Issue 7: Blockchain at scale | Modular and rollup designs

In this issue of the newsletter, we cover the idea of modular blockchain design, mentioning rollups specifically.

The crypto markets had a busy week, with bitcoin gaining 20.81% on the 7-day charts. BTC broke through $60k resistance and looks positioned to take a run at a new all-time high.

The rest of the market followed but in a more subdued way. Ethereum was up 12.79% on the week.

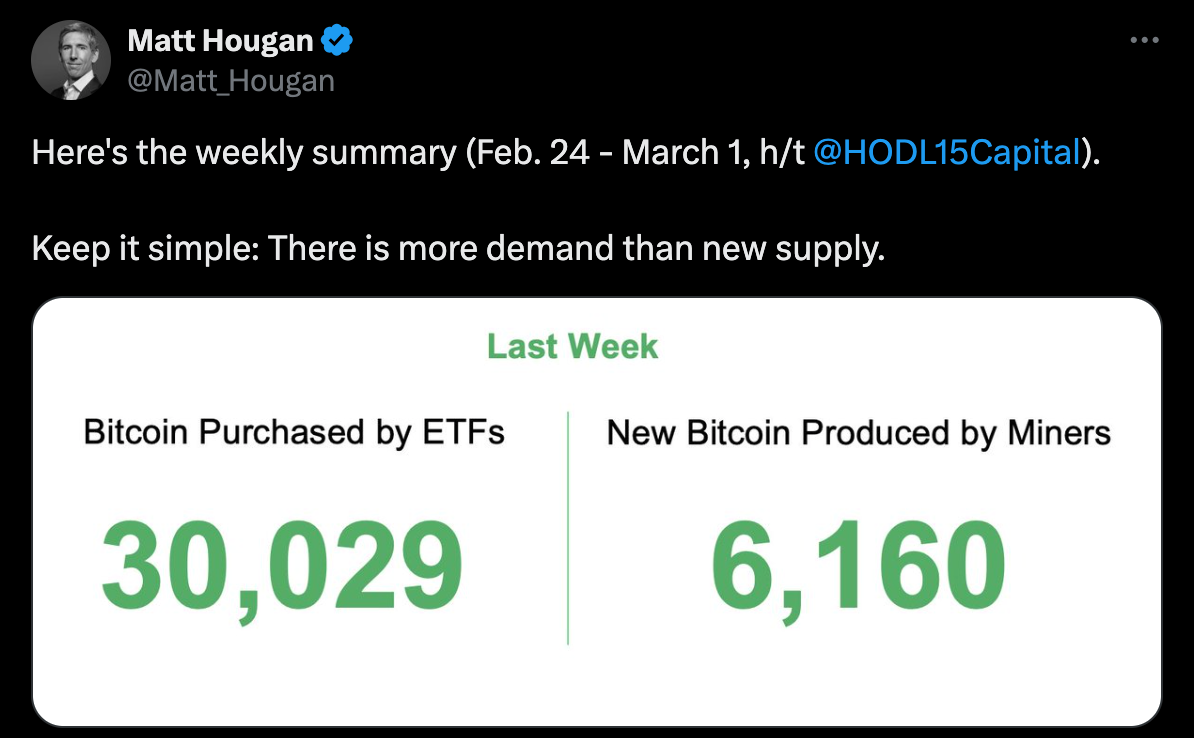

One of the reasons for the market movements is the ongoing demand and performance of the Bitcoin exchange-traded funds (ETFs). A raft of ETFs were approved in mid-January and the market reception is surprising most.

What this means in practical terms is that the demand for bitcoin is exceeding the rate at which bitcoin miners can produce a new supply. The upward price movement is a reflection of the supply squeeze.

There’s also a bit of a market frenzy around the idea that this momentum might be part of a sustained trend. In late April, the amount of bitcoin produced will get cut in half as part of a pre-scheduled supply adjustment called the halving.

The halving happens every four years since the network launched and it supports bitcoin’s deflationary economics by becoming more scarce as time goes on.

Also on the radar is the Securities and Exchange Commission (SEC) decision on Spot Ethereum ETFs. A decision might come in May.

But look, this newsletter is not about market news. I try not to pretend I know what the market is doing. No one knows what the crypto market will do next. We can look at data and make some informed calls, but we are in big-time unexplored territory.

It's not clear if the the patterns or trends that have developed over the last couple of cycles will hold up. It's also not clear what will happen if the Bitcoin ETF demand continues at it's current pace.

So I guess that’s the main takeaway here: Proceed with caution. As the market starts to rip, people get funny and start making bold predictions and claims. Scammers will start to come out of the woodwork. And lots of people will start to sound like they know what’s around the corner.

Modular versus monolithic blockchain architecture

OK, back to our regularly scheduled programming: The theme this week was how blockchain technology will scale now that it feels like the whole world is moving onchain.

Not that long ago, the idea of a blockchain was kind of a one-size-fits-all kind of situation.

The fundamental reason for the existence of blockchain is to securely and accurately process data (such as transactions) in a way that doesn’t require a centralized third party like a corporation, government, or payment company.

The four major things that a blockchain provides are transaction execution, final settlement, data integrity and availability, and decentralized consensus.

In the early days of blockchain, each new chain that was launched tried to accomplish all of these things.

But over time, and especially as more and more people started building on blockchain and more people started using blockchain to settle transactions, some blockchain issues started to show.

The biggest issue was that blockchain design became like a juggling act. The three balls that needed to be kept in the air were security, sufficient decentralization, and cost. Often time this juggling act would result in high transaction fees (and or slower transaction times) passed to users during times of high network usage.

At the same time, high transaction costs and network congestion limited the kinds of apps and services that could be built on top of the underlying blockchain.

To solve these scaling issues, developers started building new kinds of technologies that could operate in sync with a blockchain, but better handle one of the primary responsibilities (such as transactions).

At first, these layer two solutions as they become known, were focused on how to speed up transactions and how to make them cheaper, but doing things like creating payment channels or bundling transactions but still using the underlying layer one blockchain as the final settlement layer.

Over time, these layer two technologies have gotten more intricate, abstracting more and more of the underlying blockchain’s primary responsibilities into scaling solutions.

Now, layer twos make it possible to build new kinds of functionality and new kinds of privacy controls, while still leveraging the underlying security, network effects, and economics of an underlying chain.

Collectively, this move towards stacking new tech together on top of an existing blockchain ecosystem is known as modular blockchain.

One specific kind of modular blockchain solution that’s blowing up right now is rollups. Rollups are designed as scaling solutions that handle transactions off-chain and then package them together for final addition to a blockchain.

What’s interesting about rollups right now is that there is a competition for the best kind (or best fitting) kind of proof to use to maintain overall security and data integrity.

The takeaway

It feels like we are emerging from a pretty intense bear market. What’s interesting is to see all of the new things that were built during the down market times start to find traction and product market fit.

The kind of modular blockchain design described above is particularly pronounced in the Ethereum ecosystem, but the concept is catching on elsewhere.

Increasingly, developers are also starting to build more and more layer two functionality on Bitcoin. The idea of Bitcoin DeFi and a Bitcoin Layer 2 ecosystem is gaining traction, which is a big topic for another day.

Until next week,