What is bitcoin net accumulation and why does it matter? | DYOR

In some regards, bitcoin net accumulation is like the fancy way of articulating the popular “hodl” meme.

Bitcoin net accumulation is an interesting but often overlooked Bitcoin growth metric.

Maybe its not as exciting or well-covered as price movement alone, but bitcoin net accumulation does reflect an overall bullish or bearish sentiment, which makes it a useful tool for understanding some of the deeper bitcoin market currents.

If the volatility of the bitcoin market is like waves or incoming surf on an ocean, then bitcoin net accumulation can be thought of as the tides.

A surf report, like price volatility, is a constantly changing thing based on a number of inputs. The tides, on the other hand, are more enduring and regular, and have well understood consequences and impacts.

So what is bitcoin net accumulation?

In some regards, bitcoin net accumulation is like the fancy way of articulating the popular “hodl” meme.

Bitcoin net accumulation is looking at how many wallets are buying and holding bitcoin versus how many wallets are divesting, or selling bitcoin.

With any financial asset, there is always an ebb and flow or periods where people are buying and times when people are more likely to sell.

But anything more than just the baseline buy and sell activity, like if there is a clear trend one way or the other, then the bitcoin net accumulation metric could start to look like a bullish or bearish indicator.

More selling than buying over a long period of time leads to price declines and bear markets.

Meanwhile, overall net accumulation, especially over time, can set the table for price increases.

Growth in price under favorable net accumulation trends leading to upward price movements is especially correlated when looking at bitcoin because of the assets underlying characteristics.

Mainly, because bitcoin has a fixed supply of 21 million and because the issuance schedule is fixed, net accumulation trends lead to deflationary pressures, which make the price increase over time.

Charting bitcoin net accumulation

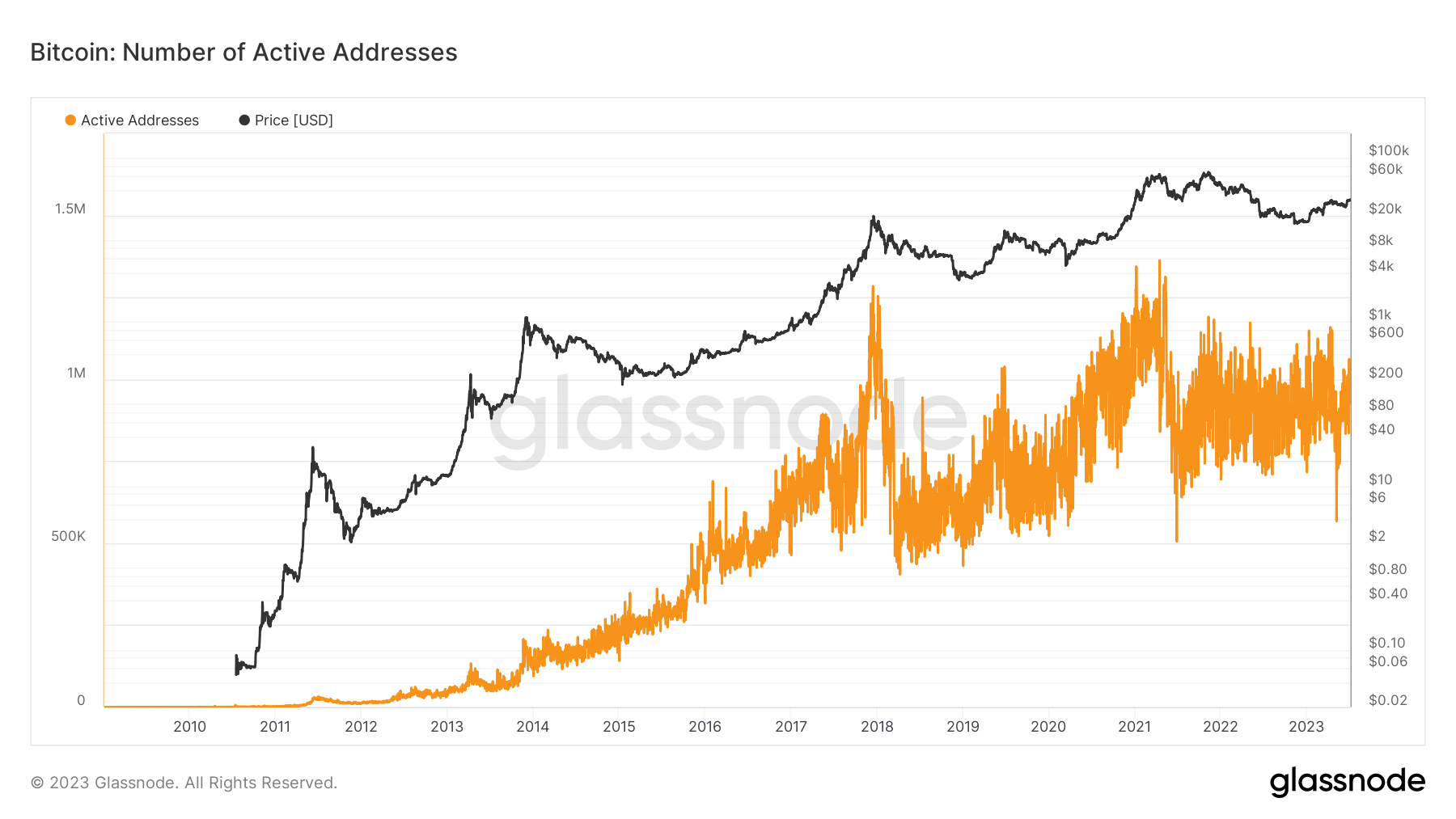

A simple way to start to look at bitcoin net accumulation is to look at the number of active addresses on the network. More active addresses implies more people coming to the network.

But looking at active addresses alone doesn't really reflect long term accumulation. Instead, more active addresses could just imply more volatility because we don't really know much about the age or behavior of individual addresses.

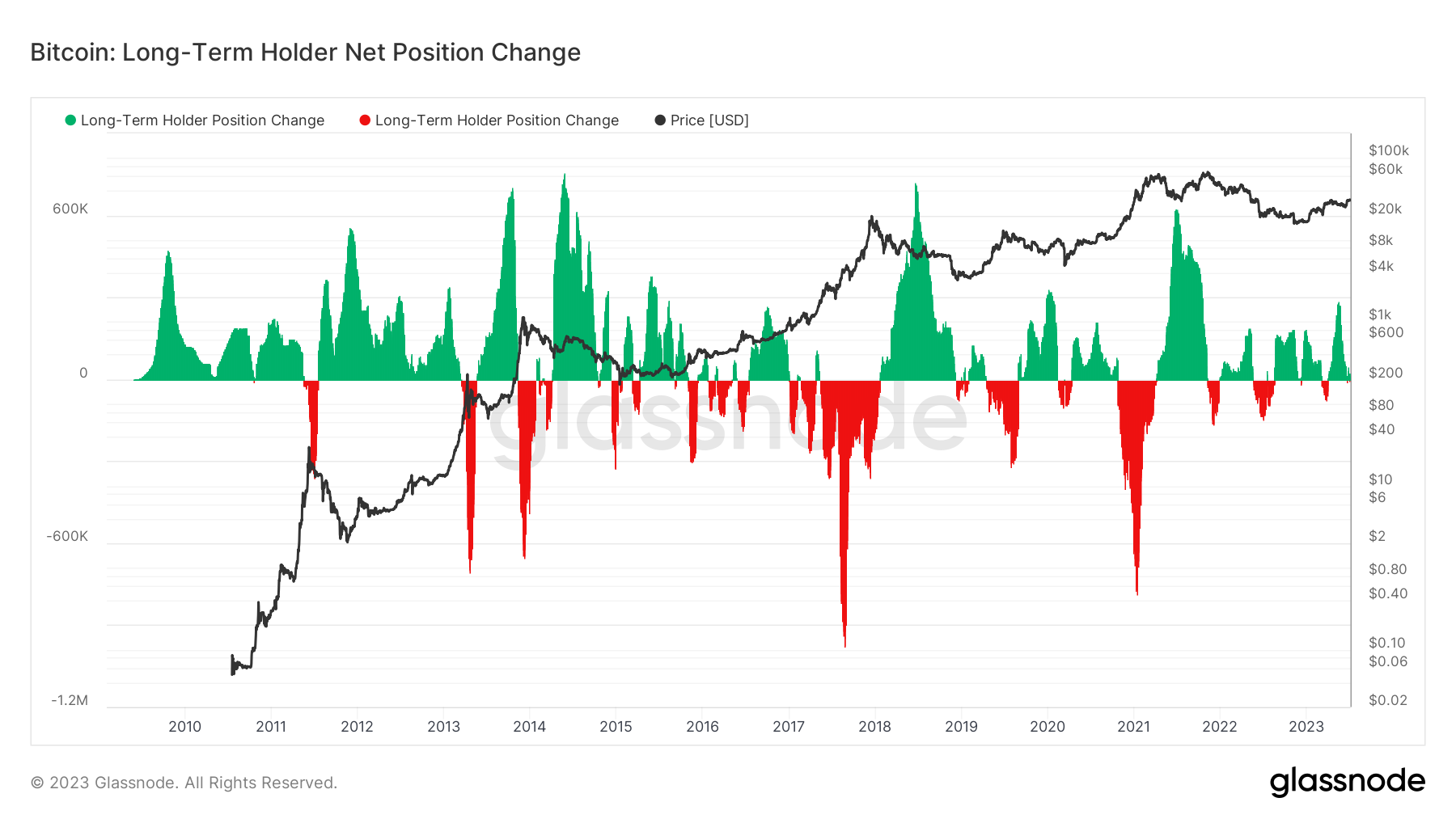

This chart shows the positive and negative trends of longterm holders on the Bitcoin network. In most instances up until 2021, negative position changes were often associated with dramatic bitcoin price increases.

This makes sense because likely early investors, or the longterm holders were cashing out.

But the trend starts to break down slightly from 2021 onward. It will be interesting to see how longterm holder behavior changes over time as the bitcoin price matures and becomes less volatile.

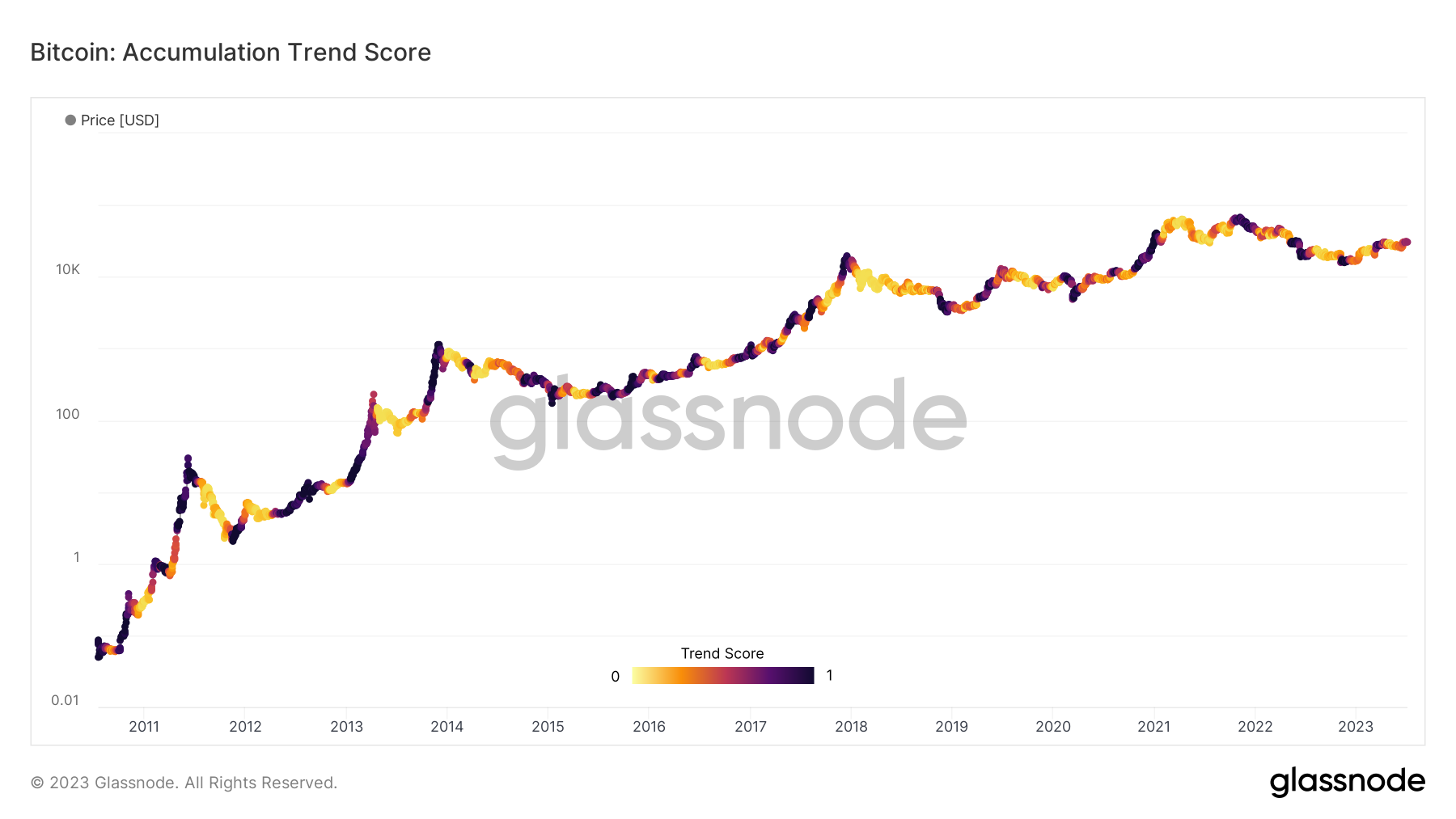

This chart blends together the relative size of different entities acquiring bitcoin and the change in behavior (either buying or selling) to come up with a weighted score between 0-1.

During times of accumulation, the score moves closer to one (or purple on the chart). During times of sell-off the score moves closer to zero (or yellow on the chart).

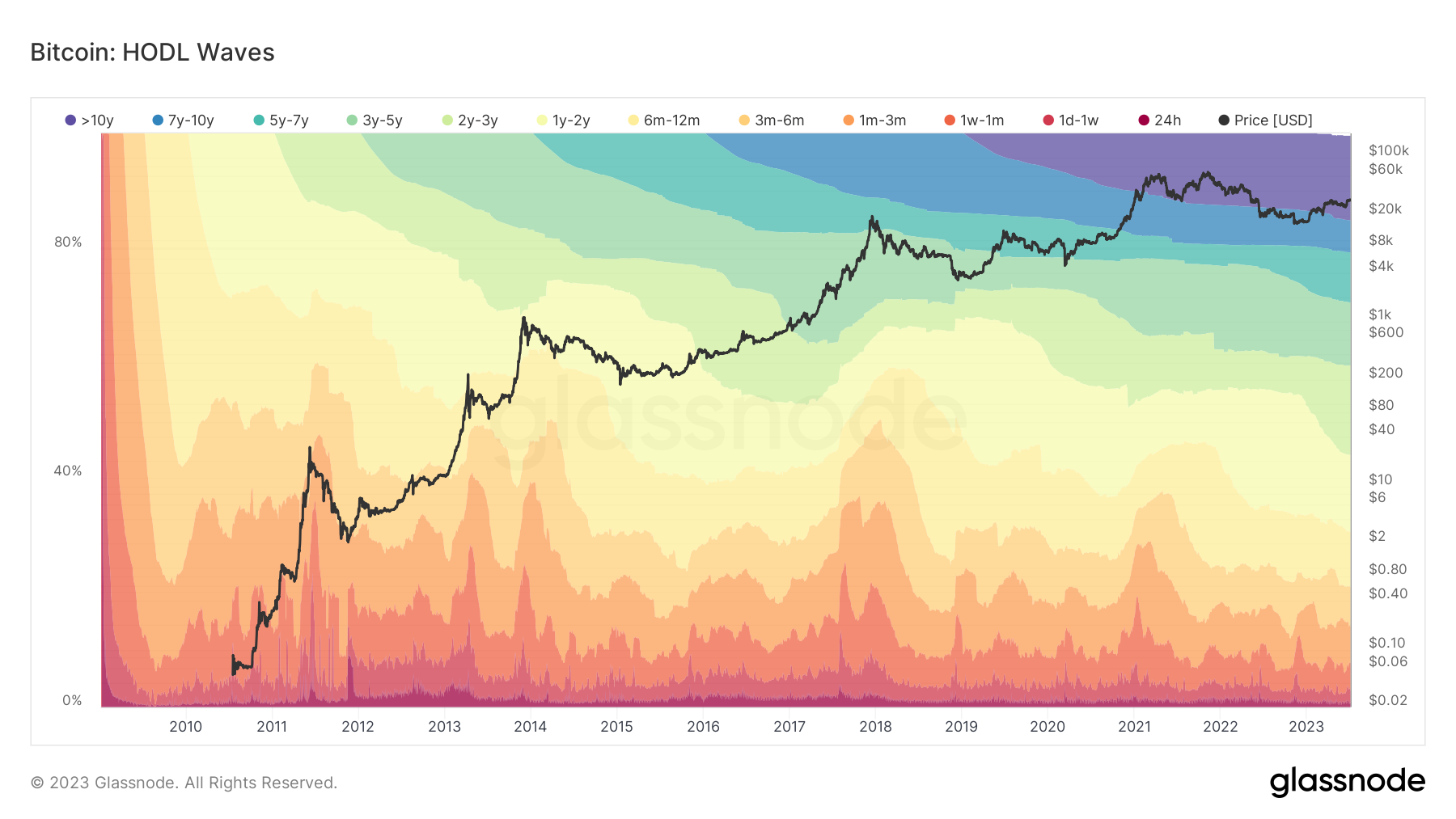

This chart shows the behavior of longterm bitcoin holders over time. In short time frames, there is more volatility among new holders.

But there is less volatility among longterm holders and the share of longterm holders continues to increase as the network continues to mature.

The positives and negatives of bitcoin net accumulation

There are a few reasons why bitcoin net accumulation is important or useful, including:

- Market sentiment: Overall net accumulation, especially over a long period of time, signals a bullish market trend or positive market sentiment. A steady selloff signals the opposite.

- Stability: It doesn’t matter if its institutional investors, or investors that are considered shrimp (people holding less than one BTC), if investors are holding bitcoin for a long period of time, then it helps with overall market stability over time. Longterm holders also effectively lock up a limited supply of the underlying asset, creating additional price pressure.

- Predictive analysis: Watching bigger trends like overall bitcoin net accumulation can be helpful to try and gauge where the market is moving longterm.

Here are a few downsides to bitcoin net accumulation:

- Bitcoin net accumulation can be a useful metric, but it is also a little bit like looking at a slow moving ship in a fast moving current.

- Looking at net accumulation is not as clear cut as looking at a metric like price, which is easy to understand and works as a “real time” signal.

The takeaway

The point here is that there are many different ways to look at and understand growth of new assets like bitcoin.

It’s important to remember that while bitcoin’s price gets all the attention, there are also other metrics or forces operating the background that point toward overall network and asset health.