2025 Crypto Crime Report: Onchain criminal activity getting more sophisticated

Also stablecoins seem to be growing in popularity everywhere, including with criminals

The 2025 Crypto Crime Report from NYC-based blockchain analytics firm Chainalysis just dropped.

I’ve covered this report in previous years because I think looking at data on the illicit use of crypto is both useful and interesting.

Every year, major trends shift. And every year, some of the broader narratives of the crypto industry are reflected in the evolving landscape of criminal activity. This year, one example of that parallel trend is stablecoins.

Most of my work on the Open Money project focuses on how regular, everyday people can start to move onchain — and why it’s in their best interest to learn how new forms of internet-based money work.

But there are also lessons to be learned from how bad actors use crypto and why they choose it. We can see in the patterns that crypto is faster, more efficient, and far more transferable than other forms of money. That’s good for criminals, but those same efficiencies also benefit the rest of us. Efficiency, speed, and self-custody make moving money easier.

The logic here is similar to why cash is still king for criminals and why cash remains so important for informal economies — it works better in certain contexts where traditional finance doesn’t.

And if there’s one takeaway from this year’s Crypto Crime Report, it’s that criminals using digital assets are becoming more sophisticated and professional. In some cases, they are even building their own products and services onchain. Let’s take a look.

Crypto crime trends

According to the Chainalysis report, identifying and tracking illicit onchain data is a challenge, which is part of the reason crypto crime numbers are always shifting.

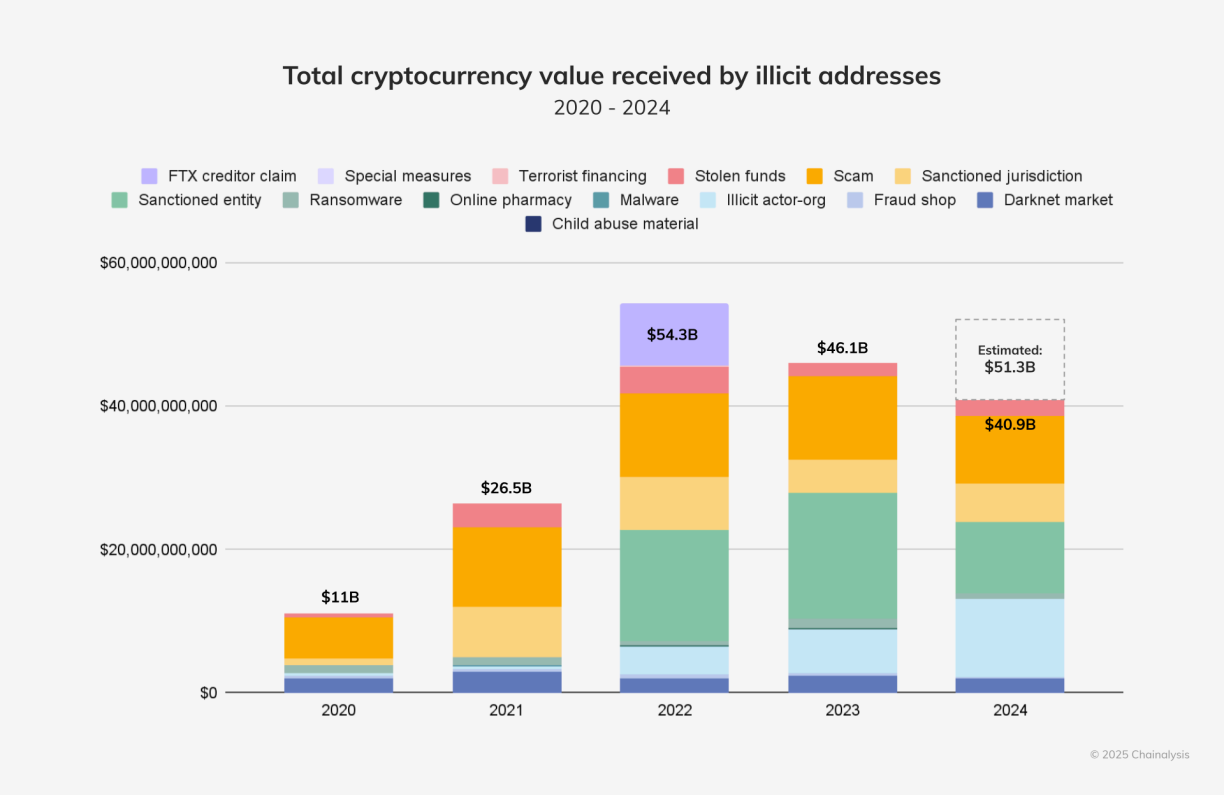

At a high level, it looks like illicit onchain activity is estimated at $51 billion for 2024, up from $46.1 billion in 2023 (last year’s number rose from $24.2 billion to $46.1 billion once all the data was tabulated).

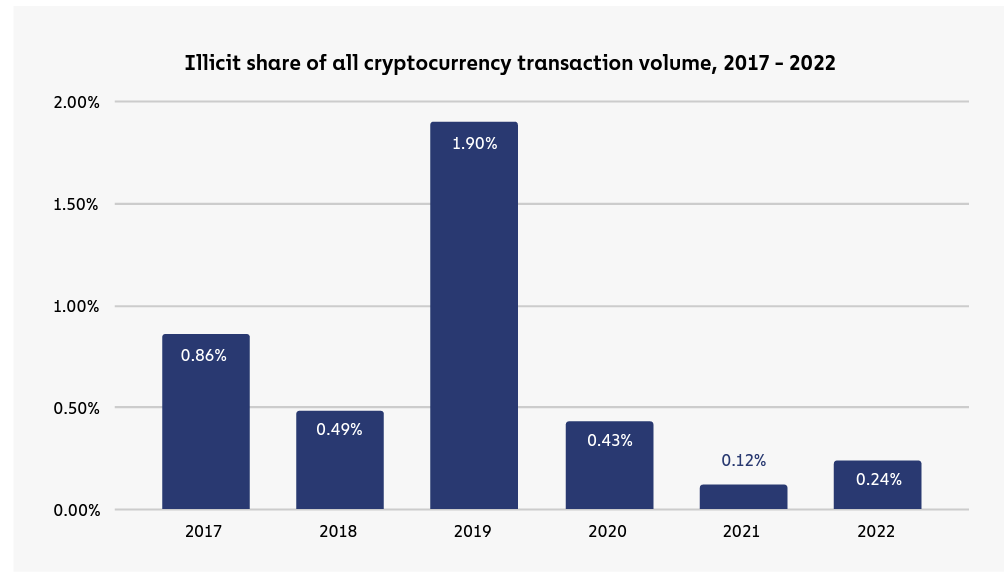

Put in context, $50 billion in known illicit onchain activity represents approximately 0.14% of all onchain activity for the year.

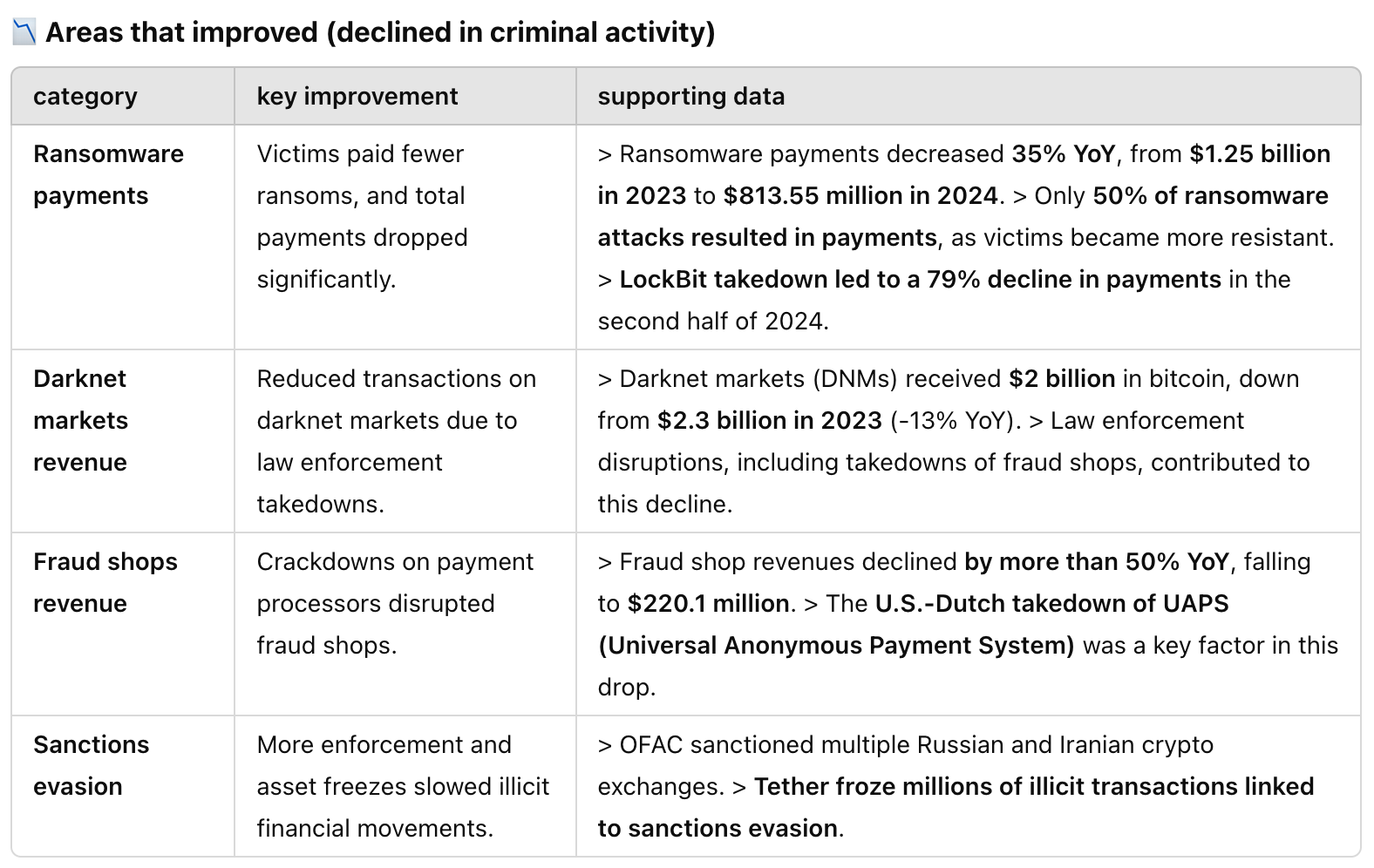

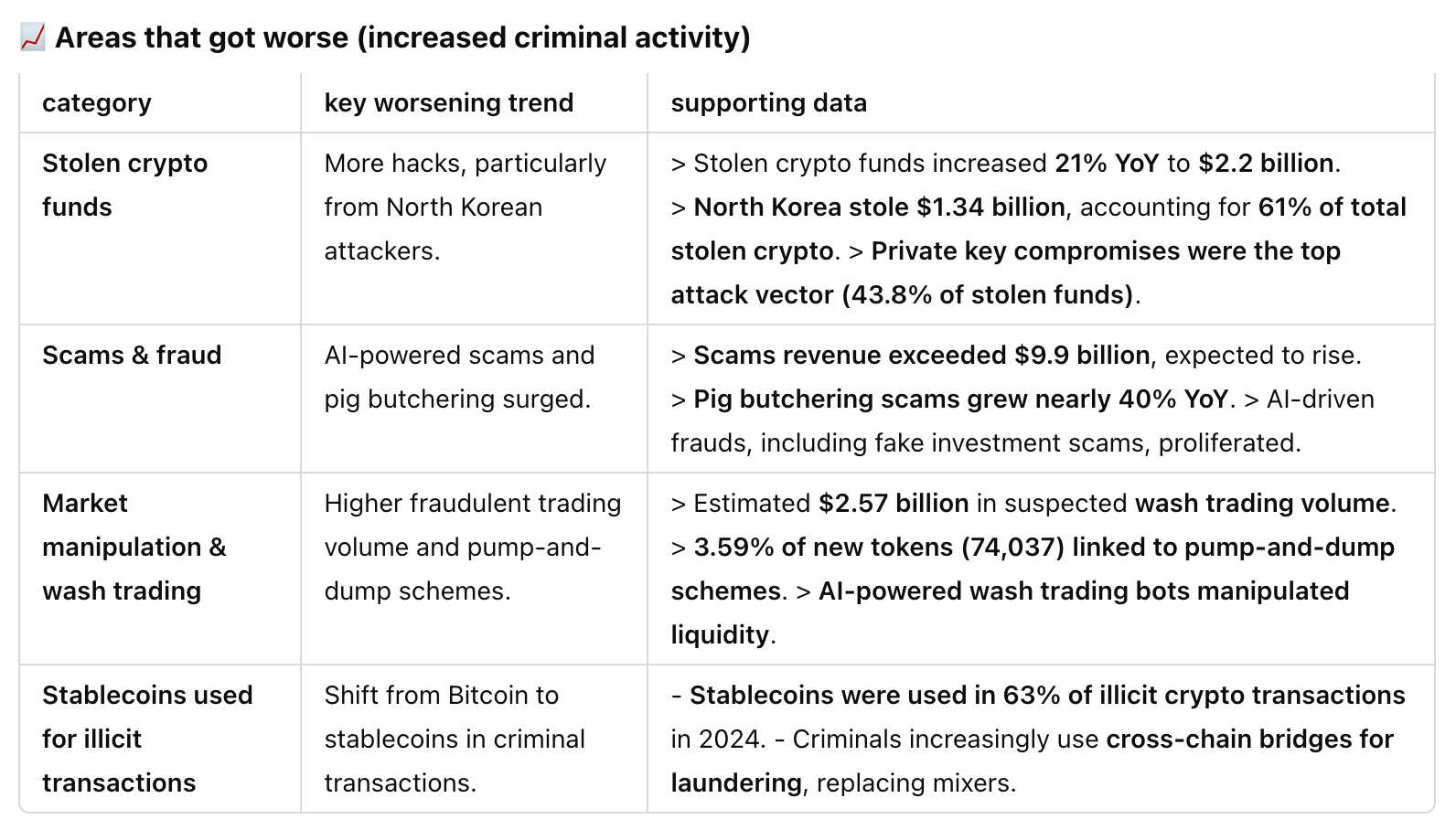

As in previous years, scams, stolen funds, and ransomware still represent a significant portion of crypto crime. Interestingly, both decentralized finance services and mainstream centralized exchanges are being targeted. Additionally, outright crypto scams are on the rise, aided by AI.

Digital scams are becoming such a big business that new firms are emerging to support the illicit industry, building tools and services that facilitate crimes like hacking and digital extortion. These entities also manage the entire supply chain — from implementing scams to laundering money through a series of wallets and services, creating intricate webs of financial obfuscation.

The 2025 Crypto Crime Report covers this development in depth and is worth diving into for more details about how new onchain crime syndicates operate.

Beyond the thefts and scams that dominate headlines, other onchain crime trends include dark markets, particularly those related to drug trade and underground pharmacies.

Also notable — especially if you’re following current headlines and political discourse — is that crypto funding of extremist groups is on the rise.

Tracking and monitoring extremist group activity has traditionally been difficult. By moving onchain, these groups are becoming more visible in multiple ways. From page 116 of the 2025 Crypto Crime Report:

“While the overall amount raised through cryptocurrency by ideologically extreme groups is relatively small, any amount is concerning given the potential activities it could support. Even modest amounts of funding can finance propaganda, recruitment, or violence—making proactive oversight essential. Blockchain analysis provides critical insights about the financial activity of such groups that would otherwise be difficult to uncover.”

Summary of key findings from the 2025 Crypto Crime Report

Here's a quick breakdown of last year's crypto crime trends.

Changes in preferred crypto crime assets

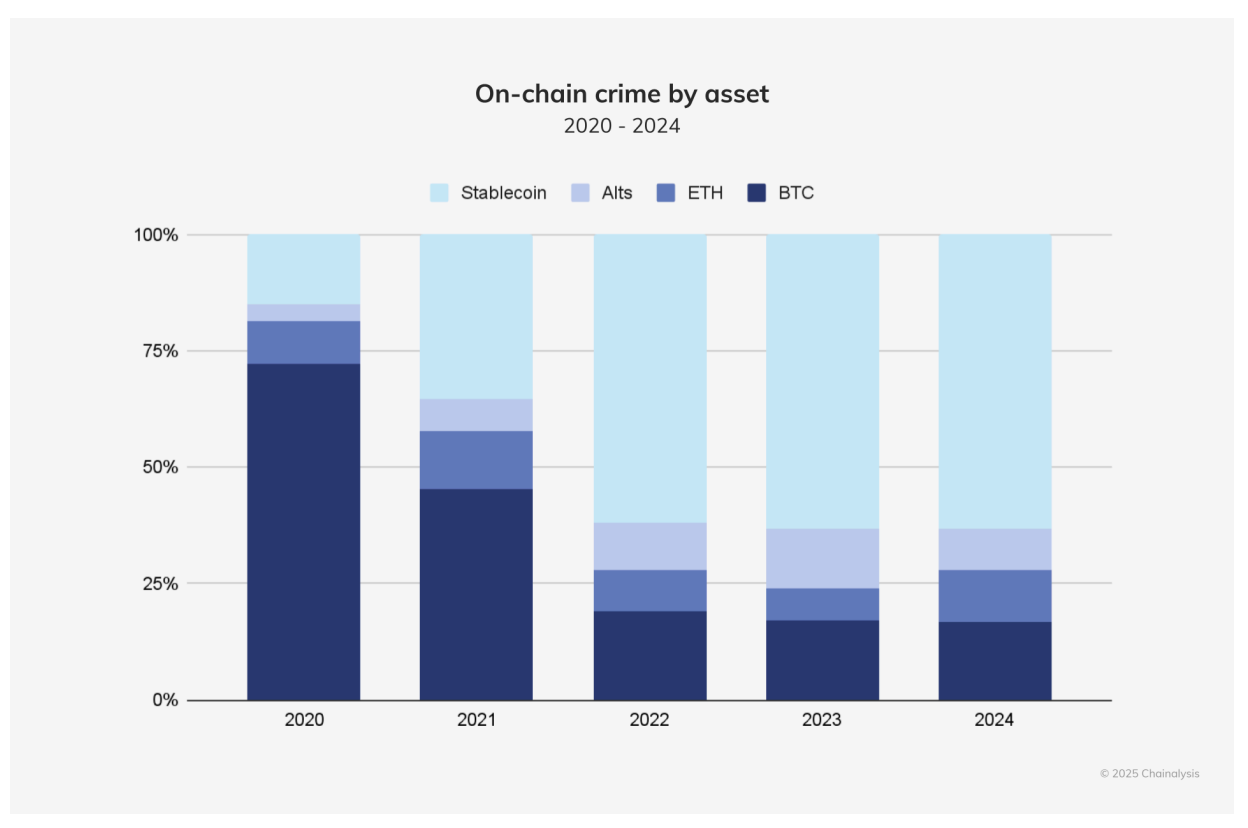

Not that long ago (around 2021), bitcoin was the dominant digital asset used in crypto-related crimes. But since then, stablecoins have increasingly become the asset of choice for criminals.

The preference for stablecoins in criminal activity mirrors their rise in legitimate economic sectors. Price stability, ease of entry and exit, and the ability to securely store and quickly transfer large amounts of value make stablecoins an attractive choice.

This trend also raises questions about centralized versus decentralized stablecoins and/or the best way to manage stablecoin treasuries – topics we'll dive into soon...

Open Money project update

Things are still progressing with the Open Money project. We finished section three, which focuses on the primitives that make Open Money possible.

On Friday, we started section four, which covers the basic Open Money tech stack. The goal is to provide a foundational understanding of key components like crypto wallets, addresses, explorers, and smart contracts. Having this knowledge can help anyone better navigate Open Money systems.

This section feels a bit more challenging than the others because it’s more practical and less conceptual. But it also seems like essential information for providing a comprehensive guide or framework.

As always, feedback is welcome.

Recent Open Money posts