Crypto’s ICO market has a noise-to-signal problem. Currently, despite boom-time growth and flood-gate-style funding, only one in ten ICOs has actually developed any kind of usable technology.

Whether or not that actually matters is still an open question.

Like all else in the land of crypto, what we see developing is a spectrum of thought on the ICO situation.

Occupying one extreme of the spectrum is the concern that ICOs are inflating a speculative bubble that could burst, damaging other developments within the blockchain space. If enough ICOs go bust, it could be a bad look, ultimately affecting other parts of the crypto economy. The flipside of the argument is the current ICO craze is attracting more capital to the crypto/blockchain projects, allowing for rapid development and greater impact.

A quick history of ICO growth

So how did we get to where we are now?

ICOs, or initial coin offerings, are like the crypto equivalent of an IPO. Only rather than buying stock in a vetted and regulated company on an exchange that has enforceable operating standards, as an investor would during an Initial Public Offering (IPO) on a stock market exchange, ICO investors are usually making bets based on a white paper outlining a new application for a coin-backed blockchain.

Blockchain can work in a lot of different ways but is generally utilized as a method to maintain trust in shared data systems. Some of the main uses we are seeing so far are for payment systems, file storage, and smart contracts.

At the heart of permissionless (or public blockchains, such as bitcoin and ethereum) are coins (or tokens) that are used as a means to incentivize data verification and the creation of new blocks of data on the blockchain. In other words, coins in a blockchain essentially represent the value of maintaining a blockchain, which in turn is based the functional value of the blockchain (mainly the purpose it is serving) and the size of the network of users.

And this is where ICOs come in. The creators of new blockchain and crypto companies and projects develop an idea for a new coin-backed blockchain system, such as a new way to make payments, share files, or develop business arrangements through smart contracts (here’s a breakdown of the blockchain ecosystem).

Previously, the road to building out a new technology company usually meant trying to attract venture capital or some other kind of early investment, such as running a crowdfunding campaign on Kickstarter. And in order to attract traditional capital, there was usually some sort of proof of concept required, taking the form of either a strong prototype, an early working product, a well-vetted business plan, a strong founding team, or some combination of all of the above.

One of the greatest assets, but also one of the greatest liabilities of the ICO model is that it upends the traditional investment model, in some ways making access to early ideas more distributed and equitable, by spreading out the opportunity as well as the associated risk.

ICOs going boom, bust, boom?

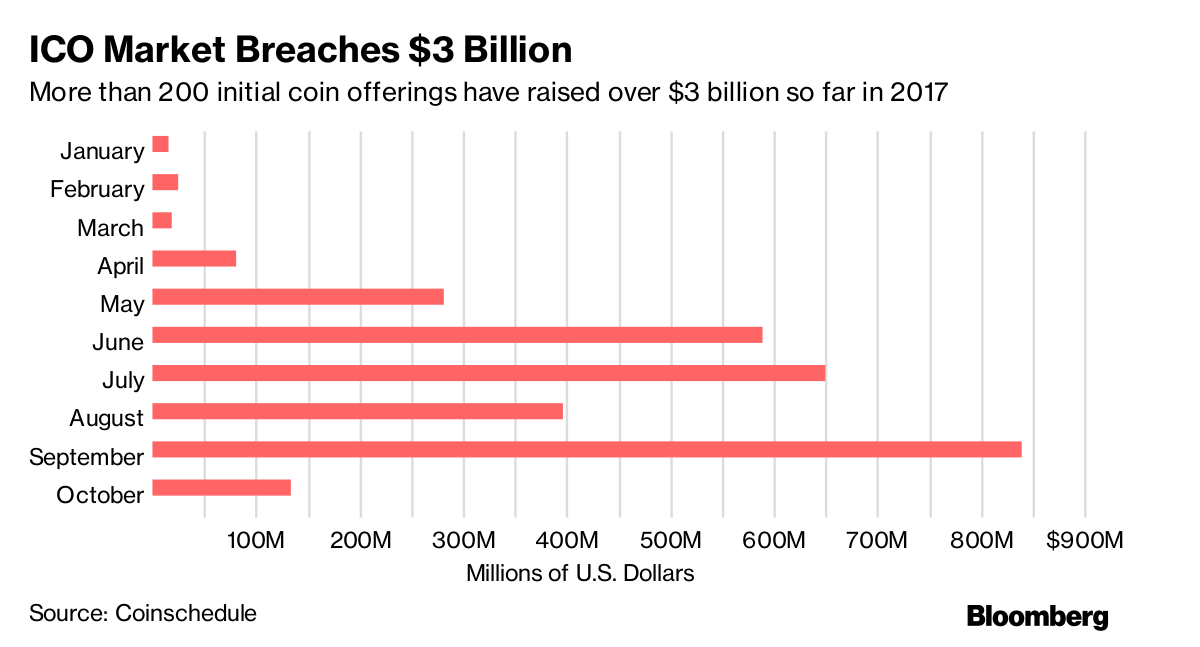

ICOs are not vetted or regulated. They are happening all over the world, and new ICOs are rolled out at what feels like a daily pace. So far in 2017 alone, according to Bloomberg, investors have put $3 billion into the ICO market.

Also according to Bloomberg: Of the 226 ICOs (that number was published a few days ago and it’s probably already outdated), only about 20 of them actually have networks up and running, the rest are still under development or they have hit significant snags.

Take for instance, the Tezos ICO, which raised $232 million earlier this year. The project was developed and marketed as a blockchain with more governance baked in, presumably making it more efficient than existing technologies — the Tezos founders often citing how in-fighting between bitcoin’s developers, vested interests, and miners creates a level of uncertainty and stalls growth.

However, the Tezos team has recently run into its own governance issues, slowing project growth and enthusiasm, and putting future prospects at risk.

And maybe of even more significance, the struggles of such a high profile ICO, such as Tezos, is likely to trigger increased scrutiny from regulators. The SEC and other financial regulators in the United States have announced they are investigating ICO markets, signaling that maybe the freewheeling Wild West ICO days might be numbered.