Digital loonies and the fate of central bank digital currencies

After years of research, the Bank of Canada is putting a pin in plans to develop a central bank-backed digital currency.

THE WEEK

In this issue

- Dispatches: New launches, NFTs in Congress, and jail time.

- Resources: The journey onchain begins with some simple research

- Framework: Governments worldwide are investing heavily in central bank digital currency R&D. What are the implications for Open Money?

DISPATCHES

News from the frontier

- What’s the difference between an NFT and a ticket to a Yankee game? This is a brief clip from a congressional hearing that offers a simple framework for understanding NFTs — and how it doesn’t make sense that NFTs are considered securities.

- A foundation for the Fediverse: A new nonprofit launched this week that will support the buildout of the Fediverse, which is one model for creating more decentralized social media.

- Caroline Ellison is sentenced. The former head of Alameda Research gets 24 months in the slammer. Meanwhile, CZ, the founder and former CEO of Binance, gets out of jail.

- The tokenization of everything. Just last week we talked about how bringing real world assets onchain will be a big deal. It’s happening quickly.

- Scams as growth metric? “’If you were to create a scammer index of bull versus bear market, it would currently be pointing more toward bull than bear,’ Coinbase Chief Security Officer Philip Martin said on Talking Tokens.”

- One betting pool on the outcome of the presidential election just crossed a billion bucks. Just in case you needed another reason to be interested in the election’s outcome.

RESOURCE

Base is an extremely popular platform for onchain builders.

If you are looking to get onchain, learn more about this quickly moving space, or just need a new adventure, then getting a handle on the Base ecosystem is a great place to start.

This free database can help. It contains 400+ Base projects, with descriptions and more links to take a deeper dive.

Check it out!

OPEN MONEY

Rethinking what it means for governments to mint digital money

In Canada, a dollar coin is called a loonie. A two-dollar coin is called a toonie.

A loonie is called a loonie because the dollar coin has a loon on it. A loon is duck-like, but it’s not in the duck family. It’s a diver and a predator and is known for its eerie call.

Loons, like maple leaves, are a symbol of Canada.

The etymology behind the toonie is a little bit more straightforward if that’s even possible. A toonie is a rift on the loonie, only for the two-dollar coin.

With that out of the way, the transition and analogy that follows might feel forced, but here it goes: Central bank digital currencies are loon-like. What I mean is that while digital dollars issued by a central bank might look like a duck and quack like a duck… they are not ducks.

Here’s a basic backgrounder on central bank digital currencies, also known as CBDCs:

The risk/reward of CBDCs

The Bank of Canada just released a paper saying that after years of research into CBDCs the organization has decided to stop pursuing a central bank digital currency.

The main reasons? The bank decided that there are plenty of good payment and digital currency alternatives available — and so a government-backed entity doesn’t necessarily need to create its own to ensure access for all.

One interpretation of this is that the digital currency space is sufficiently mature and developed enough to provide access points for all segments of Canada’s population.

The other reason that Bank of Canada researchers said they were putting a Canadian CBDC in a holding pattern is that they’ve consistently received a lot of feedback related to privacy concerns during public comment periods over the years.

The crux of the situation is that the creation and issuance of CBDCs can be reframed as an issue of the role and need of public and private digital money.

Put another way, should governments still be issuing money if more efficient alternatives exist?

Or, looking at it from another perspective: What are the risks of not having some level of government-issued digital currency — at least to handle the basic functions and tasks of public administration?

This public/private debate is part of the Bank of Canada’s paper explaining why the government is pulling back from developing CBDCs for the moment.

Is it possible to have many kinds of entities, governance models, and consensus mechanisms all working as interoperable networks to achieve different goals?

Or will there be a new king? And will it be different from the old king?

Why the Bank of Canada’s decision to hit pause on a CBDC matters

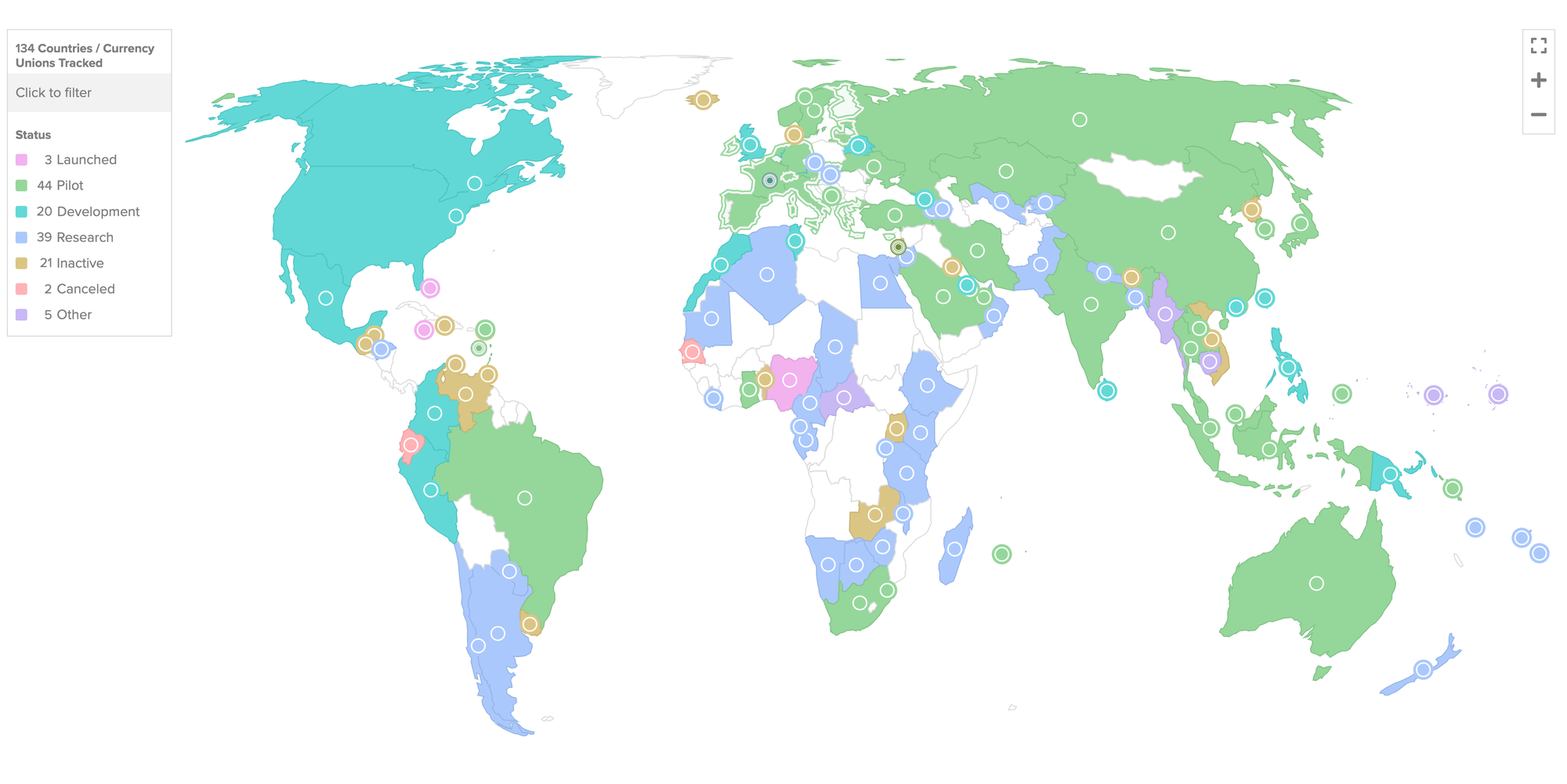

The Bank of Canada is not alone in its investigation into the potential of a central bank digital currency.

As you can see from the map above, there’s a bit of a global fascination with CBDCs at the moment.

There are surely inertial forces pulling a major global government to develop and pilot a CBDC, especially after years of research. So it seems like a very level-headed approach to take a step back and decide to pause the project.

It doesn’t sound like that is the favored approach in other parts of the world where issues related to privacy and surveillance are as big of a deal.

Likely it will take CBDCs functioning at scale and for some time across different kinds of government for us to understand all of the impacts, risks, and opportunities.

But, that does seem like a massive societal experiment to undertake — and one that will be hard to roll back in more authoritarian governments.

While those experiments take shape, there’s some in knowing that fully decentralized and privacy-centric systems are also rapidly developing.