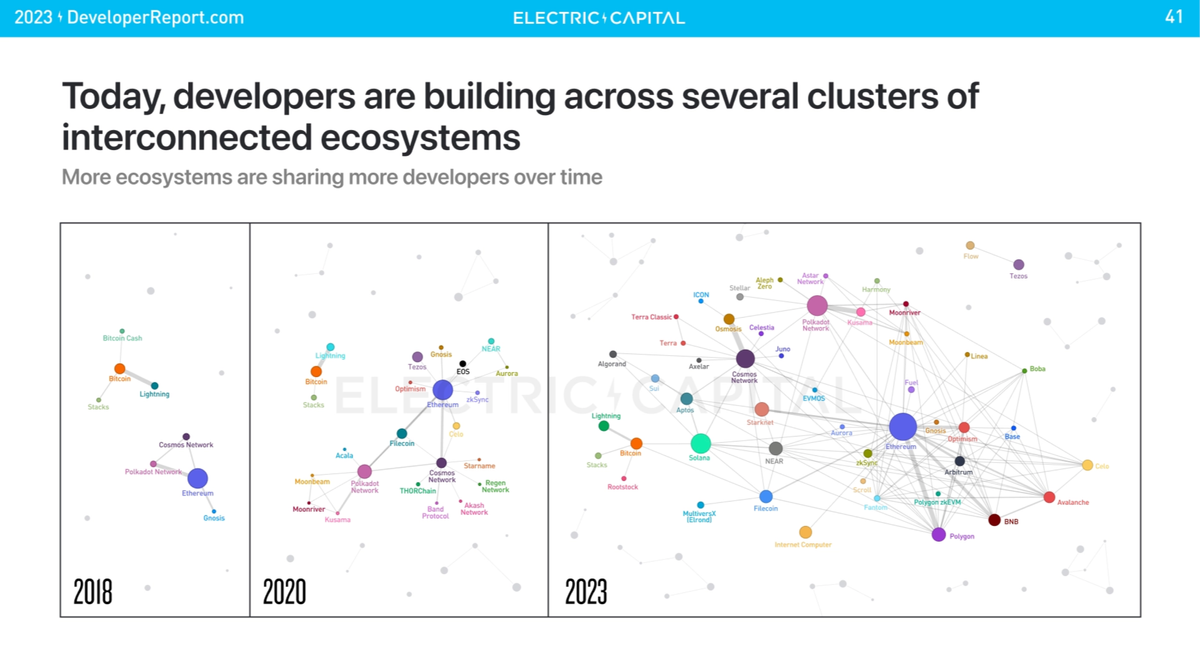

One of the most challenging aspects in the crypto space is knowing what’s coming next. If you look back at the last 10+ years, you can see wave after wave of new ideas, new networks, and new assets coming to market and looking for traction.

Some ideas stick and grow. Others fall by the wayside or never really hit escape velocity. While looking at developer activity isn’t necessarily a window into the future, it does help give some definition to where things might be heading.

In advance of the DeFi summer of 2020, for example, when a lot of the leading DeFi protocols really took off and gained market position, there was a big influx of developer activity on DeFi related projects beforehand.

The same trend was true for the growth of non-fungible tokens (NFTs) before they had their moment in the sun. Right now, or more accurately, over the last six months or so, there’s been a big influx of developers working on Bitcoin ordinals. It will be interesting to see what the impacts or results of that are in the next big market cycle.

Developer activity as a metric of network health

To summarize: crypto networks and their related assets can be difficult to value. One reason is they don’t operate like traditional assets or tech companies.

Each crypto network has its own economy, its own utility, and its own rules about how assets are created and distributed. This makes comparing them in an apples-to-apples way very difficult.

In order to really get an understanding of the value of crypto network requires looking at it from a bunch of different angles. Often looking at the crypto market capitalization is a fast and convenient way of trying to get a handle on the value of a network.