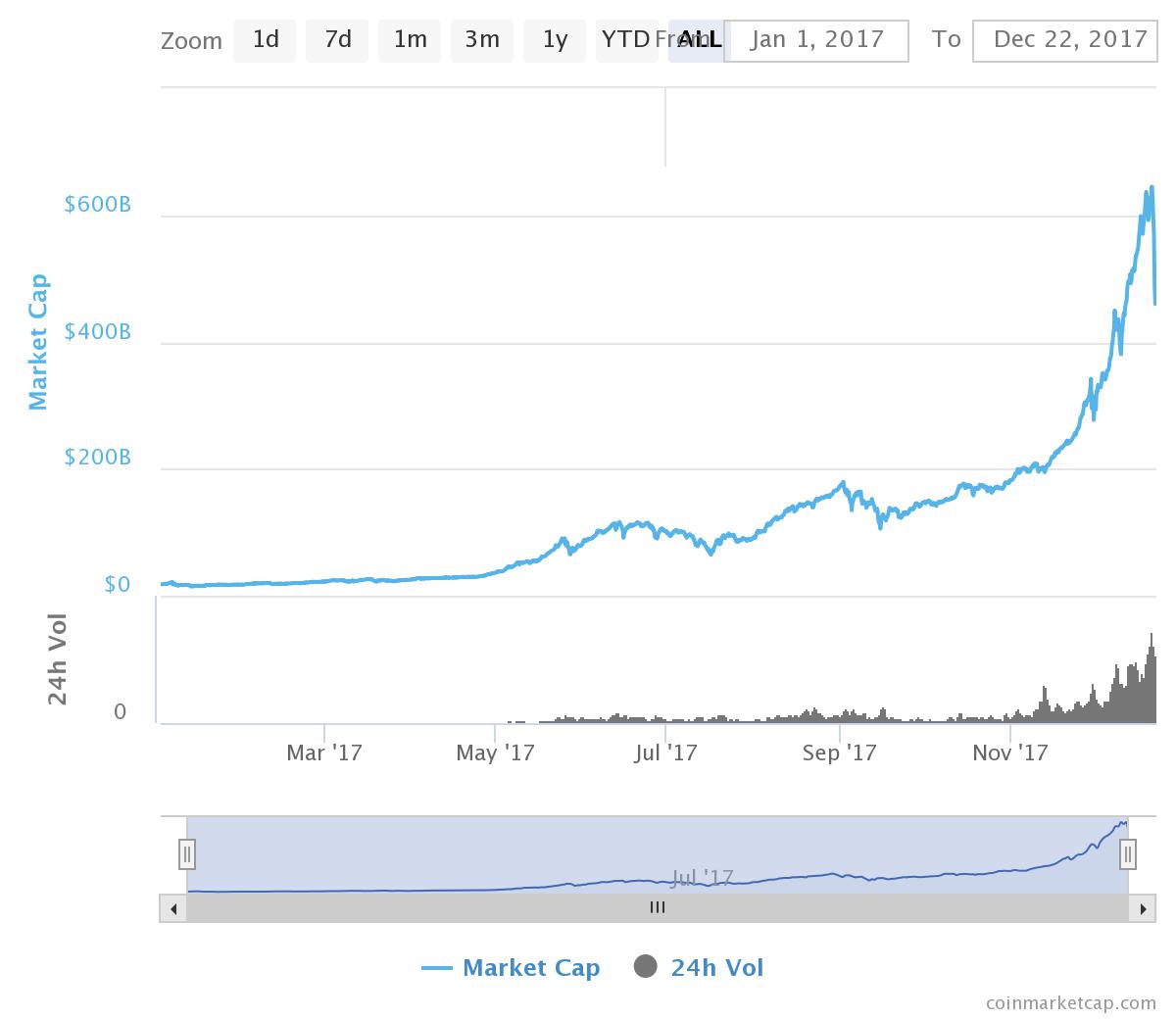

Market cap: The overall market cap of the entire crypto sector grew from roughly $18 billion at the beginning of the year to exceed more than $500 billion by the end of the year.

Also significant during that time was the overall increase in the number of crypto-related projects. Sure, initial coin offerings (read more below) blew-up, but there were also other interesting projects outside of ICOs offerings that are hopeful indicators of a maturing economy. In the past month alone notable projects such as CryptoKitties and the Pineapple Fund launched.The FOMO is real: This cuts both ways, but the Fear of Missing Out (FOMO) machine is definitely responsible for part of the massive (and speculative) growth driving some crypto valuations. FOMO, while good at inspiring dramatic pumps is also dangerous because when FOMO leads to FUD (Fear, Uncertainty, Doubt), then the pumps can easily turn to big dumps, fueling concerns about the crypto bubble.

The dramatic growth and then selloff of the past few weeks are perfect examples of the FOMO/FUD cycle.

ICO, ICO, ICO: If nothing else, 2017 will definitely be remembered for the initial coin offering (ICO) crypto boom. While there have been other ICOS, most notable ethereum’s presale in the summer of 2014 and the DAO’s sale in 2016, which each raised tens of millions of dollars, hundreds of projects launched initial coin offerings in 2017, collectively raising an estimated $3.5 billion.

Like everything else in crypto, the explosion in ICOs is controversial. On one hand, the ability to rapidly crowdfund with little oversight is seen as a means of disrupting the power structures of traditional venture capital. On the other hand, easy ICOs also attract a lot of scams, or even well-intended projects that aren’t really mature enough to handle the influx of buckets of capital.

It will be interesting to watch the growth and development of how ICOs are handled in the coming year, particularly with what looks like increased attention by the SEC and other regulators. An ideal situation is one where ICOs can continue to give equitable access to new ideas and projects while following some kind of best practice that rewards teams for rapid development and deployment of their ideas.

Futures: I’m still uncertain if the trading of bitcoin futures by legacy financial institutions will turn out to be an overall win or a loss for cryptosystems. A big concern is that institutional money will attract disproportionate regulations, and/or create more centralized systems to map the newer technology to the ways and means that people are used to dealing with financial institutions and infrastructure.

Either way — whether Wall Street money turns out to boost crypto or complicate the sector’s growth — the rollout of bitcoin futures is a major milestone and it will be interesting to watch some of the impacts in 2018.

Man on the street: Sure, the coinbase app might have blown up and become the most popular app downloads as the year closed out, but maybe more significant is the overall level of crypto-related chatter that I’ve started hearing.