Runes on Bitcoin | What are Runes?

The recent launch of Runes, a new bitcoin token standard, has renewed debates about the the best use of Bitcoin.

In the run-up to the most recent Bitcoin halving, a lot of attention was given to how the halving would affect Bitcoin’s overall hashrate.

In the past, hashrate takes a hit in the immediate post-halving re-organization as Bitcoin mining operations adjust to the new block subsidy or block reward.

But something interesting happened, which sets this halving apart from previous events.

The block height that triggered the halving, 840,000, also triggered the launch of the Runes protocol.

Runes is a new kind of token standard for Bitcoin.

Put simply, Runes makes it possible to create NFTs on the Bitcoin network, which both opens up new kinds of Bitcoin-based onchain innovation and creates more demand for increasingly scarce block space.

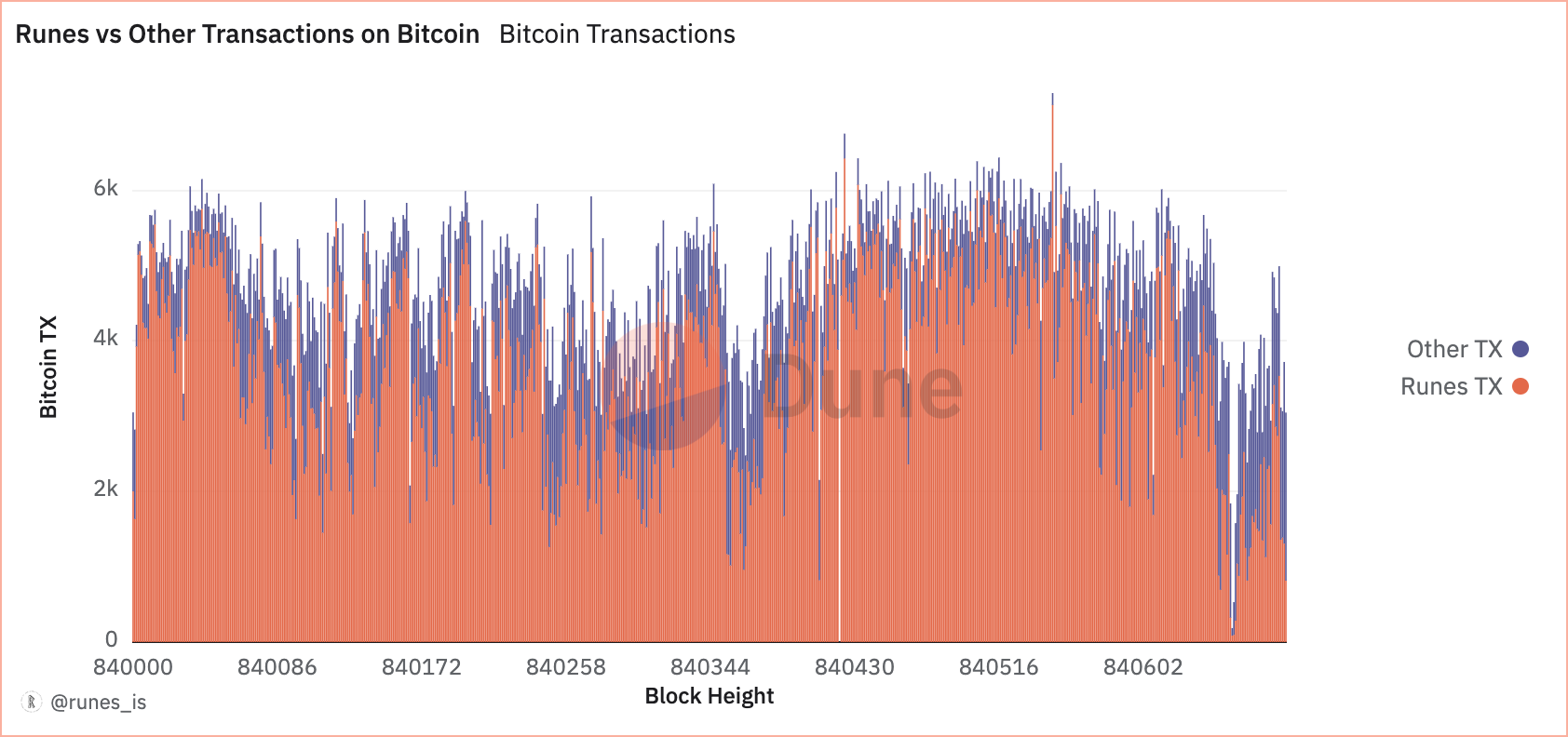

The resulting transaction congestion and fees are what make the rollout of Runes controversial.

The most interesting facet of the bump in transaction fees is that since Runes was introduced right on the same block when the mining reward was cut in half, miners who were planning on taking a haircut on the halving started seeing increased transaction fees almost immediately.

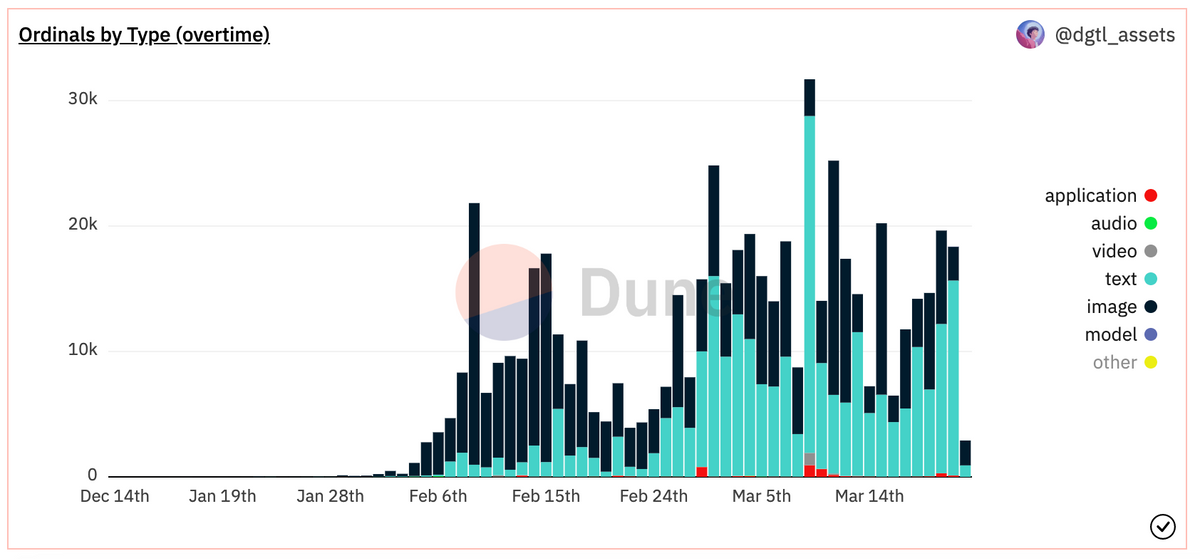

If the NFT-on-Bitcoin situation sounds familiar, it’s because the outcome of the Runes protocol is very much like the output of Ordinals — the ability to map specific data to specific segments of Bitcoin, effectively making that unit of Bitcoin non-fungible.

Check out this previous post about Ordinals.

We’ll dive into how Runes and Ordinals are different in a second, but the main point is that the demand and the tech stack for building on Bitcoin is continuing to progress rapidly, but not without its critics.

The use of blockspace by Runes versus the best use of the Bitcoin network escalated from a simmer to a boil post-halving (which was only a few days ago). If nothing else, this debate will likely be ongoing for the foreseeable future and will likely divide Bitcoin builders and proponents into different camps.

How are Runes and Ordinals different?

Runes and Ordinals share a lot in common.

The innovative functionality at the heart of each protocol is the introduction of a Bitcoin-based token standard that makes it possible to convert individual satoshis (or the smallest unit of Bitcoin, 100 million satoshis or sat = 1 bitcoin) into a non-fungible token.

Here's more about Bitcoin token standards and transaction fees.

So the goals of Ordinals and Runes are very similar — to attach data to parts of the Bitcoin blockchain and make those individual components unique and non-fungible, meaning they would be treated differently and could have different values depending on the data recorded to each satoshi.

Ordinals record, or inscribe, data to an individual satoshi in the signature data of an individual transaction.

Runes, on the other hand, record, or etch, data by writing to the UTXO component of a Bitcoin transaction.

The difference in where and how data is recorded to a satoshi is significant.

Runes are easier to use and make it easier for developers or creators to add NFT functionality to Bitcoin.

Another way to think about it is that Ordinals were like a proof of concept and Runes are like a production-ready new tech.

Ordinals and Runes were created by the same Bitcoin developer, Casey Rodarmor.

reminder to all the degens: runes, ordinals, and inscriptions are a fun sideshow

— Casey (@rodarmor) April 20, 2024

bitcoin is the main event

stay humble, stack sats

A reminder from the creator of Ordinals, Runes, and Bitcoin

The impact of Runes on Bitcoin

The introduction of Ordinals and Runes has set the stage for a debate about the best way to manage Bitcoin’s block space.

For sure we are entering a new era of blockchain. We’ve talked about it before, with the concept of modular versus monolithic protocols. In this case, the launch and early activity on Runes is like a testing ground to see just how modular a blockchain like Bitcoin can become.

Within the Bitcoin community, some people are excited by the prospect of building on Bitcoin and developing new kinds of layer two technologies.

The flip side of the argument is that Runes are frivolous and serve little purpose other than to gum up the clean and efficient workings of the Bitcoin blockchain.

In some regards, the cracks growing in the Bitcoin community mirror the cracks forming elsewhere.

Adding a new token standard to Bitcoin’s blockchain has triggered issues related to censorship and access and about who gets to decide what kinds of functionality get built on top of Bitcoin.

For now, there are no other mechanisms to decide what should happen other than the free market.