Changing crypto narratives and the stories we tell ourselves

A quick "how we got to where we are now" on crypto narratives

THE WEEK

In this issue

- Dispatches: The financialization of everything is well underway

- Resources: Check out this free database of projects building on Base

- Framework: Crypto’s shifting narratives is a story within itself

- ICYMI: Recent posts

Dispatches

News from the frontier

- LFG extensions: LFG or nah? Variations in internet extensions are a thing.

- OG wallet moves: Someone moved a whole bunch ($15 million) of Satoshi-era bitcoin. I would love to know the story behind the holdings.

- Crypto banks? While crypto might not be too big to fail, it does appear that regulators will start allowing traditional banks to custody bitcoin.

- ETFs get bitcoin options trading: Good for more exposure or just another way to get rekt? It’s still unclear what the overall impact of ETFs, and now ETF options trading, will have on the BTC market.

- Who will buy the movie rights first? Two crypto thieves stole $230 million and then went shopping. According to this New York Times story, one of them went by the handle Anne Hathaway. The other was VersaceGod. Sounds like both are in big trouble.

RESOURCE

All about Base

Check out this free database that includes all of the projects building on Base.

Whether you are looking to do more research or looking for a new way to get onchain, this database should help.

It's a Notion table and contains 400+ projects.

Open Money

What are the changing narratives telling us?

In a lot of ways trying to understand crypto and decentralized finance is like reading a choose-your-own-adventure book.

Where this is all headed feels less clear than the reason we keep coming back for more.

There’s always a strong cast of characters. Some are intriguing, some are annoying, and some sound like they can see around corners.

Some plot lines feel enduring, and others that feel like gimmicks.

In the early days, crypto narratives were about financial freedom and equal access.

Those early stories still resonate with me. It’s part of the reason I call this newsletter Open Money (and why we talked about peer-to-peer last week).

Nevertheless, the story keeps changing. We’ve seen major narrative shifts, like during the ICO boom, when “there’s an app for that,” became “there’s a token for that.”

Then we saw the boom in DeFi and the calls to be your own bank.

And then NFTs came along, and suddenly everything was going to be collectible.

There’s a certain charm in a fleeting narrative.

Remember the metaverse?

Or more recently how crypto and AI were going to join forces in a way that would change everything?

The point is that the crypto or digital asset space is full of unfinished stories and chapters that feel like dead ends, or like buildings that are abandoned before construction is finished.

Part of this makes sense. After all, there’s never been anything like crypto before — it’s the braid of money, tech, and information all at an internet scale that makes it so interesting in the first place.

Also, the world is changing rapidly. If nothing else, crypto (and more importantly) the people building crypto systems are responsive to how the world is changing.

When Bitcoin first launched it sounded like sci-fi.

As tiring as it can be to keep track of all of the subplots and narrative currents, it also makes sense (and can be entertaining) that the story keeps changing.

But here we find ourselves: 2025 is out there on the horizon. Between shifting macroeconomics, a US presidential election, and continued violent conflicts in multiple parts of the world, there’s a real promise that the end of the year will change the stories we tell ourselves.

Three narratives for right now

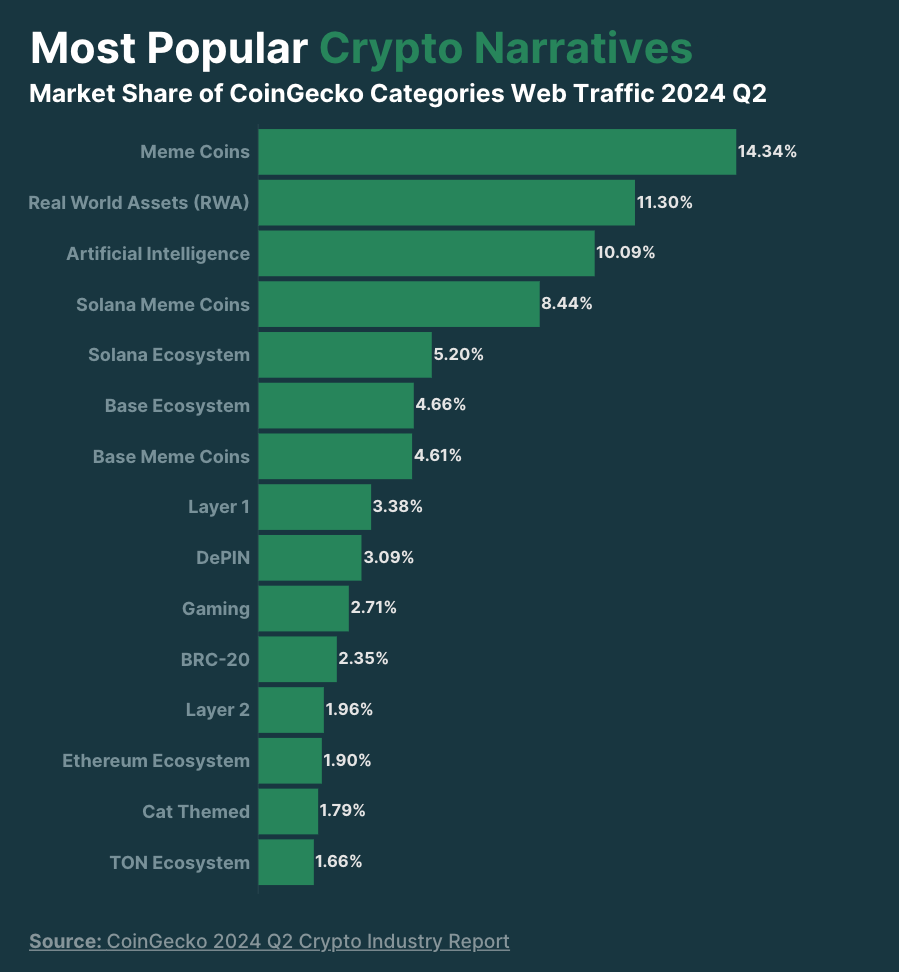

I found this graphic from CoinGecko, a crypto data aggregator, which summarizes some of the most popular recent narratives.

With the exception of cat-themed tokens, we’ve touched on most of these themes in the past few months.

Here are some highlights for background:

Of all of the narratives listed above and all of the shifts and changes during the past year, there are still three themes that I think will continue to be dominant over the coming months.

Onchain RWAs

In some regards, the real-world asset talk is a euphemism for institutional investment.

This year was a watershed for institutional involvement in digital assets. The launch of the long-awaited BTC ETF and then the sleeper launch of the ETH ETF prove that this narrative is ready from prime time.

Already we are seeing new kinds of institutional funds launching and trying to capture other facets of the digital asset space.

As a bonus, tokenizing real-world assets just makes sense from an efficiency perspective — in terms of overall liquidity and settlement times.

DePIN

In some ways, the idea of dePIN or decentralized physical infrastructure is an old crypto narrative repackaged in a new wrapper.

One of the reasons for this new theme is to try and decouple dePIN activities from the broader baggage of the crypto industry.

Increasingly, I think we will see this across the board as projects and companies look to find new pockets of users. It will be interesting to hear how newer projects message and position token-based projects if they decouple from the incentive pieces.

Macro

This feels like less of a theme and more of a reality.

While we haven’t covered this directly, the constantly shifting macro conditions do show as major drivers in this newsletter's occasional market updates.

For sure future macro changes will impact the performance of digital asset markets.

Right now the big picture stuff on the radar includes the election results and the Fed’s appetite for more rate cuts.

The sleeper narratives

The most interesting future themes will be the ones that we don’t see coming — or at least the ideas and categories that don’t find themselves in the mainstream.

One of the things that I think will become a thing is the idea of data collection and verification.

Bringing data onchain in a permissionless way and in a way that doesn’t require the resources of a trusted third party, but that can also be verified by others without any other kind of centralized solution is a big challenge.

It will also be a challenge that creates an entirely new supply chain and multiple kinds of opportunities to create new products and services.

I’m not sure what this new onchain data ecosystem will be called — it consists of multiple parts including oracles, proofs, and analytics, but it does feel like a good place to start looking for new narratives.